Mutton favoured over lamb

Key points

- Processors are favouring mutton, as sheep slaughter reaches its largest volume in 18 years.

- Mutton supply through saleyards is up 30% year-on-year.

- Adjusted mutton slaughter achieved 94% for forecasted volumes.

Sheep slaughter has reached its highest volume in 18 years, indicating processors have been favouring mutton over lamb.

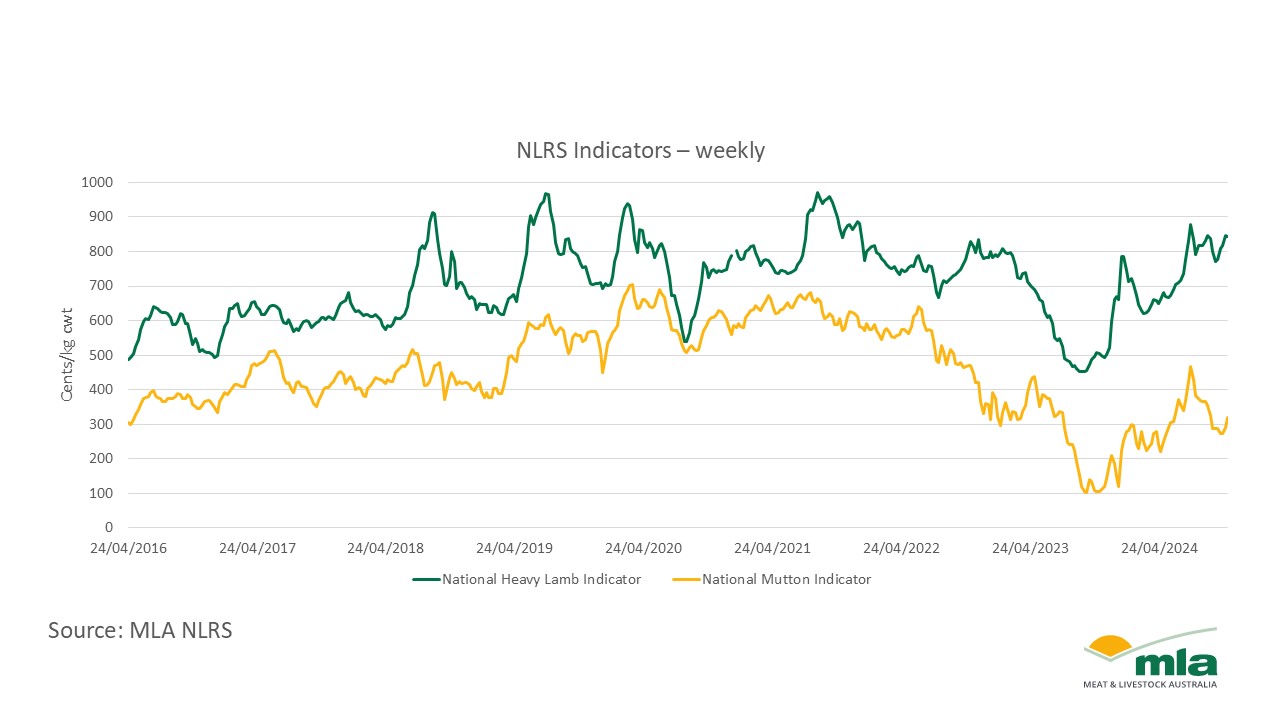

In the past month, the gap between the National Mutton Indicator and the National Heavy Lamb Indicator reached the highest nominal gap on record. In October, the Heavy Lamb Indicator reached 846¢/kg carcase weight (cwt), while the mutton indicator fell to 290¢/kg cwt at the same time, a gap of 556¢ (66%).

Prices and supply

Heavy lambs have seen significant price recovery since October 2023, the peak of the market crash, lifting 207¢ (199%) since its bottom. Conditions improved across NSW, which holds 36% of the flock and is the major supplier of heavy lambs. Quality has improved and export weights have been attainable. Due to worsening conditions across southern states in 2024, elevated competition for quality heavy lambs was fostered with southern buyers playing in the northern markets. This has led to a consistent premium for heavies over even trade lambs in national prices.

Mutton has not seen similar competition-driven price lifts. The national flock has been rebuilding for three to four years. The retention of older breeding sheep has caused a surplus of sheep that are now entering the market. Year-to-date mutton yardings are up 30% year-on-year for the end of October. Despite not seeing a hit to quality, this considerable supply has impacted prices. Following a price recovery earlier in the year, prices have eased again in the past month, as the post-lambing supply really enters the market, and producers are able to turn off that excess stock.

