What does the Eastern Young Cattle Indicator cover and how has it changed over time?

Key points

- The Eastern Young Cattle Indicator (EYCI) is currently the most widely reported National Livestock Reporting Service (NLRS) indicator, covering young cattle sales to restockers, processors and feedlots.

- The Queensland young cattle market remains relatively stable with peaks driven by restocker demand.

- In Victoria, processors and feeders compete, driving the young cattle market.

The Eastern Young Cattle Indicator, or EYCI, is a seven-day rolling average of young cattle from 23 saleyards across Queensland, NSW and Victoria. It is expressed in cents per kilogram carcase (or dressed) weight (¢/kg cwt) and is rounded to two decimal points. The indicator includes vealer and yearling heifers and steers with grade scores C2 and C3 and liveweight from 200kg.

The EYCI is produced by Meat & Livestock Australia’s National Livestock Reporting Service (NLRS) and has been a staple to market reporting for over 25 years. The indicator is the most widely reported NLRS indicator and is a useful tool for understanding restocking dynamics and a forward-looking confidence measure.

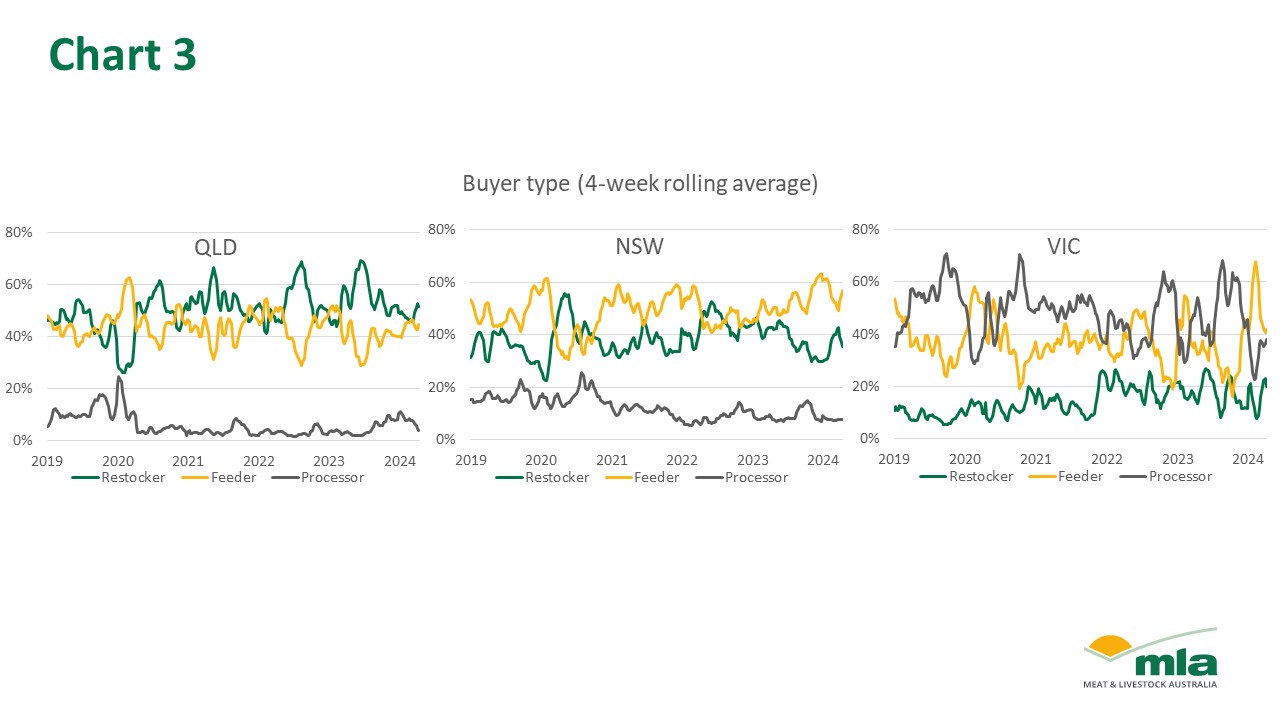

A telling dynamic of the changing demand through saleyards is the changing make-up of buyers. The EYCI records all three main buyer types; processors, restockers and feeders.

As seen below, the makeup of the EYCI has been moving away from processors since data began in 2000, and feedlot buyers have become gradually more involved in the young cattle market. We know that processor demand for young cattle has changed to heavier carcases as domestic and export market demand shifts.

Chart 1

For a period between 2010–2013, there was an approximately even split between all three buyers. Since then, processors have further exited out of the young cattle market leaving a relatively even split between restockers and feeders playing in the market.

Chart 2

Looking on a week-by-week scale, we can see a strong seasonal inverse relationship between feeder and restocker buyers, indicating these buyers are competing and driving prices. The seasonality reflects a weaker restocker demand between October/November and April/May. This is driven by producers’ reluctance to restock over summer. On the east coast, producers only understand their season capacity after the impacts of summer rainfall. Operating in a system less reliant on seasonal conditions, feedlots seem to take advantage of this lower restocker competition.

Looking at state-by-state dynamics, the Queensland young cattle market remains relatively stable with peaks driven by restocker demand. Restockers compete starting early in the year after the impact of summer rainfall is felt in ground feed. This demand remains solid for most of the year, before dipping off in the last quarter. The last two years have seen strong surges as restockers are willing to compete with lot feeders to restock post-drought. Average weekly throughput for Queensland is 10,080 head.

Chart 3

NSW is more volatile, with feeders and restocker purchasing acting less cyclical in nature. Over the last five years, feedlots have been much more active in the young cattle market. Despite this, you can see post 2019 drought, and during the wet season of 2022, restocker competition led over feeders through saleyards. Average weekly throughput for New South Wales is 11,391 head.

Victoria has a different buyer dynamic again. Processors and feeders compete driving the Victorian young cattle market. In Victoria, breed type and decent year-round rainfall resulting in high-value feed leads to cattle putting weight on earlier and faster than in systems further north. Hence, younger cattle fall within the desired weights, driving processor competition. It is important to note that throughput in Victoria is relatively small with an average weekly throughput of 1,177 head.