Neither restockers nor feeders buyers are driving market dynamics

16 May 2024

Key points:

- Processors have become the largest buyer in the market.

- Restockers are preferred when there is a larger price differential between the Feeder Steer Indicator and Restocker Yearling Steer Indicator.

- The market indicates no discernible preference for restockers and feeders as prices converge.

After two years of intense rebuilding, there is an increased supply of cattle on-farm, supported by the largest herd in 15 years (28.7 million head in 2023 and 28.5 million head in 2024). The herd has now reached maturity, indicating producers will start to turn-off cattle regardless of weather conditions.

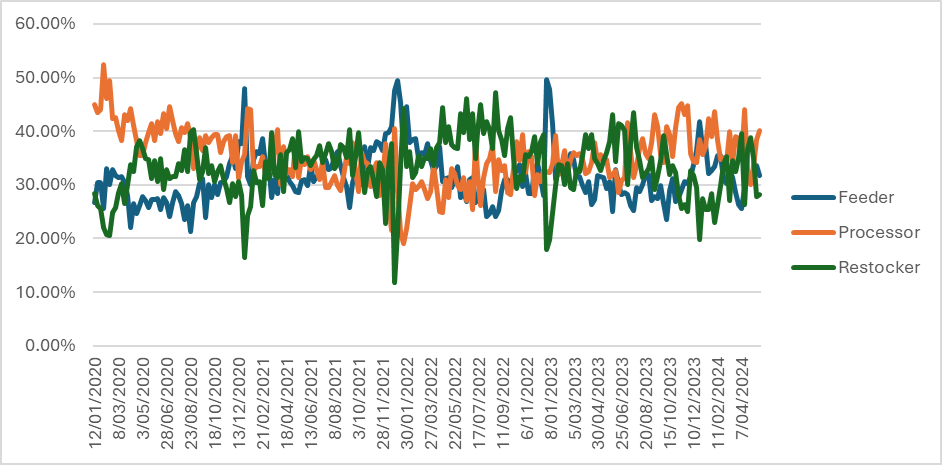

Figure 1: Buyer throughput at saleyards

Year-to-date yardings have increased by approximately 30%, which has largely been driven by a growing number of processors participating at saleyards. Since the end of 2023, a growing number of cattle have been sold to processors, supported by the record weekly slaughter figures averaging 130,000 head per week.

There has been a recovery of buyer interest in restockers in 2024 from reasonable price improvements, but there lacks a clear preference for either restockers or feeder cattle (notably due to a 20¢ price difference between the Feeder Steer Indicator and Restocker Yearling Steer Indicator).

Looking back at the trend, there is a clear inverse relationship between the restockers and feeders buyer type, most likely driven by the substantial price difference between the two indicators. The larger the price difference, the stronger the preference for restockers and vice versa, thus incentivising buyer actions.

Typically, feeders are in high demand at the end and beginning of a new year, but the current trend has never been seen before, with no clear preference for either restockers or feeders. This indicates that the market is in flux, for either cattle bought by restockers and feeders.