US cow production continues to decline

27 September 2024

Key points:

- US beef exports are forecast to fall 13% in 2025.

- Australian beef exports to the US have risen 69% so far in 2024.

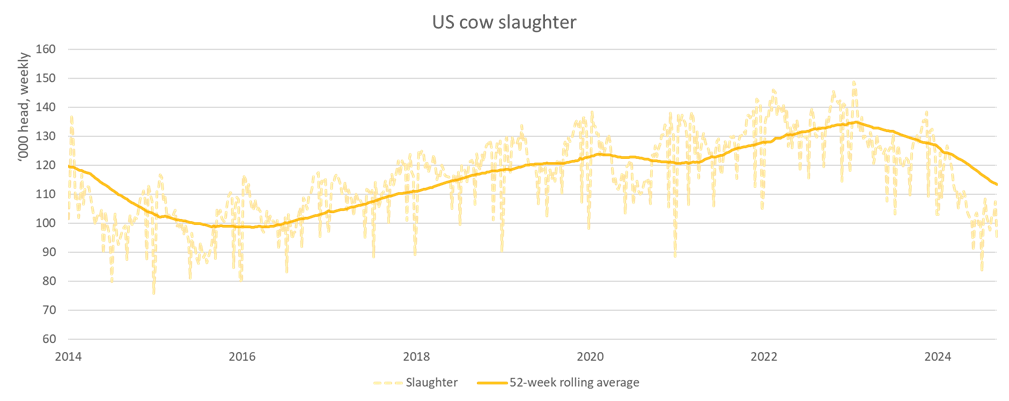

United States (US) cow slaughter has fallen by over 650,000 to 3.76 million head year-to-date – a 15% decline from 2023. This is alongside a substantial reduction in bull slaughter, meaning that production of lean domestic beef in the US has fallen by 12% from last year to 1.2 million tonnes (the smallest production volume since 2016).

Source: USDA

The number of heifers entering feedlots has risen substantially at the same time, and overall carcase weights have risen substantially. This means that despite a 4% decline in overall slaughter, production has only fallen by 1% so far this year and is only forecast to fall 1% in 2024 overall, according to the United States Department of Agriculture (USDA).

The lift in heifer feedlot entries is effectively shrinking the future breeding herd, which will slow down the size of the future rebuild. Although production remains higher than expected, the outlook for future production is expected to stay smaller for longer. In 2025, beef production is forecast to fall another 4% from 2024 levels and exports are expected to fall 13%.

Australian exports to the US have already risen substantially over the past two years; year-to-August beef exports to the US have risen 69% from last year to 234,975 tonnes, making the US the largest export market for Australian beef.

As Australian production is projected to rise to record levels in 2025, the USDA forecast shows opportunities exist on the global market, as US production continues to slow down. While US production remains higher than expected due to heavier carcase weights, the increase in heifer turn-off forestalls the possibility of sustained rebuilding to 2025 at the earliest.

Attribute content to: Tim Jackson, MLA Global Supply analyst.