Strong supply drives market trends

Key points

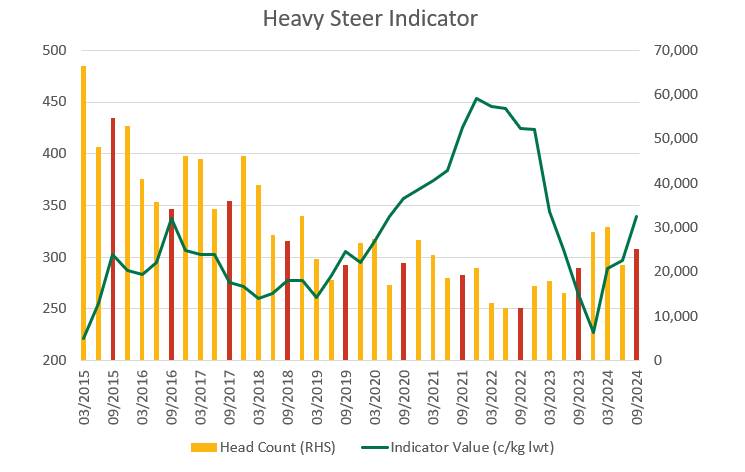

- The Heavy Steer market appears to be returning to historic trends.

- Heavy Steer prices surged 14% from July to September, with a lift in yardings of 80%.

- Cattle slaughter hit a four-year high this week, showcasing strong processor demand.

After a volatile few years, MLA analysis has indicated a return to normal trends, with the Heavy Steer Indicator being one of the pricing dynamics that has stabilised.

The third quarter of the year is traditionally a strong period for cattle markets, and 2024 has been no exception. According to the National Livestock Reporting Service’s (NLRS) Heavy Steer Indicator, cattle supply through saleyards typically increases from June to November. During this period, spring supply tends to consist of high-quality and heavy-finished stock, leading to a rise in prices alongside increased supply.

Historically, in 19 of the last 24 years, the third quarter has seen both prices and head count rise. This year, from July to September, heavy steer prices increased by 41¢/kg liveweight (lwt) (14 %), while yardings surged by 80%, reflecting the flow of high-quality animals through to saleyards. Conditions across northern NSW and Queensland have supported these pricing trends, while prices in SA and Victoria have seen less of a quality-based lift.

While supply starts to lift in June and continues through the summer months, cattle yardings will eventually reach a point where rising prices are no longer sustained by demand, causing a turning point for the indicator. Historically, this turning point occurs between September and November, leading to a slight market correction. In 2023, this happened in July when yardings reached 2,914 head, while in 2022, it occurred in November when yardings peaked at 3,500.

Last month, after peaking at 352¢/kg lwt in mid-September, heavy steer prices dropped 7%, settling at 328¢ as yardings exceeded 4,400. This decline aligns with historical patterns, suggesting that supply has surpassed the demand threshold.

Looking ahead, the throughput of processor-ready steers is expected to remain strong through the final months of 2024. Last week was the highest weekly slaughter levels since January 2020, with 143,800 cattle processed—an 11% increase above the 2024 average, indicating sustained strength in both supply and demand.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst