South Korea our fastest growing goatmeat market

Key points

- South Korea is now the second largest export market for Australian goatmeat

- United States remains our biggest market, accounting for around 66% of exports

- Growth potential for Australian goatmeat exports to the United Kingdom.

South Korea is emerging as one of Australia’s fastest growing goatmeat export markets by value and volume, almost doubling its Australian goatmeat imports in 2021.

It is now the second largest export market for Australian goatmeat, claiming the position from Taiwan which had held the title since 2000.

In the January to September 2021 period, the value of Australian goatmeat exports to South Korea increased 107% compared to the same period in 2020.

The value of exports to South Korea is expected to further increase under the Korea–Australia Free Trade Agreement (KAFTA), which will see import tariffs drop to 2.2% this year and 0% in 2023.

US still Australia’s biggest market

The United States remains to be Australia’s most important goatmeat markets, accounting for around 66% of all Australian goatmeat exports in the 2021 calendar year, following a 47% year-on-year increase in volume.

In the 2021 calendar year, goatmeat exports to the US were valued at $167 million, up from just under $100 million in 2020.

With demand for goatmeat in the US remaining strong, Mexico has increased its volume of goatmeat exports to the US, competing on a lower price point than Australian goatmeat.

Canada is the other key export market with increasing goatmeat demand, driven by similar consumer demand as the US with significant Indian, Caribbean, and Middle East populations where goatmeat is popular in their cuisines.

Potential for growth in UK

Growing consumer demand in the United Kingdom combined with the Australia-United Kingdom Free Trade Agreement (A-UK FTA) could open up further export potential for the Australian goatmeat industry.

The UK has significant and growing populations that enjoy goatmeat, with imports trending up over the past 25 years and averaging around 550 tonnes per year over the past five years.

In the 12 months to November 2021, the UK imported around 830 tonnes shipped weight (swt) of goatmeat valued at just under A$5 million. The main supplier of goatmeat to the UK is Spain with 83% volume share in 2021, followed by Greece (10%), Ireland (3%) and Australia (2%).

Looking at comparative import unit prices (Free On Board A$/kg), Australian goatmeat is priced somewhat lower than most other suppliers.

The Australia-United Kingdom Free Trade Agreement (A-UK FTA) is anticipated to enter into force later this year. There will be improved market access for Australian goatmeat, though somewhat less than for beef and sheepmeat, which will benefit from significantly larger tariff-free quotas from year one.

Pre-FTA tariffs on Australian goatmeat were 12% plus an additional value per 100kg, depending on the tariff line. Once the A-UK FTA enters into force, tariffs on Australian goatmeat will reduce every year to ultimately reach 0% on 1 January 2029. During the transition period, goatmeat will continue to access the existing shared sheepmeat / goatmeat WTO quota (13,335t) at 0% in quota tariff.

There are also a range goatmeat consumption growth drivers in the UK, including a sizeable ethnic population of greater than five million consumers that enjoys goatmeat. Increasing demand from consumers who have a strong interest in cuisine experimentation and trying new foods is also a key factor.

Production increasing

In 2021, the production volume and value of Australian goatmeat started to increase for the first time since 2017.

The downward trend had been largely due to unfavourable seasonal conditions and COVID-19 disruptions to foodservice channels globally, which is a main selling channel for Australian goatmeat exports.

Australian goatmeat export values generally continue to rise, with the average unit value in 2021 of A$12.55/kg swt.

The goat over the hook (OTH) indicator is now just under 900c/kg carcase weight.

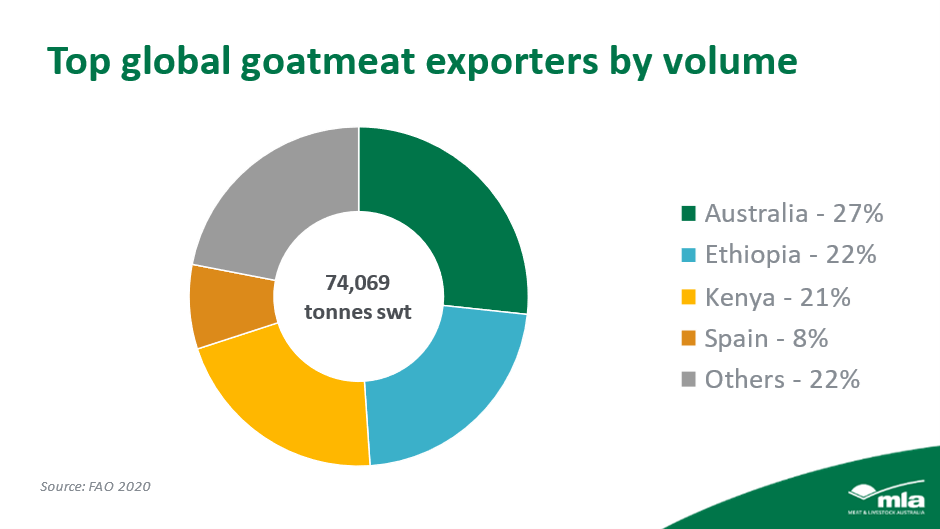

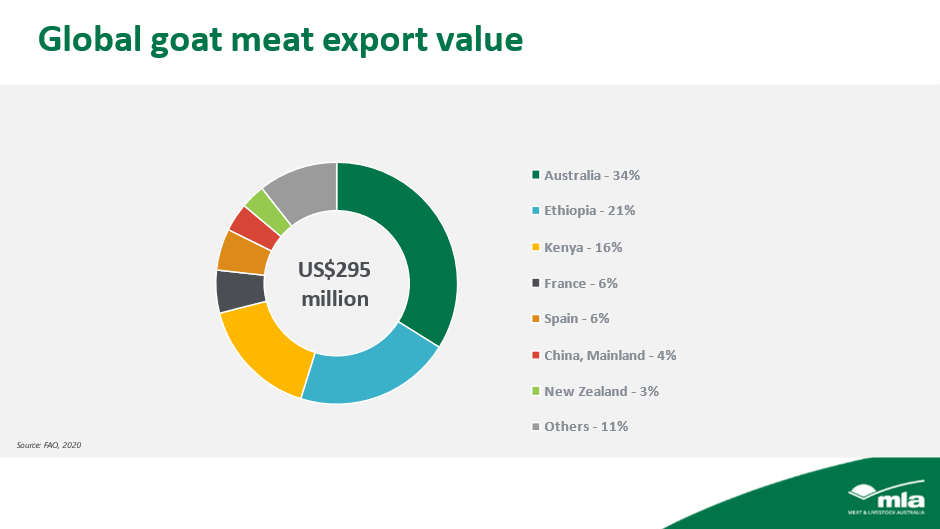

According to FAO data, Australia remains the top global goatmeat exporter in volume and value.

Ethiopia is the second largest exporter in volume and value. Aid programs are supporting increased production and exports in Ethiopia which – along with climate change – are driving the shift by farmers from cattle and sheep production to better adapted animals such as goats.