Will the steer to heifer premium continue?

Key points

- The restocker steer market has been significantly more stable in 2024 when compared to 2023.

- The steer market has maintained a high 31% premium over heifers.

- Post elevated turn-off in 2023, there is limited demand for breeding heifers.

Market stability

The restocker market has been significantly more stable in 2024 than in 2023. Restocker steer prices peaked in February at 392¢/kg liveweight (lwt) and bottomed out shortly after in March at 314¢/kg lwt, meaning the market has only moved within a 78¢ band so far this year.

This is a significantly reduced price band when comparing against the last five years (as can be seen in the chart below). Over the same 10 months, 2023 steer prices moved between 459¢/kg lwt and 214¢/kg lwt (a 245¢ band). The steer market has not been this stable since 2018 and 2019, when international demand for protein supported high supply through the saleyards.

The National Restocker Heifer Indicator has followed similar trends, remaining within a similar price range. This means the heifer/steer relationship MLA analysts mentioned earlier this year has remained.

Restocker steer premiums

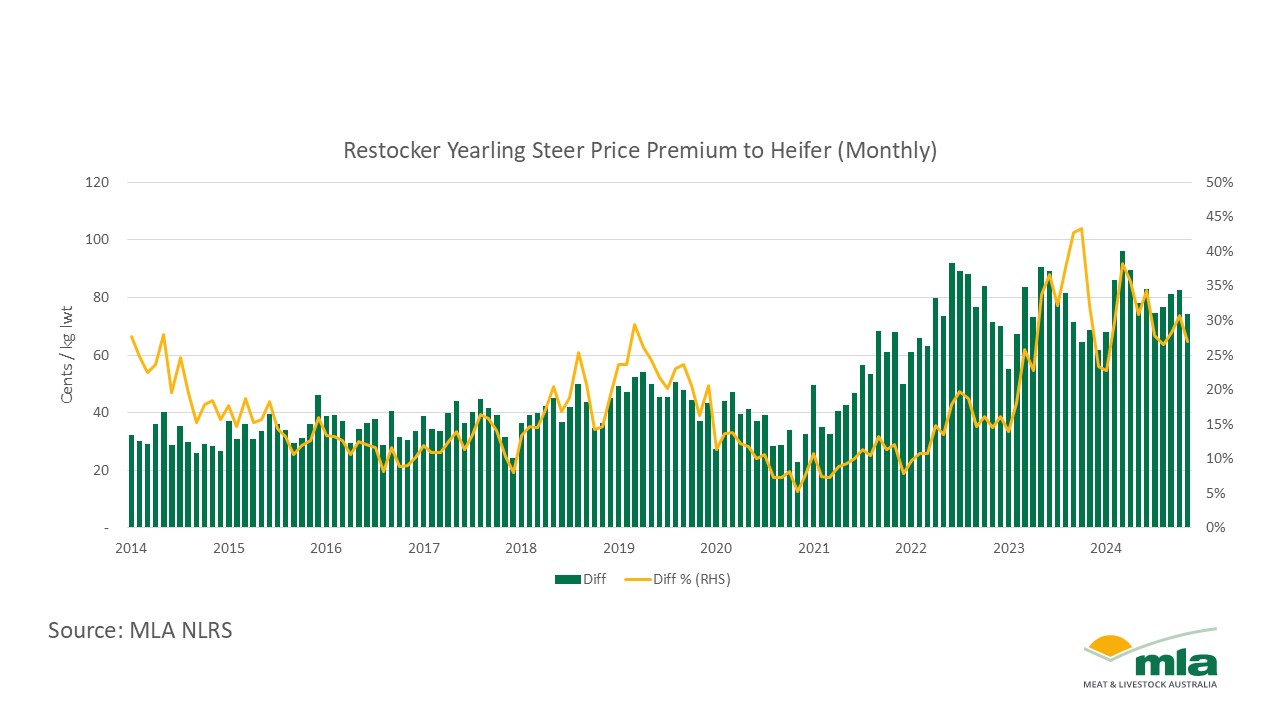

The National Restocker Yearling Steer Indicator has maintained a sizeable and steady premium to the equivalent heifer price for the first 10 months of 2024, with steer prices between 23–38% above the heifer market.

For the month of October, the average price gap was 31% – well below the 43% premiums of a year ago. MLA’s Market Information team provided analysis on this gap in November last year, noting that the unusual, sustained growth in steer premiums was driven by confidence in the market.

Insights

The volatility, or lack thereof, and the stable steer premium show that the market is currently operating at a level of maturity which has not been seen in recent times. The ‘restocker yearling steer to restocker yearling heifer’ price premium tends to mimic drought-induced liquidation or herd rebuilding; however, the herd is not currently facing drought-driven destocking.

A number of insights can be garnered from this dynamic:

- The herd is at maturity with no move to restock: While the current premium is a significant drop, indicating a slight return in demand for heifers, the stable market and stable premium are leaning towards a market that is not desperate for future breeding females. Stocks on-farm remain high.

- The 2023 market fall was not caused by liquidation: The significant turn-off and market impact of 2023 was not a result of producers liquidating their breeding herd, as they did not eat into breeding stock. We have not seen premiums shorten significantly after this high turn-off phase.

- Stable and elevated supply has softened dramatic market movements: Heifer throughput for the first 10 months of the year is up 13%, while steer throughput is up 25% when compared to 2023 numbers. This indicates that demand for heifers is being satiated by current supply.

Price differences like this are normally driven by factors such as a climate outlook or a market disruption. It is hard to predict whether this premium will remain looking forward, as there is no clear catalyst for current premiums. Supply is forecast to remain stable, and no recent climate outlooks are pointing towards a weather extreme, so we may continue to see this gap in the short term.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst