Key industry analysts' price forecasts put to the test

18 July 2024

Key points:

- The National Heavy and Feeder Steer indicators are both within the estimate price.

- Restocker demand is no longer driving cattle market prices.

- Since the end of FY24, the Heavy Lamb and Trade Lamb indicators have both reached their estimated price.

MLA’s February projections collate forecasts from five industry organisations including Rabobank, Episode3.net, Mercado, ABARES and Rural Bank (excl. MLA). In June 2024, forecasts were made for the National Heavy Steer Indicator, Feeder Steer Indicator, National Heavy Lamb Indicator and Trade Lamb Indicator. This article outlines how closely these forecasts align with actual market conditions.

Cattle

At the beginning of the year, cattle prices started strong, driven by strong restocker demand for both heifers and steers. However, by the middle of winter, the dynamic shifted towards more processor-ready cattle.

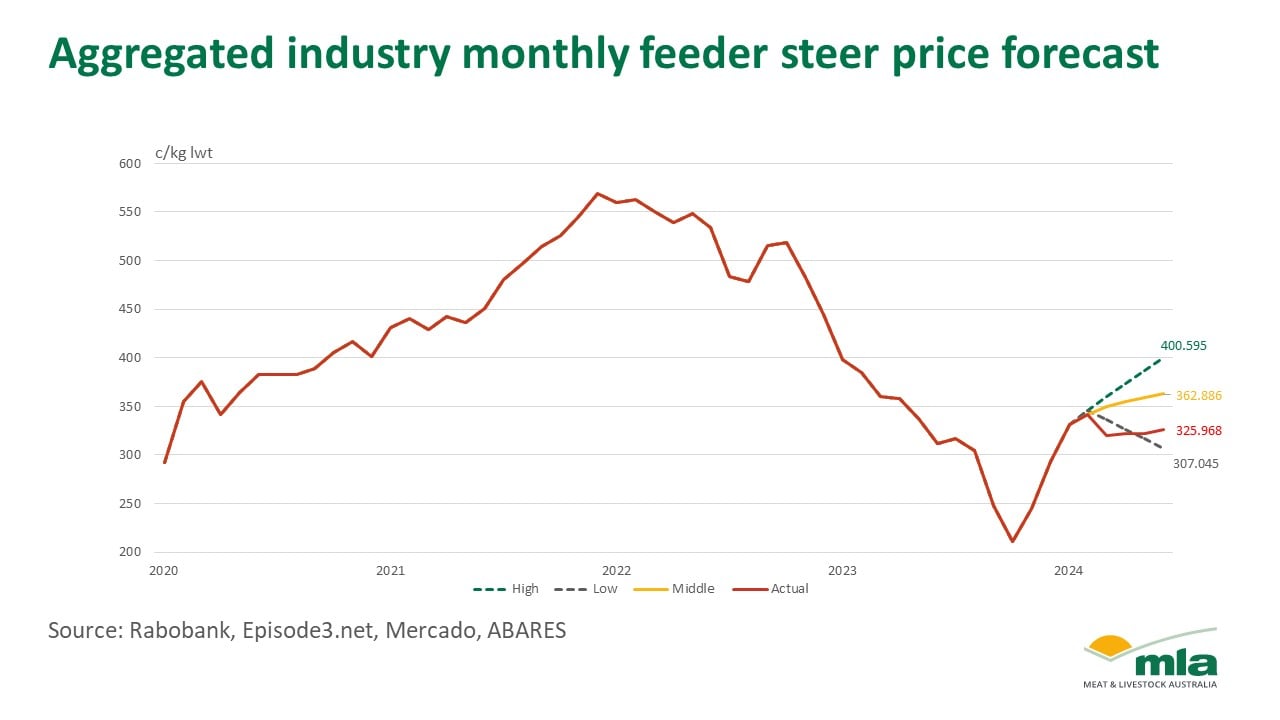

The National Feeder Steer Indicator was forecasted at 362.89¢/kg liveweight (lwt), with a lower limit of 307.05¢/kg lwt and an upper limit of 400.60¢/kg lwt. As of 30 June 2024, the projected price was 39¢ below the actual price of 323.94¢/kg lwt.

