What’s next for the US cattle herd and what does that mean for Australian beef?

28 November 2024

Key points:

- The US cattle herd is at its lowest level in decades.

- US carcase weights have lifted above previous records.

- Potential declines in future production may provide export opportunities for Australian beef.

This article is kicking off our Top 10 Trends of 2024. Keep an eye out in the coming weeks to read the rest of the series.

The United States (US) holds a unique position in global beef markets as the world’s largest producer, consumer, second largest importer and fourth largest exporter of beef in the world.

Due to the size of the US herd, fluctuations in the cattle cycle have impacts globally.

Herd dynamics

Despite signals of an imminent herd rebuild at the start of 2024, the American cattle herd has shrunk over the year. Heifer slaughter has partially compensated for lowered cow slaughter, keeping the herd in a liquidation phase.

Year-to-October, cow slaughter has declined 15% to total 4.7 million head. Despite this decrease, heifer slaughter has remained constant at 8.3 million head.

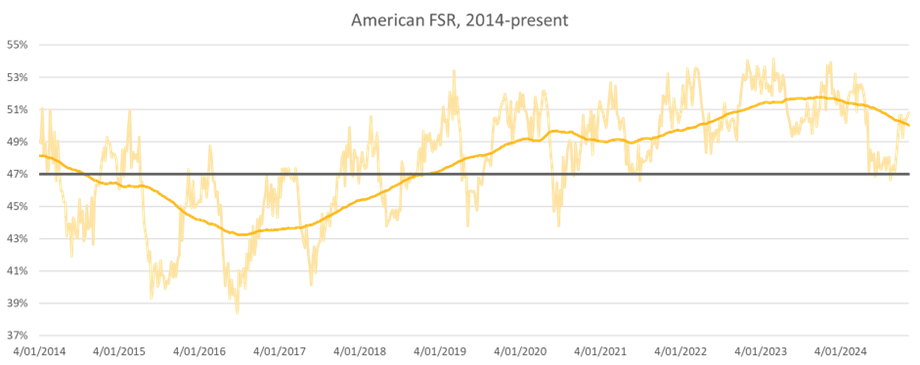

The lower cow slaughter numbers have reduced the intensity of the US destock, though it has not stopped entirely; in the year-to-October the female slaughter rate (FSR) ran at 49.7%. This rate is below the 51.4% seen in the first 10 months of 2023, however it’s still above the 47% tipping point.

The US cattle herd was 87.2 million head at the beginning of 2024 (the lowest figure since 1951). There are strong signs that in 2025, the herd will be smaller again.

Source: USDA, Steiner consulting, MLA

Production dynamics

Despite lower cow slaughter, overall beef production has lifted; for the year-to-October, 10.1 million tonnes of beef were produced. This is a slight (0.3%) increase on 2023 numbers.

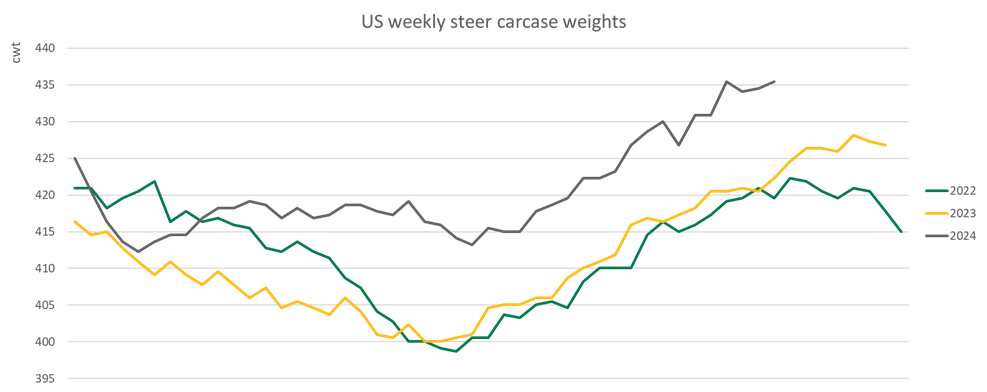

The small increase has been caused by a substantial lift in steer and heifer carcase weights. To boost production, processors have been more willing to accept heavier cattle, meaning cattle have been spending more time on feed.

In October, US steers averaged 430kg carcase weight (cwt), a record for steer weights. This has meant production from steers lifted 9% year-on-year in October, totaling 583,000 tonnes.

In contrast, declines in cow slaughter meant cow beef production fell by 10% year-on-year to 142,000 tonnes in October. Taken together, this means that production of beef from cattle in feedlots has risen, while non-fed production has fallen.

Source: USDA, MLA

Effect on Australian trade

The decline in non-fed beef production has led to a shortfall in lean beef in the American market, creating an increased demand for Australian beef.

Prices for imported 90CL beef in the US market reached a new record in July at 988¢/kg. Prices have been at near record levels all year for lean imported beef.

The strong demand has powered exports into the US, resulting in the US becoming the largest market for Australian beef in 2024. In the year-to-date exports have risen 66% to 317,532 tonnes, the largest export volume to the US since 2015.

The lift in volume has mostly come from exports of frozen, grassfed, and manufacturing beef.

Looking forward

Due to the decline in cow slaughter and the lift in steer carcase weights, American lean beef production is low while fed beef production is remaining relatively high. If and when the rebuild kicks off in earnest, lean beef production will likely stay low and fed beef production will fall.

This will have two impacts. Firstly, it will mean that (all else being equal) import demand in the US market will rise for beef and protein more broadly. It is also likely to shift the import mix, with lower supplies of steaks and other primal cuts available domestically.

The other impact would be a reduction in exports coming from the US. Just under 70% of US exports this year have gone to Japan, South Korea or China. Lower American exports would create a boosted demand for imported beef from other sources.

Although it is unclear when rebuilding will commence in the American cattle herd, it’s clear that movements in the herd will have global impacts. This could potentially reduce global supply and provide opportunities for Australian exporters.

Attribute content to: Tim Jackson, MLA Global Supply Analyst