Australian beef meeting Chinese consumer expectations

Australian beef offers a number of competitive advantages on attributes that are very important to Chinese consumers. While delivering ‘freshness’ is a key challenge in the context of exporting fresh produce of any kind, Australia’s red meat industry’s efforts to address this issue are being noticed and appreciated by those affluent urban Chinese consumers who buy Australian imported beef.

These findings are derived from MLA’s annual Global Consumer Survey. In China, interviews were conducted in June 2015 with 1,020 18-64 year-old residents of Shanghai, Beijing, Guangzhou and Shenzhen. All were main grocery buyers for the household, and 84% were living in upper income households (earning 100K+ Yuan per year).

- ‘Freshness’ is the most important consideration for Chinese urban middle class consumers when they purchase meat, and has been so for the three years the survey has been conducted.

- Chinese consumers rate proteins differently according to their general perception of ‘freshness’. Seafood is considered to be the freshest (55% endorsement), which reflects in large part the fact that seafood is typically bought live and either killed at the point of purchase or at home during preparation prior to cooking. Beef rates second-best (41%), followed closely by pork (38%), chicken (34%) and then lamb (32%).

- Around half (49%) of the survey respondents said they had eaten Australian beef in the past month. This went up to 87% among the affluent group – those living in households earning at least 200,000 Yuan per year.

- Among all respondents, Chinese beef has a significant edge over Australian beef on freshness: 50% associate freshness with Chinese beef, 36% with Australian beef.

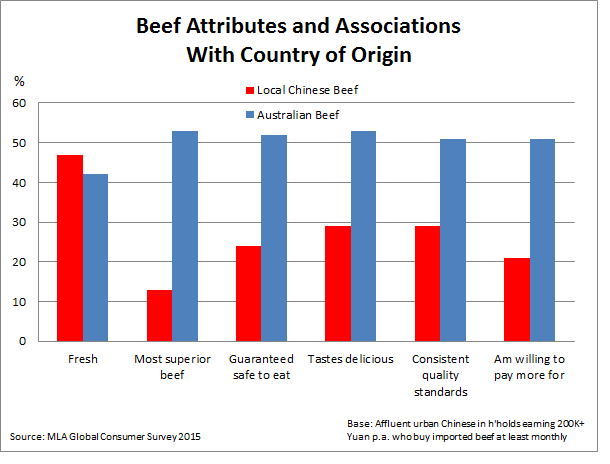

- However, affluent Chinese consumers who buy imported beef at least once a month were found to have a more positive perception of the freshness of Australian beef. For this group, the difference in perceptions of freshness between local and imported beef is much smaller: 47% associate freshness with Chinese beef, 42% with Australian beef.

- This strongly suggests that their experience of Australian beef freshness has been very positive.

- Australia’s red meat industry’s technical experts are innovating methods to maximise the freshness and shelf life of Australian red meat, extending the boundaries of traditional exporting constraints.

- Chinese consumer demand for freshness in the context of food has led key e-commerce companies to make significant new investments in cold chain logistics. At the same time, the Chinese government is supporting a number of initiatives that offer improved cold chain logistics, including their opening of the “inland meat ports” (covering the cities of Zhengzhou, Luohe) and the free trade zone pilot expansions focusing on facilitating China Cross border eCommerce (CBEC) (covering the six cities of Hangzhou, Shanghai, Ningbo, Zhengzhou, Chongqing, Guangzhou and Shenzhen).

- Currently, Australia is the sole official supplier of chilled imported beef to China – 4,337 tonnes swt, valued at US$33,817,477 have been imported in 2015 up to September, according to China Customs. This gives Australian beef an advantage over competitors when it comes to freshness perceptions. Australia’s physical proximity to China, compared to other key competitors in South America, also works in our favour.

- Despite the priority of ‘freshness’, the following three important attributes to consumers – ‘high nutritional value’, ‘guaranteed safe to eat’ and ‘taste’ – are not far behind. And it is on these attributes that Australian beef has a particularly strong competitive advantage over local product, especially in the minds of the affluent consumers who are already buying imported beef at least monthly.