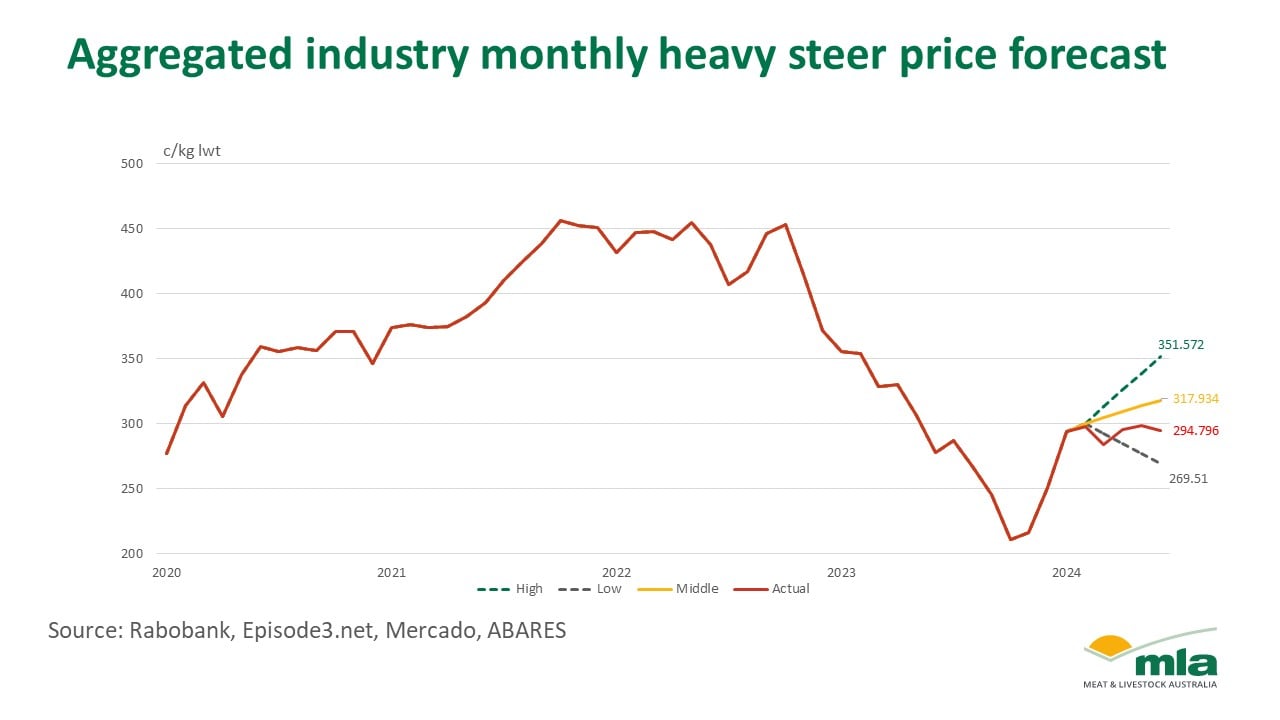

The National Heavy Steer Indicator was forecasted at 317.93¢/kg lwt with the actual price 7% below. The lower range was forecasted at 269.51¢/kg lwt with an upper range of 351.57¢/kg lwt.

Analysts believed that an upward price shift would have been on the back of strong export and restocker demand supporting prices seen in 2024. Favourable climate outlooks were forecast through cattle regions and would provide an uptick in restocker demand and thus upward pressure on prices.

The shift towards processor-ready cattle suggests an increased export demand, particularly from the US for lean beef. High numbers of product have been shipped to the US in the last three months, indicating a reduced supply in the US and a greater reliance on imported beef product.