Impact on processor decisions

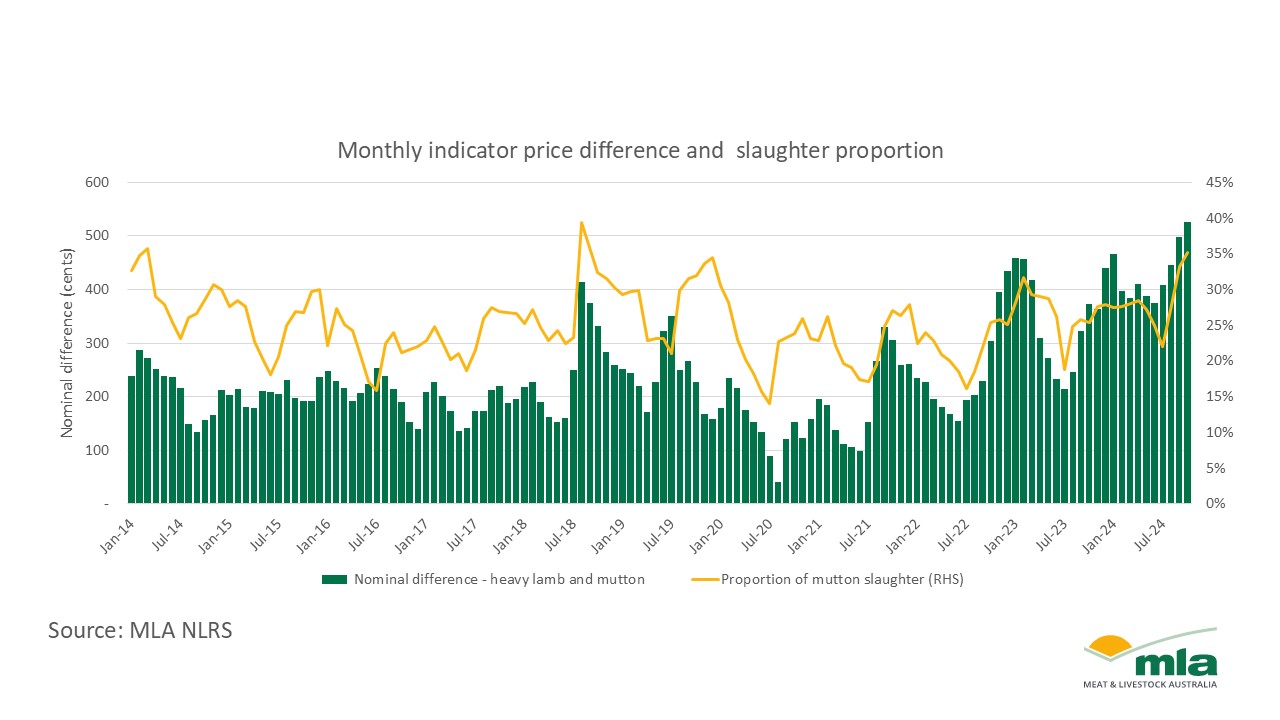

These significant price disparities significantly impact processor margins, which have clearly been impacting buyers' decision-making. Last week, weekly National Livestock Reporting Service (NLRS) sheep slaughter reached its largest volume since 2006. While total sheep and lamb slaughter has lifted, the proportion of mutton processed for the month is 35% of the total kill – the highest proportion since September 2018, and well above general averages.

Processors of small stock have the ability to shift buying activities between mutton and lambs to take advantage of lower input costs (livestock) if export demand and price have not moved. Historically, we have seen this dynamic play out. The chart below shows that when the price gap between Heavy Lamb and Mutton lifts past a certain point, the mutton proportion of kill lifts along with it.

This also plays out in individual states. In NSW, over half (51%) of stock slaughter was mutton, while October 2023 average was 43%. In Victoria, October saw 24% of sheep slaughtered over lamb, with 2023 numbers at just 14%. WA saw 48% compared to 34%, and SA 30% compared to 18%.

Mutton supply is still picked to remain elevated. NLRS weekly reports traditionally capture 80% of the actual figures published by the ABS. Adjusting NLRS year-to-date mutton slaughter of 7,548,419 with this coverage assumption, it is assumed year-to-date sheep slaughter sits around 9.4 million; just 6% below the forecasted 10 million head for the 2024 calendar year, meaning the estimate is on-track to be surpassed.

MLA forecasts another lift in mutton processing next year to 11.3 million, as the retained ewes from the rebuild will need to exit the system. Looking forward, buyers will continue to prioritise mutton if supply and margins remain elevated.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst