Records continue for the lot feeding sector

30 May 2024

Key points:

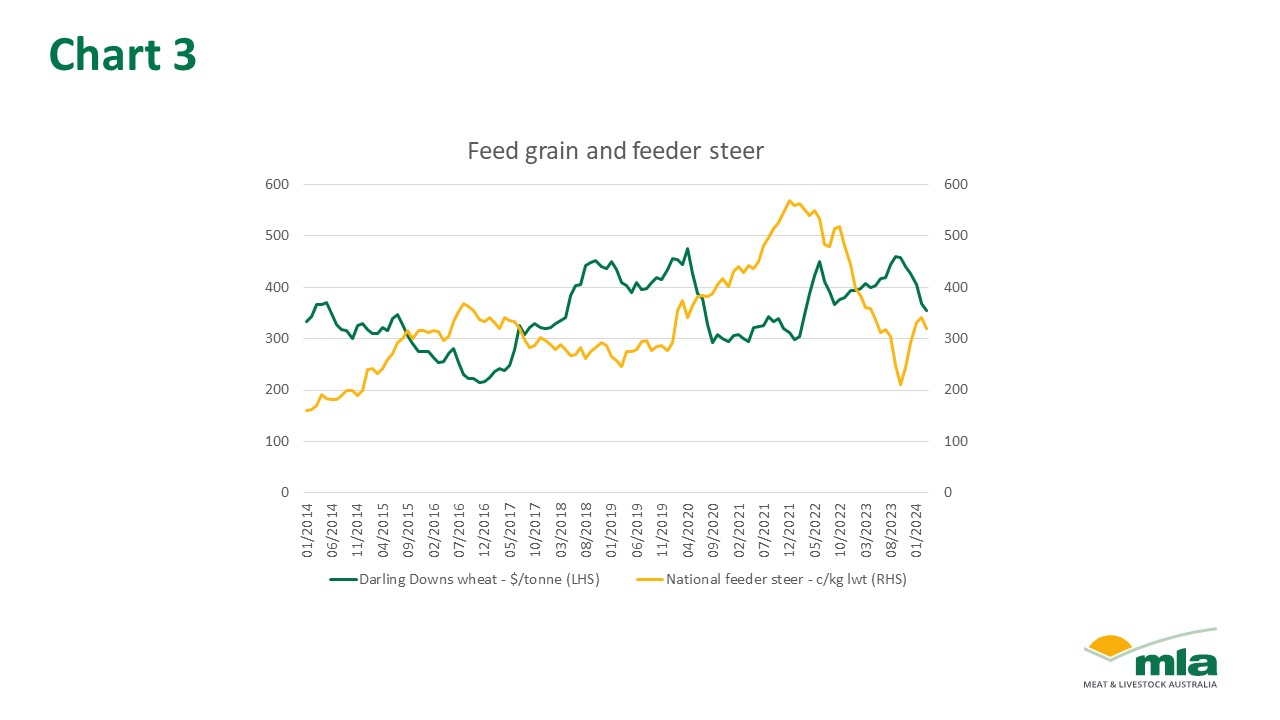

- For the first time on record, numbers on feed tipped 1.3 million head.

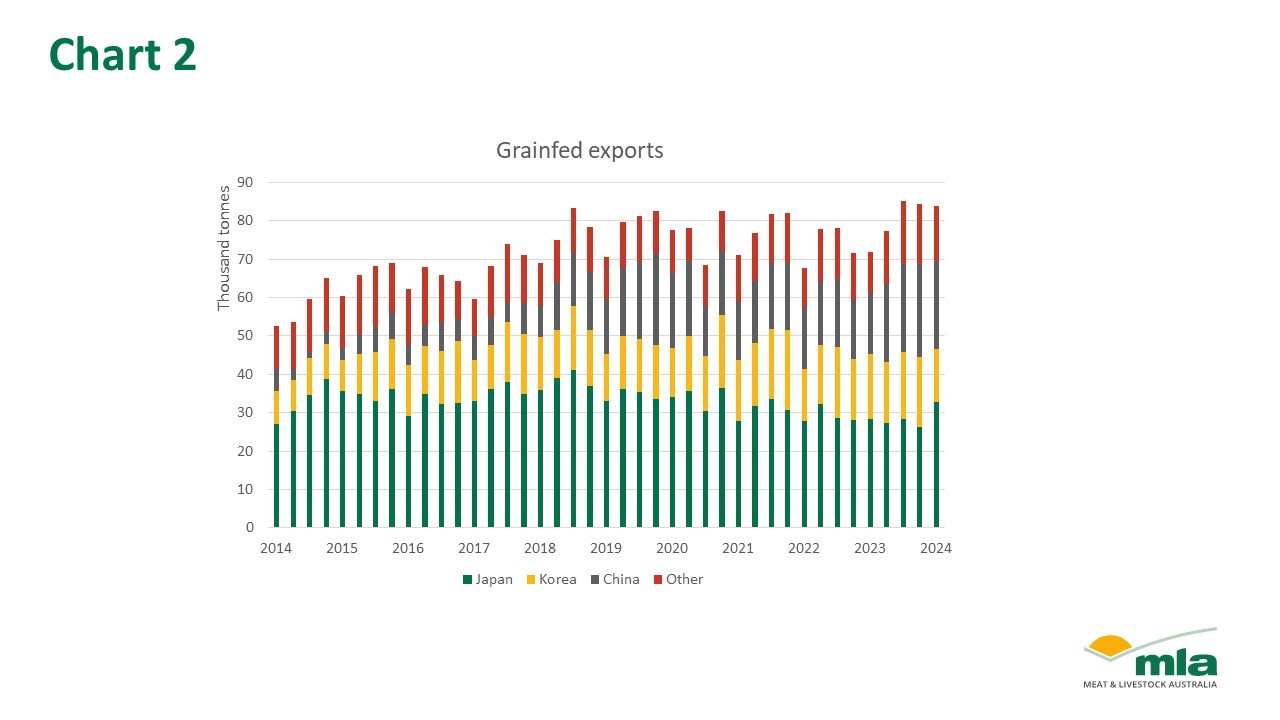

- Quarterly feeder steer prices have lifted and eased wheat prices, making a positive impact on margins.

- Grainfed exports remain firm as Japan's market continues to grow.

The Australian Lot Feeders Association (ALFA) and Meat & Livestock Australia (MLA) released their 2024 March quarter Lot Feeding Brief, covering information gathered through a quarterly survey of lot feeders across the country. Survey data has revealed the number of cattle on feed has tipped 1.3 million head for the first time on record.

Numbers, turn-off and capacity

For the sixth consecutive quarter, numbers on feed have lifted, pushing the sector once again to record figures. Numbers on feed were up 5% on last quarter and a significant 15% on last year, reporting a total of 1,355,000 head. There was a 13% lift within feedlots with a 0–1,000 head capacity, which assisted in driving the overall lift seen in the March quarter. Producers with feedlot capabilities on-farm are taking advantage of the desirable margins from feed cattle and feed wheat prices over the first quarter. The industry also saw growth in numbers for larger feedlots (10,000+ capacity), with numbers sitting at the highest on record as we see the return of these larger facilities.

On a state level, NSW was the only state which experienced declines in the number on feed. This small decrease has been driven by high turn-off as cattle from the previous quarter, which was a record quarter, reach maturity. Both QLD and SA lifted to individual records on feed at 802,000 and 65,000 respectively.

Quarterly turn-off lifted once again with 762,000 heads turned off, lifting quarter-on-quarter and year-on-year across states. Moving forward, turn-off should remain high, as the elevated number of cattle on feed reach the end of their feed programs. Note WA's turn-off lifted by 166% as they entered the peak seasonal high period over the March and June quarters.

Feedlot capacity fell by less than 1%, remaining at 1.6 million head. The lift in numbers on feed and steady capacity has, in turn, caused an increase in utilisation to the highest utilisation rate in two years at 85%.