Lamb

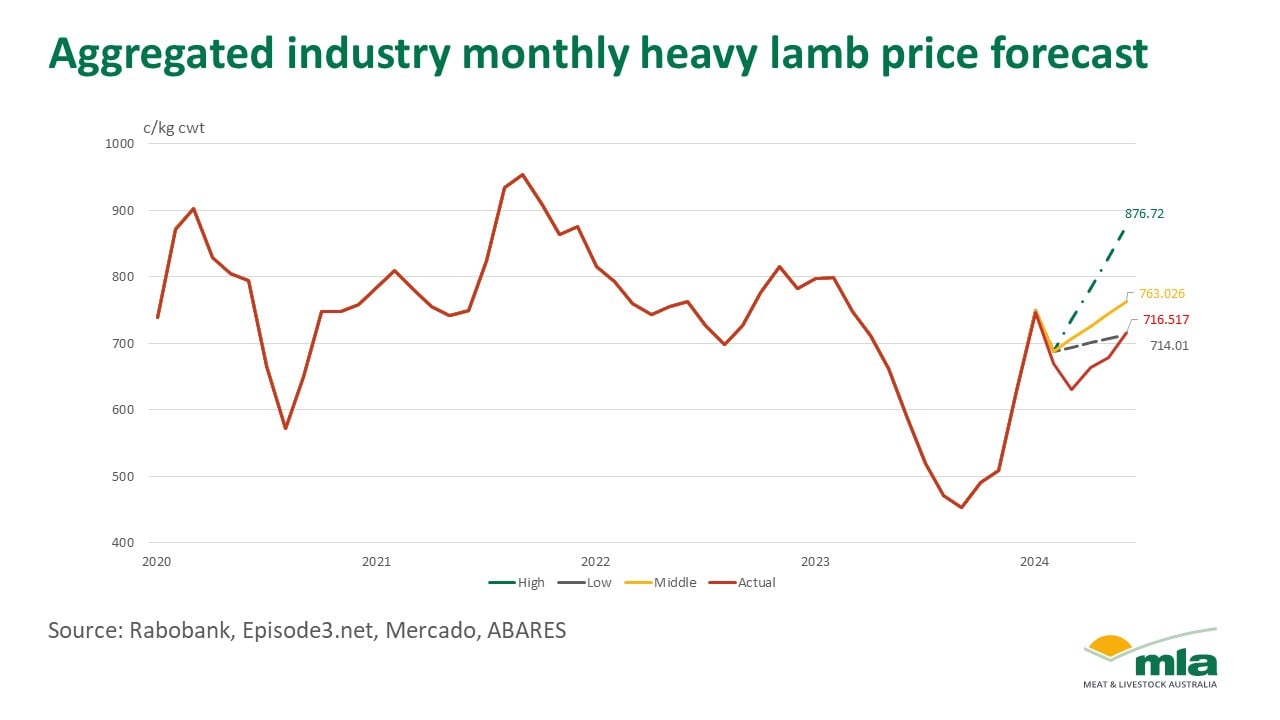

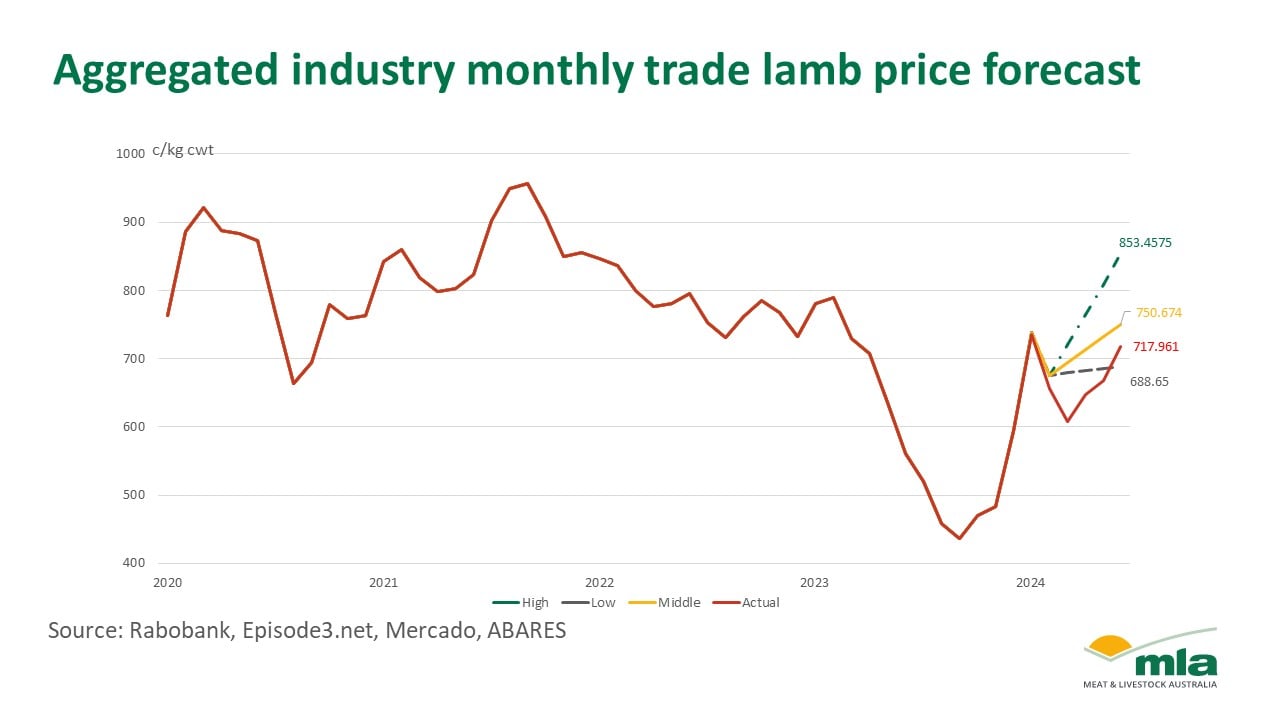

The sheep market has ended the financial year on track to reach the highest prices since November 2022. Analysts forecasted the Heavy and Trade Lamb Indicator would remain at the five-year average, indicating increased market confidence.

The National Heavy Lamb Indicator was forecasted at 763.03¢/kg carcase weight (cwt), with a lower limit of 714.01¢/kg cwt and an upper limit of 876.72¢/kg cwt.

The National Trade Lamb Indicator was forecasted at 853.46¢/kg carcase weight (cwt), with a lower limit of 688.65¢/kg cwt and an upper limit of 750.67¢/kg cwt.

The sheep market has seen an upward trending since March but as of 30 June 2024, the Heavy Lamb Indicator was 18¢ below the forecasted price at 735.20¢/kg cwt. The Trade Lamb Indicator was 24¢ under the forecasted price at 742.31¢/kg cwt. Due to the seasonal conditions in key sheep country where the climate outlook has indicated two distinct market conditions, price growth has slowed. Based on sheep and lamb prices as of 15 June 2024, the Heavy Lamb indicator rose to 873.59¢/kg cwt – this is 0.3% below the forecasted price. The Trade Lamb Indicator was not far behind, at just 1.3% below the forecasted price. These price gains reflect typical market trends during lambing season where supply declines.