National slaughter and production overview for 2023–24

06 September 2024

Key points:

- Cattle production almost hit new records due to genetic investment and growth in feedlots.

- Lamb slaughter surpassed previous records by over 18%.

- The goat sector continued to record strong growth.

The Australian Bureau of Statistics (ABS) recently released its second quarter statistics on livestock slaughter and meat production, which are finalised six weeks after the close of the quarter. The statistics have revealed strong growth across the cattle, sheep and goat industries.

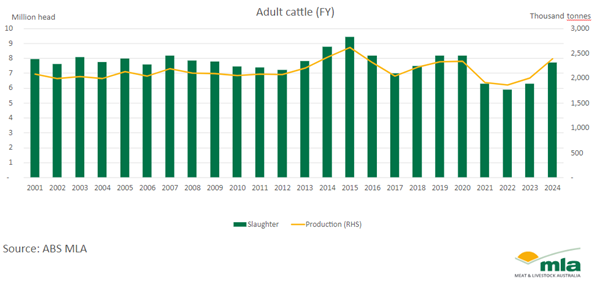

Cattle

The cattle industry has experienced significant growth over the past three years throughout the rebuild period.

In 2023–24, Australia processed 7.7 million head of cattle. This is a 22% increase over last year's figures and sits just above the 10-year average of 7.6 million head per financial year. This is the largest slaughter since the tail end of the drought in 2020.

Slaughter has remained elevated and robust for the past 12 months due to a maturing herd. Both male and female slaughter lifted across the financial year, though a 37% lift in female slaughter caused a female slaughter rate of 49%. This sits above the industry benchmark of 47%, indicating the herd is currently operating through a destock.

MLA analysts believe this technical destock and high female slaughter rate have been driven more by the turn-off of older retained breeding cows, which were used across the rebuild, rather than drought-driven destocks.

Production has lifted alongside slaughter to 2.4 million tonnes over the financial year. This is 18% above the previous financial year and 10% above the 10-year average. Consistent growth in carcase weights has caused a greater lift in production compared to slaughter. Despite easing this financial year, average carcase weights of 310kg are still 9% above the three-year average thanks to genetic investments and growth in feedlots.

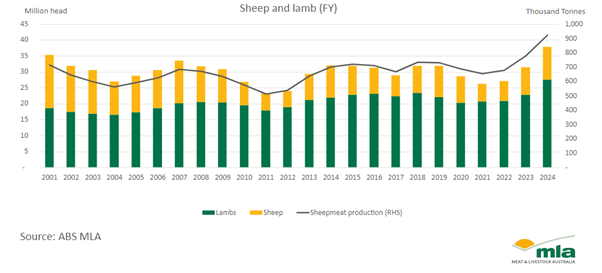

Sheep

The sheep sector has experienced huge lifts due to changes in flock dynamics, with more meat breeds, increased production efficiency and growth in the breeding ewe base.

Lamb slaughter tipped records this financial year, with over 27.5 million head processed across the financial year. This figure is 18% above the previous record in 2018, and 31% above the 10-year average. Sheep slaughter lifted 18% to 10.3 million head, and the largest processor throughout since 2009 was recorded. This took combined sheep and lamb slaughter to 37.8 million head, 27% above the 10-year average. Processing capabilities have grown significantly in the past few years, enabling production to keep up with current supply levels.

Production has lifted alongside slaughter, just as is the case with cattle. Sheepmeat production lifted 19% to 922,000 tonnes, driven by a 19% lift in lamb production to 662,000 tonnes and an 18% lift in mutton production to 261,000 tonnes. Lamb production was the largest on record. Industry is expected to operate at this production capacity over the next few years.

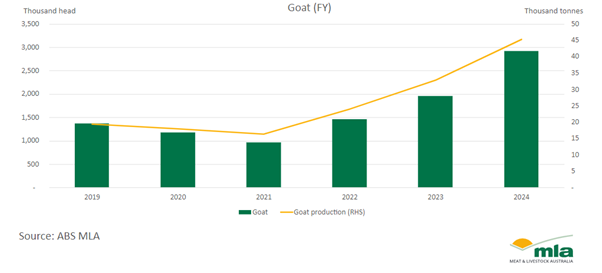

Goat

Goat production has experienced increases once again. From a shorter range of data, both goat slaughter (lifting just under 50% to 2.9 million head) and production (lifting to 45,000 tonnes) landed in record territory. This is largely due to a new processor growing goat processing capacity in Bourke, as well as increased producer interest in goat production.

To find a data summary of the quarterly ABS release click here

Attribute to: Erin Lukey, MLA Senior Market Information Analyst