Market access breakthroughs boosting Australian red meat exports

26 February 2025

Key points:

- Securing trade agreements and defending existing favourable market access are critical to the success of Australia’s red meat industry.

- The Australia-UK Free Trade Agreement (FTA) has driven significant export growth in its first year.

- The new Australia-UAE Comprehensive Economic Partnership Agreement (CEPA) enhances access to a growing market.

This article is part of our Top 10 Trends of 2024. Keep an eye out in the coming weeks to read the rest of the series.

Maintaining and expanding market access is essential to the long-term prosperity and sustainability of Australia’s red meat industry. Strong trade agreements help enhance export competitiveness and market diversification.

In 2024, the majority of Australia’s red meat exports were directed to markets where trade agreements have been secured. Collaboration between MLA, peak industry bodies, the Australian government and global market partners has led to significant breakthroughs in Australia accessing key red meat and livestock markets worldwide.

Australia primed to fill United Kingdom supply gap

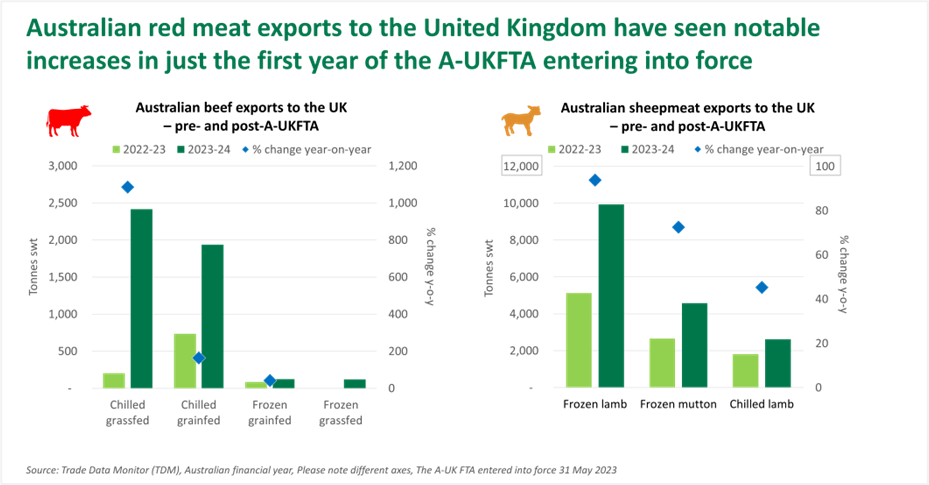

The Australia-United Kingdom Free Trade Agreement (A-UKFTA) took effect on 31 May 2023, granting Australian beef and sheepmeat expanded tariff-free access to the UK. The agreement allows:

- 35,000 tonnes of tariff-free Australian beef exports in the first year, increasing to 110,000 tonnes by 2033.

- 25,000 tonnes of tariff-free Australian sheepmeat exports in the first year, rising to 75,000 tonnes by 2033.

- Full removal of out-of-quota tariffs for both products by mid-2033.

In the first year of the A-UKFTA, Australia’s red meat exports to the UK surged 79% to A$170 million, albeit from a previously small, quota-constrained volume. The increased trade reflects strong UK consumer demand for quality chilled grassfed and grainfed beef and frozen lamb. The significant growth highlights Australia’s ability to supply high-quality products that meet market needs, particularly in grainfed beef, where supply shortages exist.

MLA research confirms that UK consumers trust and value Australian red meat for its safety, traceability and quality. The A-UKFTA has expanded opportunities for UK consumers to enjoy Australian products.

Meanwhile, UK domestic red meat production is projected to decline for both beef and sheepmeat from now through to 2029. The UK’s primary red meat supplier, the EU-27 (particularly Ireland), is expected to experience declining production and exports in the coming years. These factors position Australia as a key supplier to help fill potential UK supply shortfalls.

