Livestock trading slows amid market uncertainty

Key points

- Financial planning has been hindered by unpredictable market conditions.

- Subdued market confidence has limited cattle trading despite positive seasonal conditions in the north.

- Over the past year, cattle prices have lifted by almost 33%.

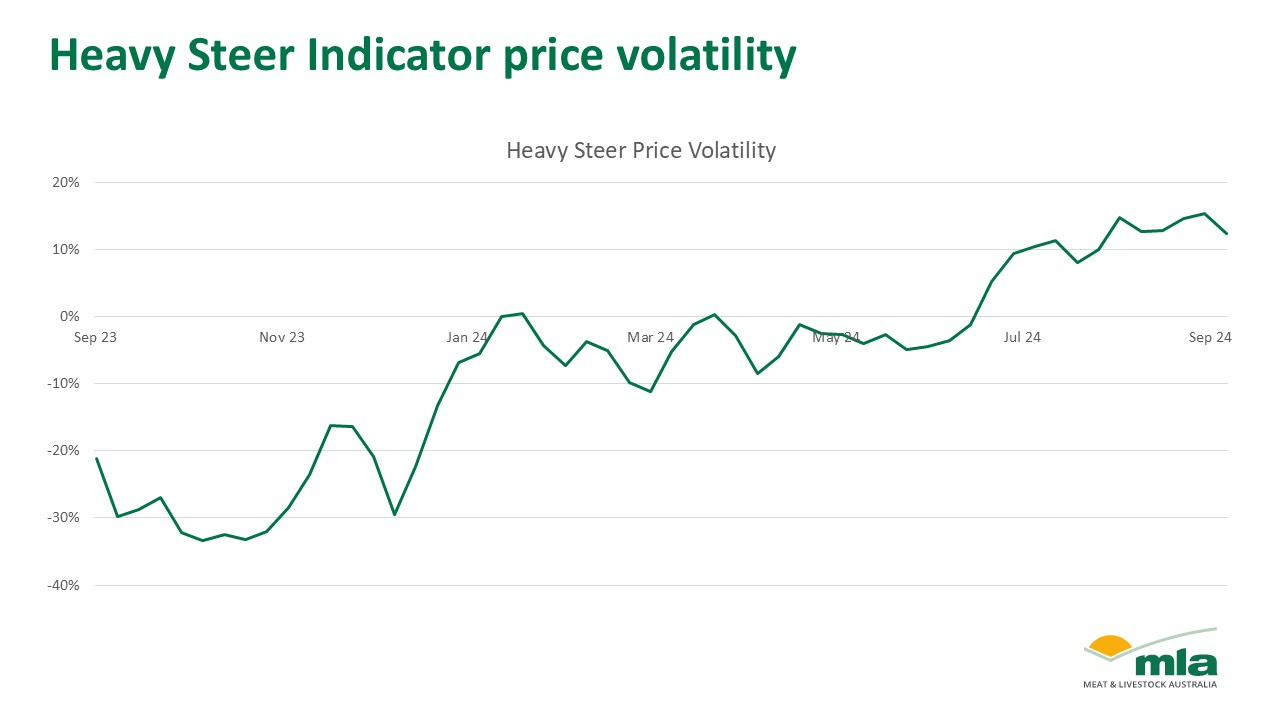

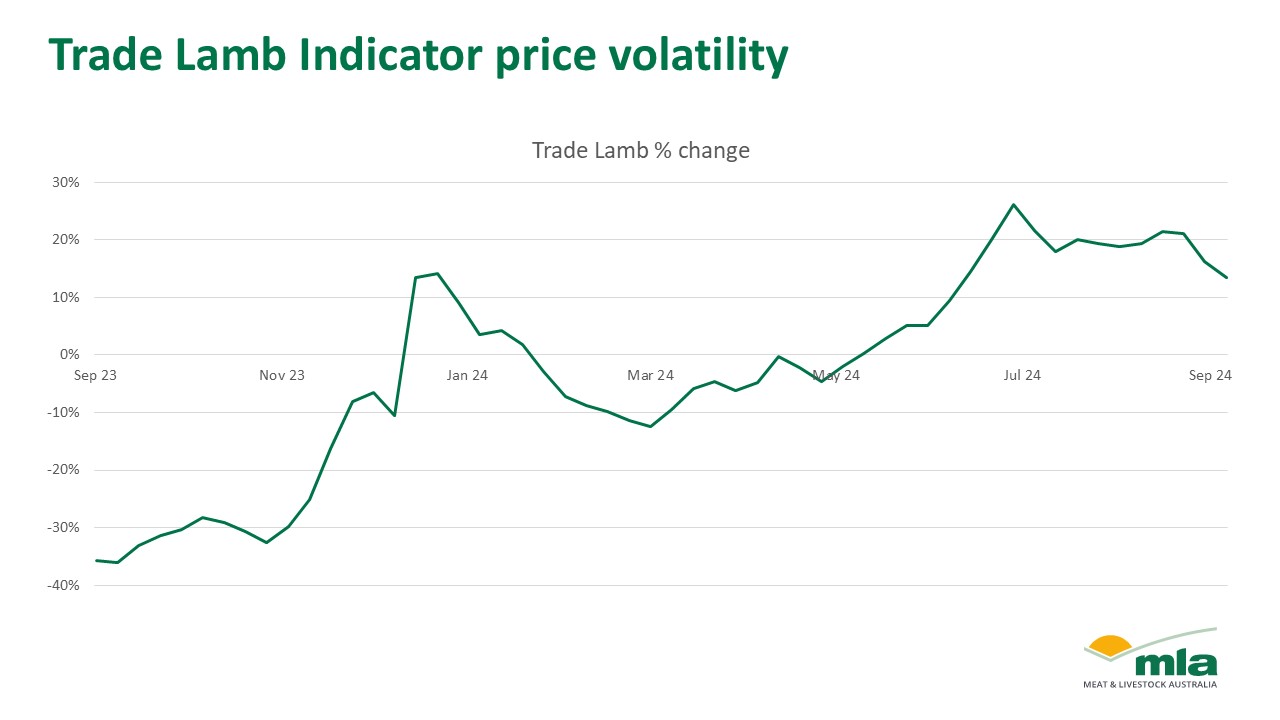

Livestock prices have been relatively stable year-to-date, but this stability was not evident over the last 12 months. At the end of 2023, producers experienced a market crash, and price increases have since been more subdued.

When comparing prices to a year ago, heavy steer prices have lifted by almost 33%, with the most significant increase nearing 50%. Despite favourable seasonal conditions in the north, many had expected a larger price rise. The sheep market has followed a similar trend, with prices also climbing by nearly 50%. Summer rainfall, which influenced producers’ joining decisions, influenced the sheep market. As conditions dried up, prices eased, but the start of lambing has led to a price rebound.

Price volatility has impacted cattle trading frequency, affecting both those who rely on sales for cash flow and those who see livestock as a long-term investment.

Confidence has been subdued, with producers becoming more cautious about stocking rates and opting to sell earlier in preparation for potentially dry conditions. Rising operating costs have also added pressure, making it harder to ensure expenses are covered.

In the face of unpredictable livestock prices, cropping or mixed operations have become more appealing. Financial planning has become nearly impossible as prices fluctuate dramatically within a single year. Despite the recent improvement in livestock prices, producers continue to struggle to cover business expenses adequately.

Attribute content to: Emily Tan MLA Market Information Analyst