Aussie retail beef prices follow US trend

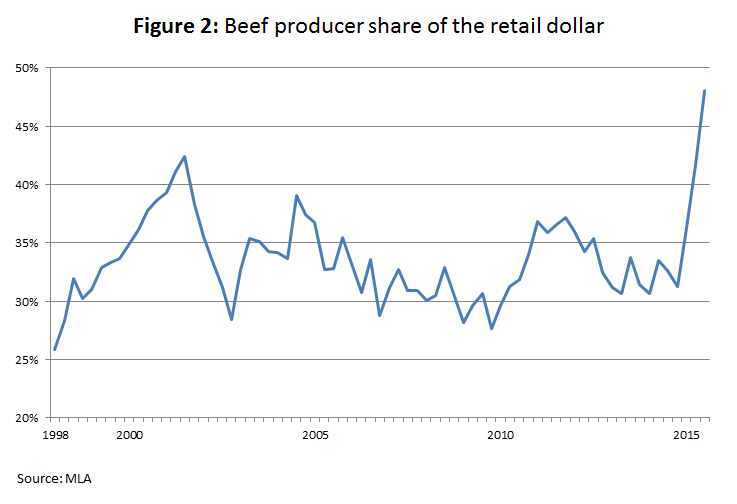

Australian retail beef prices have increased for eight consecutive quarters, under the pressure of tightening domestic cattle supplies and strong export competition. However, the increase in cattle prices has far outstripped the rise at the retail level, lifting the producer share to its highest level on records going back to 1998.

According to Australian Bureau of Statistics (ABS) and Australian Bureau of Agricultural & Resource Economics (ABARES) data, during the September quarter retail beef prices averaged $17.77/kg retail weight (rwt), up 9% year-on-year and the highest nominal value on record.

Interestingly, rising beef prices have also been reflected in the US, following two years of very tight beef supplies across North America.

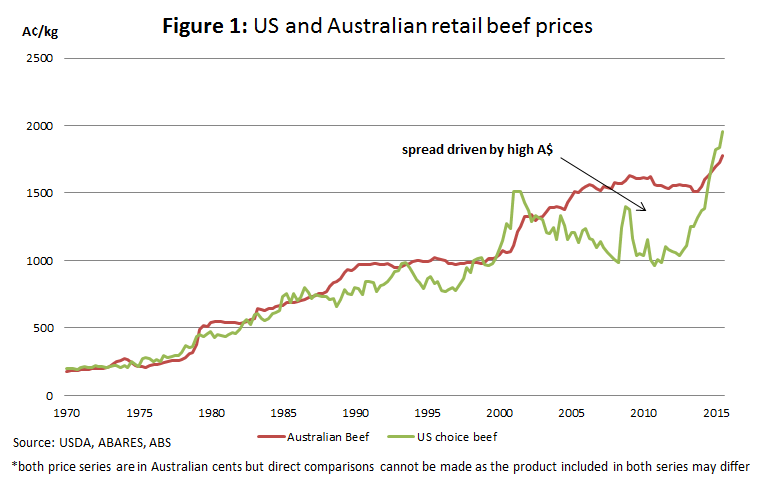

As illustrated in Figure 1, after converting the average US choice beef price into A¢/kg, Australian and US beef prices track one another relatively closely over the long run. The notable separation during the 2000s can mostly be explained by the strong A$ as a result of the Australian mining boom. In addition, the recent strong increase in the US choice beef price has been exacerbated by the devaluation of the A$.

Up until August this year, US choice retail beef prices had recorded sixty six consecutive months of year-on-year growth, averaging almost 8% over that time, but in September prices declined nearly half a percent, to 623US¢/lb (or 1,373US¢/kg) (USDA). Given Australia is expected to go through a phase of significantly tighter supplies over coming years, not dissimilar to what the US industry has just been through, Australian retail beef prices may continue feel upward pressure.

The beef producer share of the retail dollar lifted during the September quarter, following a surge in cattle prices. Nationally, saleyard trade steers (330-400kg live weight, C3) averaged 318¢/kg live weight (or an estimated 587¢/kg carcase weight) during the September quarter, up 60% year-on-year and the highest nominal value on record. The significant rise in cattle prices resulted in the beef producer share of the retail dollar increasing to 48.1%. As illustrated in Figure 2, only once before this year has the beef producer share of the retail dollar exceeded 40%, on records going back to 1998.

To see how the beef producer share is calculated, please click here to read the previous market news story.