US slowdown boosts Australian cow prices

01 August 2024

Key points:

- High demand from the United States is pushing up lean beef pricing.

- American carcase weights are at record highs.

- Opportunities for Australian beef in the US are set to grow.

Among the saleyard indicators that the National Livestock Reporting Service (NLRS) publishes, the Processor Cow Indicator has been the strongest performer over the past year, rising by 25% compared to an average of 17%.

The strong performance of the processor cow is due, in part, to the specific requirements of beef importers in the United States. As the American destock slows, the positive demand drivers currently affecting the processor cow will likely generalise to other parts of the market.

American supply situation

As discussed in the Global Beef Market Update, the United States is currently emerging from a long destock that began in mid-2019 and peaked in 2022. Although still technically destocking, cow and heifer slaughter is down 7% from last year. In the first half of the year there has also been a fall in the female slaughter rate from 51.7% to 50.4%.

In particular, dairy cow slaughter has fallen by 14% from last year. This is important, as a large proportion of American lean trim production comes from dairy cow slaughter.

Overall, slaughter is down 4% from last year, but production (as measured in tonnes) has only fallen 2%.

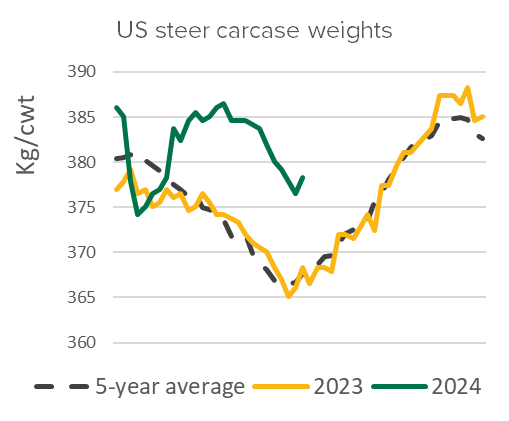

Steer and heifer carcase weights have not followed the usual seasonal pattern in the US, with weights remaining much closer to seasonal peaks for much longer than is normal. So far this year, average carcase weights are well above previous records.

This has pushed up production overall, and in particular led to robust production of fatty trim (50–70cl).

Taken together, this means two things:

- American production of steaks and fat trim remain robust

- Lean trim production is falling rapidly.

Imported market dynamic

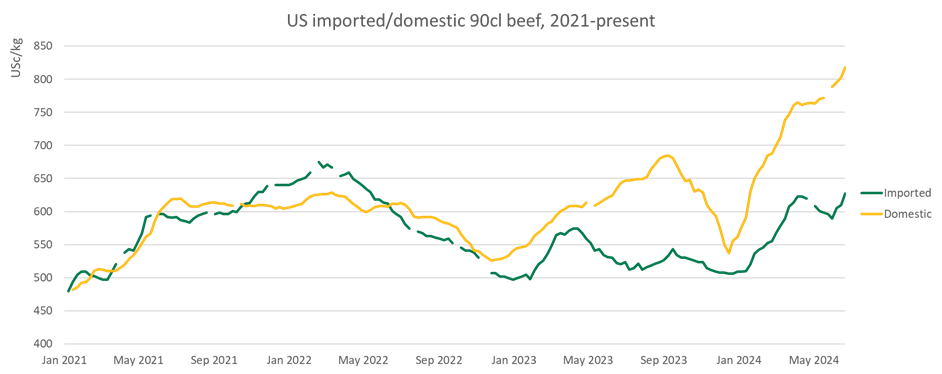

The shortage of lean trim in the US market is pushing prices up, both for domestic and imported product. Prices for 90cl lean trim hit record highs for domestic product during June, and the imported pricing is being steadily pulled up by the domestic shortage.

Source: USDA, Steiner Consulting

At the same time, general beef prices in the US are much steadier. While prices have lifted, carcase cutout values have not risen nearly as quickly as lean trim values, and fat trim values have remained under year-ago levels.

High carcase weights are holding beef production numbers up, which is suppressing some beef prices, while low cow slaughter is pushing up demand for lean trim.

Impact on Australia and looking forward

The impact of this can be seen in the robust performance of the Processor Cow indicator when compared to the market overall. The cows in the indicator are purchased by processors and will often yield lean beef that is well suited to the US market. This has resulted in the Processor Cow Indicator being closer than most others in the United States.

As a result of US carcase weights declining, the opportunity for Australian beef in the American market will broaden, and the range of Australian beef exports is likely to grow.

The US cattle herd remains in a destock, and slaughter numbers continue to fall. As American seasonal conditions improve, the opportunity for Australian beef will continue to grow.