Survey delivers key insights into sheep producer selling behaviour

Key points

- MLA undertook an analysis of data from the February Sheep Producer Intentions survey, identifying the unique differences in selling behaviour relative to producers’ flock sizes and the states they operate in.

- Large producers retained lambs in 2022 to ensure adequate finished condition could be afforded to lambs, mitigating risk of a downturn in prices with better quality stock offered to market

- Queensland and WA producers preferred to utilise more direct sales channels compared to the national average.

- The tightening in supply may not eventuate in winter 2023 due to increased supplies of lambs due to the flock growth and wet weather.

Sheep producers are operating in unique ways according to their state and size, an analysis of the MLA and Australian Wool Innovation’s February 2023 Sheep Producer Intentions - PULSE survey has found.

Analysis and insights

The February survey’s aim was to identify:

- actual producer reported sales up to 31 December 2022 and reasons behind any changes in performance against October 2022 estimates

- producer forecast sales for January–June 2023

- which market channels producers intended to sell their sheep and lambs.

When MLA’s Market Information team analysed the data at a state and flock size level, three key insights emerged:

- Between October and December 2022, 75% of producers with more than 10,000 sheep sold less lambs than expected. Larger-scale producers tended to focus on finish and quality for lambs.

- Over-the-hooks and paddock sales dominated Queensland and WA producers’ preferences of sale platforms, reflective of limited saleyards and distance required to travel to reach public auction in the states.

- Wet weather impacting lamb performance in the second half of 2022 looks set to deliver increased supply and will ensure the seasonal tightening of supply may not eventuate up to June 2023.

1. Large producers focus on finish and quality for lambs

The survey data provided unique insights into the management behaviours of different producers relevant to their flock size.

Larger producers preferred to retain lambs on-farm rather than selling in the 2022 spring flush period.

Between October and December 2022, 75% of producers with more than 10,000 sheep stated they sold less lambs than expected, while 83% stated the reason behind reduced sales was the impact of weather on lamb performance.

Large-scale producers preferred to retain lambs to ensure finish, weight and quality rather than offloading and receiving a discounted price. This recognises the importance of weight, finish and even, adequate fat cover as key drivers of price performance and therefore return on investment.

Recent NLRS market reports, commentary and data have confirmed lambs with finish and weight are receiving price premiums, supporting larger producers’ behaviour, selling decisions and management.

2. WA and Queensland sheep producers prefer to sell over-the-hooks and out of the paddock

Due to vast distances required to truck sheep to public auction at the saleyards and lack of public saleyards available in Queensland and WA, producers prefer to sell in a direct-to-buyer method rather than at the saleyards.

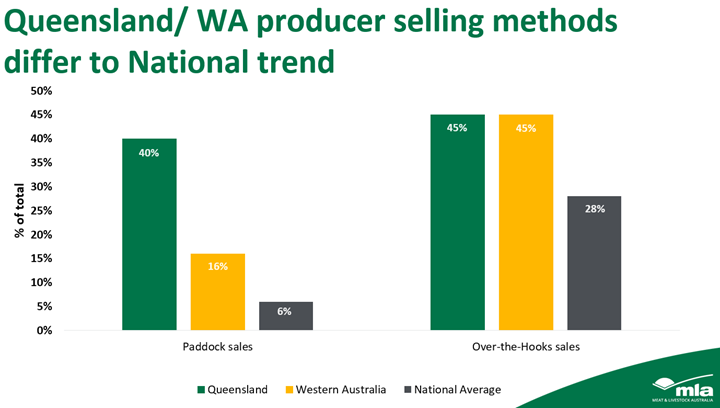

For Queensland producers, 45% stated that expected sales in the first half of 2023 would be made over-the-hooks and a further 40% expected these sales to be made as paddock sales (Figure 1).

In WA, 16% of total expected sales were to be paddock sales and 45% were expected to be made over-the-hooks.

This is compared to the national average expectation of 28% of sales made over-the-hook and only 6% of sales to be made out-of-the-paddock.

The outline of the difference between each state relative to the national average can be found below (Figure 1).

Figure 1: Queensland / WA producers selling methods differ to national trend

To support the higher preference for more direct sales channel choice in WA, 40% of producers noted the reason for selling fewer lambs than expected was because “prices were not strong enough at the time”.

This indicates WA producers prefer more direct, reliable methods than the potential volatility of saleyard prices, therefore reducing reliance on this sales channel and shoring up expected market performance with more direct channels such as paddock sales or over-the-hooks.

3. Wet weather impacts will ensure the typical winter lull is avoided in 2023

With 43% of producers stating weather impacted lamb performance last year, the typical tightening of seasonal supply into winter may not eventuate. This is due to the increased number of expected sales in the first half of 2023.

As a result of this change – and inclement weather in the second half of 2022 – both yardings and slaughter numbers of sheep and lambs may remain above long-term averages into June 2023.

Year-to-date, an increase in lamb yardings across the states has occurred (Table 1), proving that larger yardings may continue into the middle of the year due to the high retention that eventuated as a result of wet weather in 2022.

Table 1: Year-to-date change in lamb yardings to 31 March

|

State |

YTD | YOY (actual) |

YTD | YOY % |

|

NSW |

148,169 |

14.5% |

|

Victoria |

62,288 |

9% |

|

Queensland |

1,252 |

9.4% |

|

SA |

33,476 |

28% |

|

Tasmania |

683 |

4.4% |

|

WA |

-58,631 |

-38.8% |

|

National |

240,757 |

14.4% |

Source: MLA

Other than WA, all other states have had increases of 4% or more in lamb yardings in 2023. Importantly, the increase in NSW lamb yardings has accounted for 62% of the total national lift, demonstrating the significance of the NSW flock growth.