Various dynamics influencing light vs. heavy lamb price split

19 April 2024

Key points:

- Heavy lambs fetch a 162¢ premium to light lambs in saleyards.

- Elevated US demand for heavier carcase weights has supported heavy lamb prices.

- Supply of light lambs expected to trend upwards, following long-term trends.

Over the last five years, the National Light Lamb Indicator has averaged 30¢ below the National Heavy Lamb Indicator. More recently, the price disparity between light and heavy lambs has grown. Currently, the indicators are showing a 162¢ light lamb discount, the largest discount this year.

National Heavy Lamb Indicator: 649 ¢/kg cwt

National Light Lamb Indicator: 487 ¢/kg cwt

Looking over the longer-term trends we can assume a shift in the market dynamic has caused these premium changes. To understand this, we need to understand the type of market each lamb indicator represents.

The National Trade Lamb Indicator (NTLI) represents our domestic lamb product. It includes lambs bought by processors up to 12 months of age with all fat scores and carcase weights from 20–26kg. The ‘ideal’ Australian lamb carcase weight is 24kg.

The National Heavy Lamb Indicator includes lambs up to 12 months of age with a carcase weight of 26kg+ and bought by a processor. This indicator is used to represent an exported lamb product. Australia exports a lot of sheepmeat to the US, which prefers a heavier carcase to the domestic product.

The National Light Lamb Indicator includes lambs up to 12 months of age and carcase weights from 12–20kg, bought by processors and various restockers. This indicator may also represent an export lamb product destined for countries with a demand for lower carcase weights, such as the Middle East and the UK.

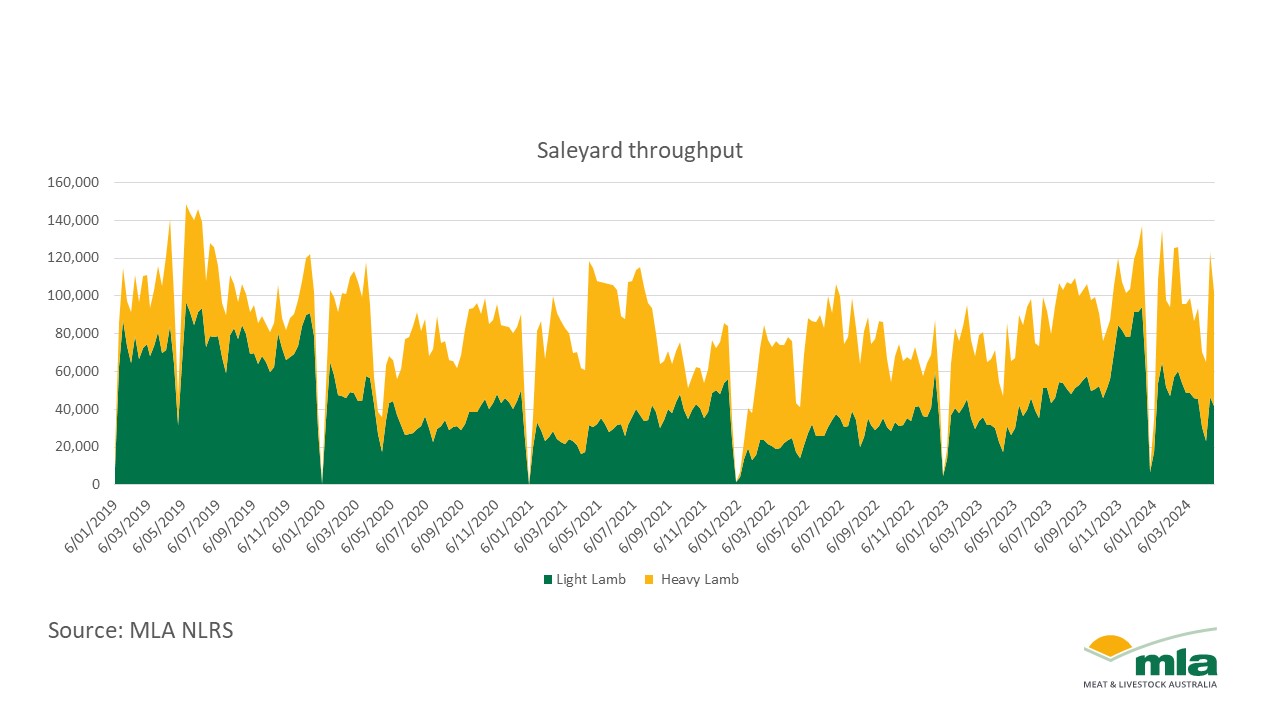

2022 marked the end of a rebuild period, where lambs supply was constricted by the sector's interest in retaining lambs to rebuild flocks to pre-drought levels. This limited options for processor. A limited supply of heavy processor-ready sheep increased competition in light lambs. During this time, restocker premiums also occurred due to the cost-benefit of buying light lambs to grow out and sell for an increased dollar-per-head price.

As saleyard throughput increases post-rebuild, processors are able to prioritise a heavier product. As the cost of processing is largely based on a per-head basis, demand for higher carcase weights increases processor profits per head with access to a heavy lamb market.

In addition to throughput, elevated US demand has influenced heavy lamb premiums. March export data indicated Australian exports of lamb lifted 36% in March from 2023 levels to 30,707 tonnes, making February and March the second and third largest export months on record.

Post-April, throughput of light lambs tends to increase until the end of the year. Weather will likely play a large role in the restocker appetite, which may shift buyer dynamics towards a lighter animal moving forward.