Land proves to be producers’ most valuable asset

Key points

- Farm cash profits for beef, sheep and sheep-beef businesses eased in 2023.

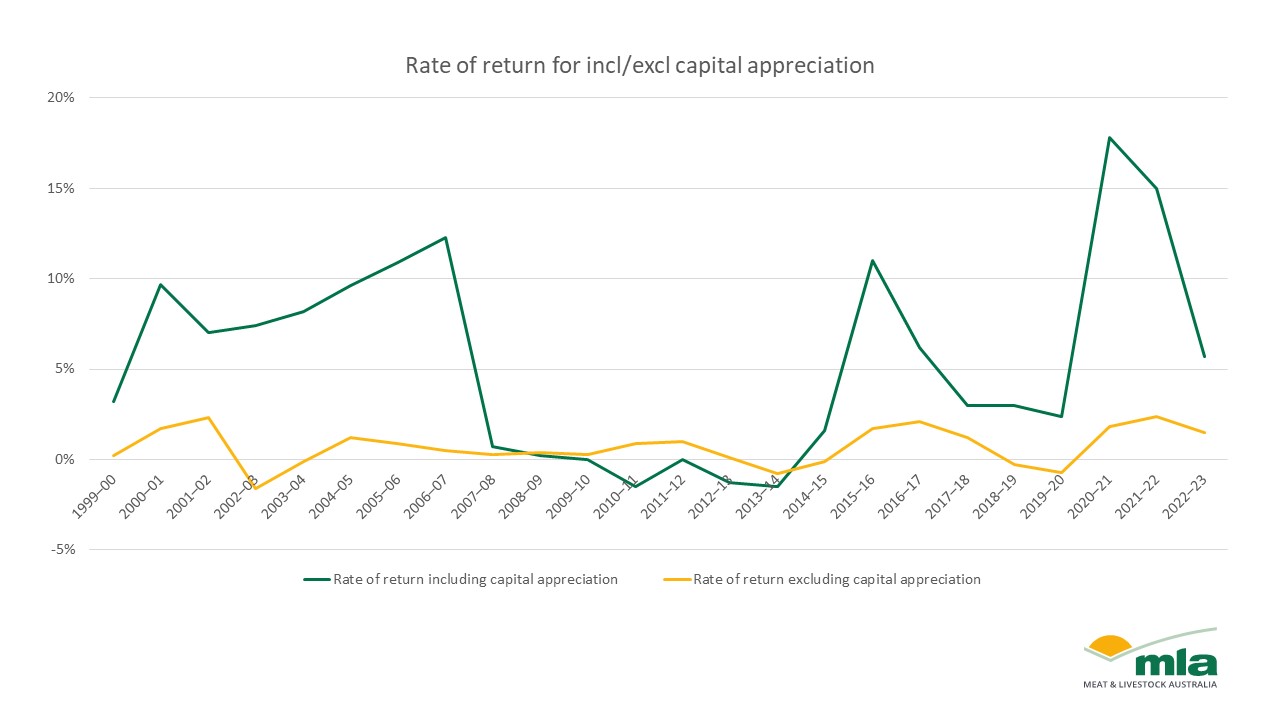

- The rate of return declined in 2023.

- Land value has continued to rise despite economic downturns.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has released the preliminary estimates for the 2023 Farm Data Portal. It provides insights into the financial performance of broadacre, beef, cropping, dairy, sheep and sheep-beef farms.

In the second half of 2023, the anticipation of drought-like weather conditions led to a market crash. To prepare for drought-like conditions, producers were turning off cattle earlier and faster, at unfavourable prices.

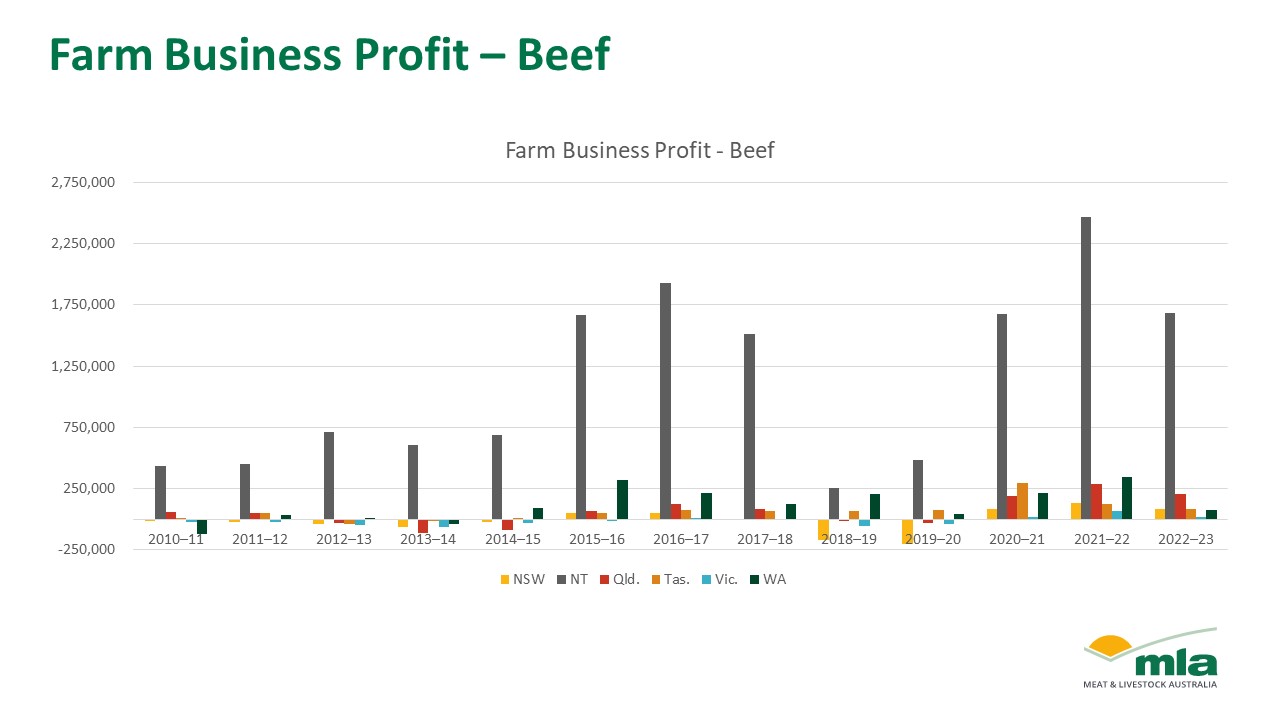

According to ABARES, farm cash profit for cattle businesses eased by 33% in Australia, with Victoria and WA incomes easing by almost 80% compared to 2022. In 2023, sheep operations didn’t fare much better, with declines of almost 90% in NSW, and Victoria easing by 75%. Sheep-beef operations followed in a similar vein with a 53% decrease across Australia.

The rate of return, including capital appreciation, for beef operations in 2023 eased by 15% to 63%. This substantial reduction in rate of return reflects the current economic conditions and the impact of declining cattle prices on businesses. A similar trend was seen in rate of return excluding capital appreciation, where across Australia the rate of return reduced by almost 50% from 2022 to 2023. Across all states, the rate of return eased for sheep, beef and sheep-beef operations.

These two metrics are important because it indicates the reliance on land value to ensure their borrowing capacity opposed to ongoing liquidity. The rate of return (excluding capital appreciation) is also declining. Producers are finding it harder to generate value as their capital, as land value continues to rise and profits reduced in 2023. Operational efficiency cannot be achieved if profits cannot keep up with increases in land value, as this will inevitably decrease efficiency.

The data shows that the most valuable asset producers own is their land, as opposed to the business itself.