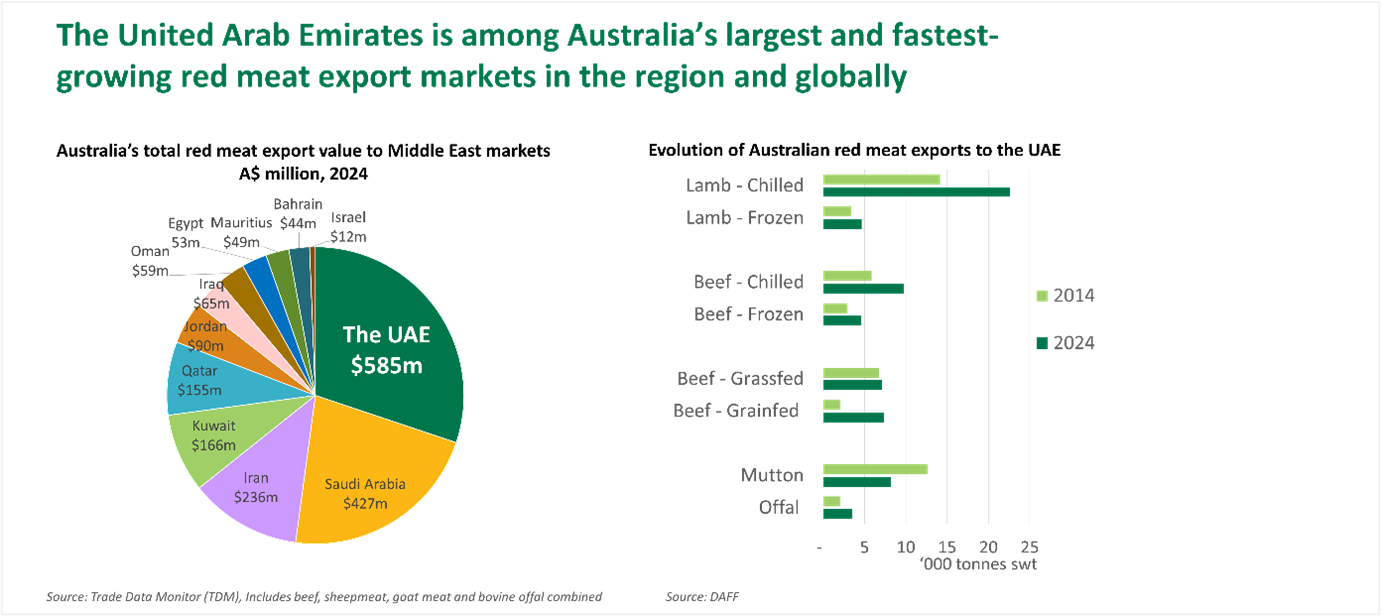

New agreement with United Arab Emirates to begin during 2025

The United Arab Emirates (UAE) is Australia’s largest red meat and livestock export market in the Middle East, with a total export value of A$529.4 million in 2023–24. On 6 November 2024, Australia signed the Australia-UAE Comprehensive Economic Partnership Agreement (CEPA), which is expected to take effect this year. A major benefit of the agreement is the elimination of the 5% import tariff on frozen red meat. Chilled red meat already enters the UAE at 0%.

Consumer demand for premium red meat is rising across the Middle East, particularly in the Gulf countries like the UAE, this trend is driven by high-end restaurants and luxury hotels, as well as growing demand for premium packaged meat products in modern retail for home consumption. The UAE has the highest number of five-star hotels and Michelin-star restaurants in the region, further boosting demand for high-quality beef and lamb.

With UAE red meat consumption and imports projected to grow, Australia – already a preferred supplier – is well-positioned to meet this increasing demand.

For information about Australia’s market access to the UK, Middle East and all key global markets, view MLA’s recently updated Global Red Meat Market Snapshots.

Access more information about Australia’s market access conditions.