Record surge in the National Mutton Indicator

10 April 2025

Key points:

- The National Mutton Indicator surged 26% last week, reaching its highest price since July 2022.

- Reduced yardings and strong saleyard competition are driving prices.

- Upcoming short weeks could encourage elevated yardings and buyer participation.

Last week, the National Mutton Indicator experienced its most dramatic weekly increase on record, rising to 529¢/kg carcase weight (cwt), with daily prices peaking at 551¢/kg cwt. This week, prices have eased, as outlined in MLA’s weekly market wrap for 11 April.

Supply dynamics

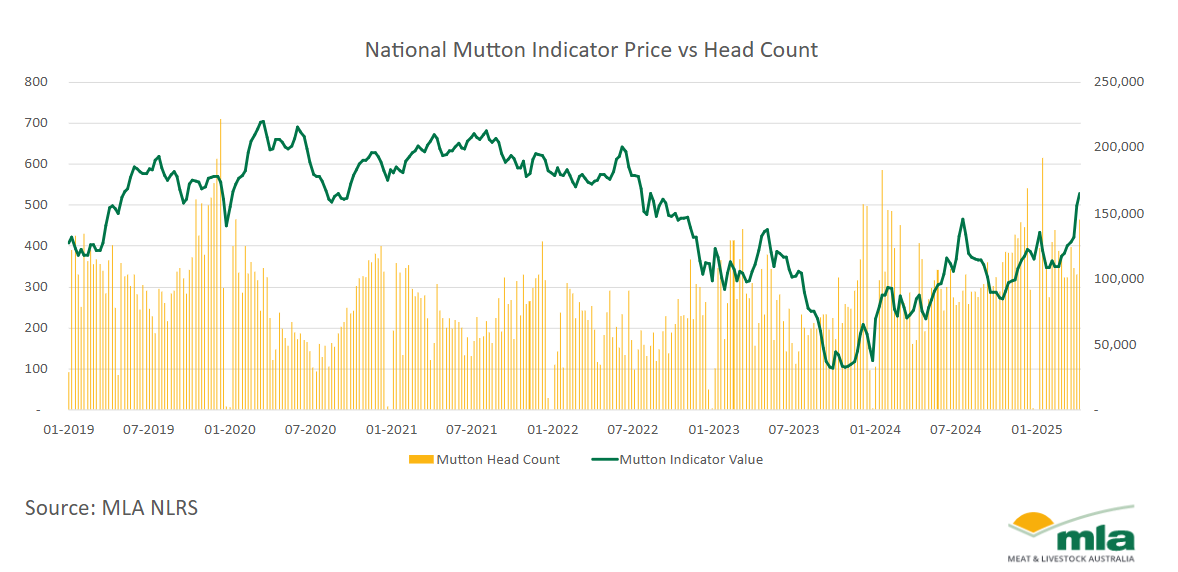

Mutton supply and pricing are highly seasonal, as reflected in the National Livestock Reporting Service (NLRS) data. As mentioned in a previous article on mutton seasonality, supply typically peaks in summer. This increase is driven by higher turn-off as producers retire breeding ewes. After this, supply tightens and prices generally peak around June or July.

Mutton is a crucial export product for Australia, and as the largest exporter, Australia’s processors face consistent global demand for the product. This, in turn, creates consistent saleyard demand.

Price movements

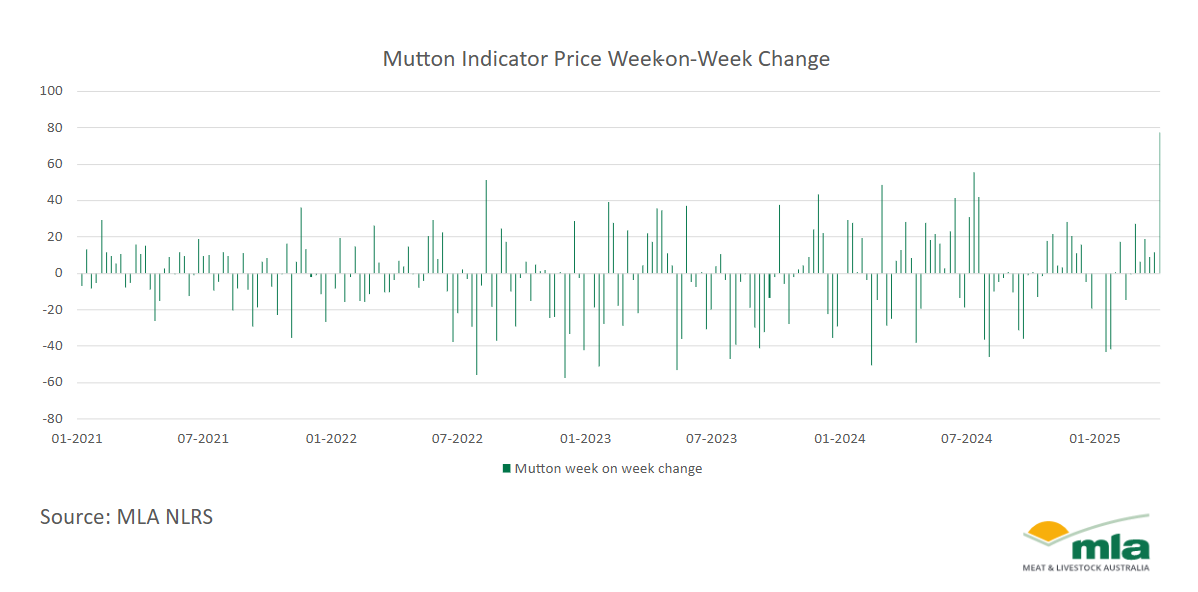

Over the past two weeks, Australian livestock markets have experienced significant price movements. Lamb prices have increased by 4–8%, while mutton prices have seen a more significant spike, rising 26% to their highest levels since July 2022 last week. The week-on-week lift tipping 100¢ was the largest weekly price lift seen outside of a year opening sale.

While the weekly price spike was dramatic, there has been a gradual movement over the first quarter of 2025, following seasonal trends. For the first four weeks of 2025, mutton prices averaged 379¢/kg cwt, with yardings averaging 139,000 head. However, in the most recent four-week period, yardings decreased by 15%, while prices increased by 22% to 465¢/kg cwt, with an average 104,000 head traded.

Factors driving price increases

Several factors have likely contributed to the recent surge in mutton prices. One key factor is the gradual pullback in mutton supply. Sheep yardings have been declining since their peak in late January, and the turn-off of non-pregnant ewes has slowed as producers prepare for lambing season in June. Additionally, rainfall on the east coast has improved feed availability, encouraging producers to hold back stock and take advantage of the new feed to gain extra weight.

Additionally, last week mutton buyers were likely caught off guard by the constrained supply. With contracts to fill, competition in saleyards intensified, leading to strong processor demand. At Wagga's final sale of the week, heavy ewes fetched up to $200/head, with some reaching nearly $300.

Looking ahead

As the Easter and ANZAC Day long weekends approach, typically there is a strong buyer demand as processors prepare for several short weeks and anticipate higher supply volumes from producers turning off stock pre-break.

The current high market prices may further motivate producers to capitalise on the strong market conditions, increasing throughput in saleyards. Early sales this week (week of 6 April) suggest a slight market correction, with prices easing slightly due to larger yardings. Wagga is expected to pen over 100,000 head at their Thursday sale.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst