Solid sentiment lift among sheep producers

Key points

- New survey results indicate that sentiment among Australian sheepmeat producers has moderated over the past six months, but several issues are affecting the industry.

- Producers have cited the volatility of prices, operating conditions and concerns around the live export ban as contributing to their sentiment in this survey.

- Of the estimated 47 million breeding ewes on hand, Merinos (61%), prime lambs (15%) and first cross (12%) are the dominant breed types across the country.

Meat & Livestock Australia (MLA) and Australian Wool Innovation (AWI) released the May 2024 Sheep Producers Intentions Survey (SPIS) results this week. The SPIS gathers important industry data across the sheepmeat and wool industries covering flock profile, industry sentiment and producer intentions for the season ahead. The focal point of the May wave was breeding ewe and wether flock intentions.

Sentiment

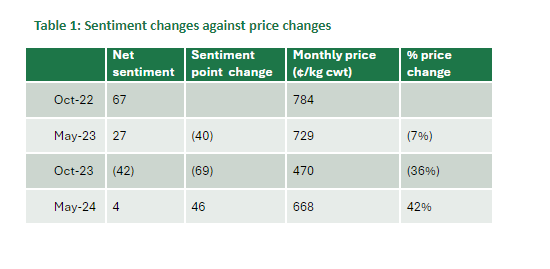

Looking at the different times where sentiment has been recorded; in May 2023, prices were still high in terms of long-term averages, with neutral conditions forecast. In October 2023, the survey was conducted while the industry was at the bottom of the price crash, and an El Niño announcement was made from the Bureau of Meteorology. Now, despite poor seasonal outlooks across southern sheep producing regions, producers have gained cautious confidence, with the sheepmeat sector in a position of price recovery.

National

Sheepmeat producer sentiment in May improved over the seven months since the previous survey. National net sentiment for the sector was recorded at +4, up 46 points from October; however, it is still below sentiment levels in May 2023 when it was +27.

Producer sentiment is a strong indicator of a point in time and can change swiftly and significantly pending sudden moves in market prices, climate forecasts and industry policies.

State sentiment breakdown

Three states reported a negative net sentiment. WA experienced the poorest net sentiment (-64), up only 7 points from the October wave. Prices and seasonal conditions in the state remained below average, and the live export trade announcement likely had an impact on responses.

Tasmania (-5) and SA (-1) were the only other states reporting a negative net sentiment, though they are up 37 and 54 points respectively, compared to October 2023. These results reflect the current climate conditions across these states. SA, Tasmania, and Victoria experienced a neutral summer rainfall period, leading to normal ewe retention and joining. This has led to high scanning rates and a larger reliance on feeding out.

Victoria (+12), NSW (+21) and Queensland (+33) all saw lifts into positive sentiment territory, buoyed by improved conditions and/or prices.

Flock profile

The SPIS methodology gathers and scales responses to provide a national flock profile breakdown. Through the latest survey data, the proportion of the flock across states is as follows: NSW: 36%, VIC: 24%, WA: 19%, SA: 14%, TAS: 4%, QLD: 3%.

Breeding ewes

There has been a significant number of sheep turn-off over the last six months, yet despite this, the survey estimates have shown the breeding ewe flock growing from 46.14 million in May 2023, to 47.97 million in May 2024 – a 4% lift.

Through the rebuild, producers have retained older ewes to inflate their flock, choosing to sell ewe lambs because of lamb-mutton price discounts.

There has been a small reduction in the Merino makeup of the flock to 61%, while prime lamb (15%) and shedding ewes (7%) have both grown in proportion. First-cross ewes (12%) and dual purpose (4%) have both reduced in makeup.

Among the producers who completed the May 2024 survey, just over four in 10 (42%) reported they intended to downsize their breeding ewe flock over the upcoming 12 months. One in five (22%) intended to increase their ewe flock, and about one in three (36%) reported no expected change.

Wethers

The wether flock has decreased by 7% from 9.2 million to 8.6 million, made up of predominantly Merino-based breeds. The survey showed around half of producers (53%) expect no change to the size of their wether flock in 2025, with a further 18% expecting more wethers and 29% expecting fewer wethers in 2025.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst