Lamb exports to Papua New Guinea up 75%

19 October 2022

After a strong August, Australian red meat exports fell back to 124,698 tonnes in September, a 6% decline year-on-year.

A clear distinction between proteins was evident, with beef exports softening by 12% year-on-year to 70,296 tonnes while lamb and mutton exports rose 5% year-on-year to 37,648 tonnes. Read on to see the latest recap on Australian red meat exports.

Beef exports

Beef exports have fallen across most markets but have held firm in South Korea and even rose in China.

Exports to Japan fell by 26% year-on-year to 15,791 tonnes. Although remaining the largest market for Australian exports, September saw the lowest share of exports going to Japan since December last year, at 22.5% of the total.

Of Australia’s major export markets, the United States saw the largest decline in volume to 8,589 tonnes – a 44% decline from September 2021. This figure is exaggerated by the rollout of new export certification software in the United States, which caused delays in processing data and meant that exports in the final week of September were not included in the total figures.

Exports to South Korea held firm at 13,635 tonnes, while exports to China rose 20% year-on-year to 14,917 tonnes. This increase was due to a 45% rise in grassfed exports to 8,972 tonnes. Meanwhile, grainfed exports fell 5% to 5,945 tonnes.

Chilled exports declined by 29% year-on-year to 16,473 tonnes across all markets, while frozen exports only fell by 5% to 53,823 tonnes. This means that chilled beef made up 23% of beef exports in September – a slight increase from August, but well below the 2021 average of 30%.

Sheepmeat, mutton and lamb

In contrast to beef exports, sheepmeat exports were up 5% from year ago levels at 37,648 tonnes. Although mutton exports dropped by 9% to 12,622 tonnes, lamb exports rose 15% to 25,026 tonnes.

The largest sheepmeat market overall remained China. Mutton exports to mainland China rose by 8% year-on-year to 5,875 tonnes, while lamb exports fell by 1% to 5,438 tonnes.

South-East Asia saw the largest increase in sheepmeat exports, with exports in the region rising by 25% from 2021 to 4,792 tonnes – an additional 1,630 tonnes. Softening mutton exports in Malaysia were offset by a large increase in lamb exports to Papua New Guinea, which rose 110% year-on-year to 2,320 tonnes.

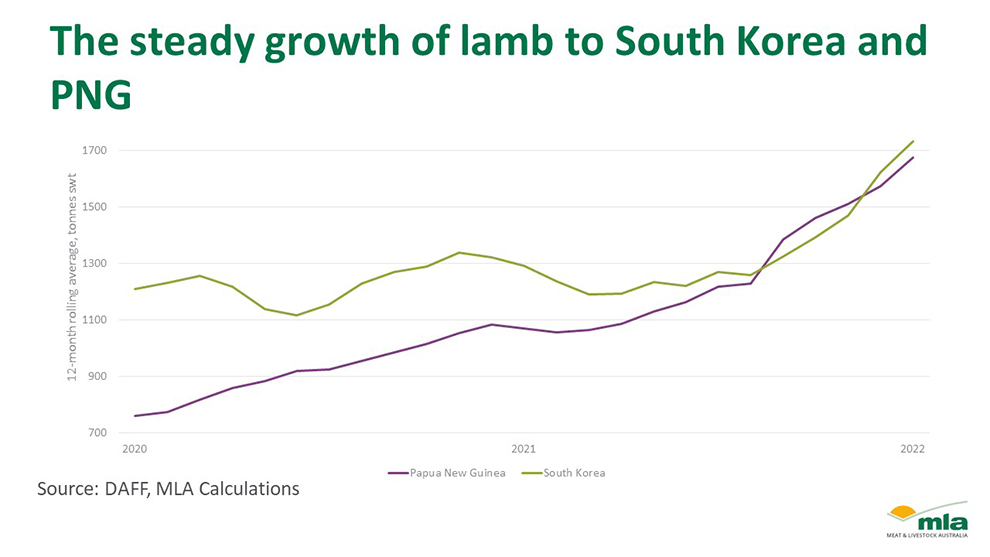

So far this year, lamb exports to Papua New Guinea (PNG) and South Korea have risen by 75% and 58% respectively, establishing these nations as Australia’s third and fourth largest lamb export markets in a display of Australian lamb’s increasingly diverse export base.

Figure 1: the steady growth of lamb exports to South Korea and PNG.

2023 outlook

The positive news for lamb and mutton exports offers a window into 2023 for producers and exporters.

The shorter production cycle for lamb and mutton have meant a faster rebound in flock sizes after the 2018–19 drought, meaning production and export can recover more quickly.

The pace is slower for beef production, but the underlying dynamic remains the same and, as shown in the recent State of the Industry report, Australian exports are likely to begin sustained rises as other major producing nations enter rebuilding phases.