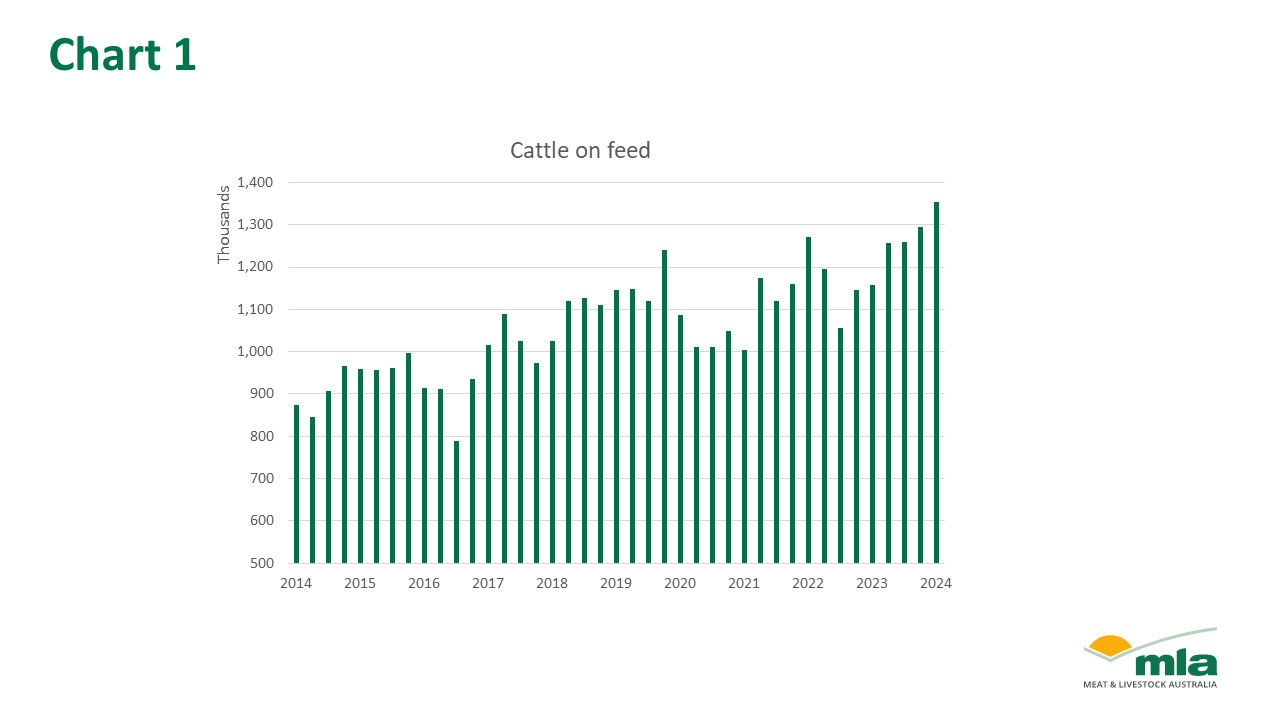

Grainfed exports

Grainfed exports remained firm in the first quarter, with 84,000 tonnes of Australian grainfed beef exported, making up 30% of all beef exports.

Japan remained Australia's top grainfed beef export market, with volumes reaching the largest since Q3 2021. With this, Japan's export market share rose by 8 percentage points and now makes up 39% of all Australian grainfed exports. Japan’s increase can be attributed to the ease in US export volumes entering the country, lifts in domestic consumption, and a reduction in Japan's domestic cold stores of beef.

There was an ease of grainfed beef exports to China by 5%. This has led to a levelling of numbers after the record volumes of the previous quarter. China makes up for 27% of exports, making it the second largest grainfed export market. There was an ease in exports to Korea, with the country now making up only 16% of total grainfed export volumes. The exports in other markets eased by 7%, largely due to a jump in exports to Japan.

Prices and supply

The supply of feeder steer cattle through MLA's National Livestock Reporting Service (NLRS) saw a 13% rise on the last quarter reaching 89,000 head. This is the largest throughput since March 2018. Individually, most states experienced lifts, with only WA reducing throughput.

Along with increased supply, average feeder steer weights lifted to 423kg (similar to throughput weights of Q1 2023). Increases were also seen in feeder steer prices, with a lift to 331¢/kg liveweight (lwt) after the lows of last year.

Feed wheat prices, measured through the Darling Downs wheat price, softened a further 15%, meaning prices are at an average of $375/tonne in Q1 2024. This is a $67/tonne fall on Q4 2023 rates. With the cost of feed grain easing and steer prices remaining low, lot feeders have been taking advantage of improving margins.