Is the lamb market becoming more volatile?

14 June 2024

Key points:

- Lamb prices are more volatile as market players become more reactive to market conditions.

- Slaughter can help indicate the overall supply of the market.

- Relying on the lamb production life cycle to predict prices without considering the overall market can lead to unfavourable outcomes.

Many will be asking themselves what has happened to the lamb market in recent years, with the uncertainty of the market having resulted in unexpected price changes.

What is happening right now in the market?

Prices are at the highest they have been in last two years, following good weather conditions since the El Niño was announced in 2023. There has been a rebound in prices in the previous couple of months. With lambing season beginning, prices typically rise during this time.

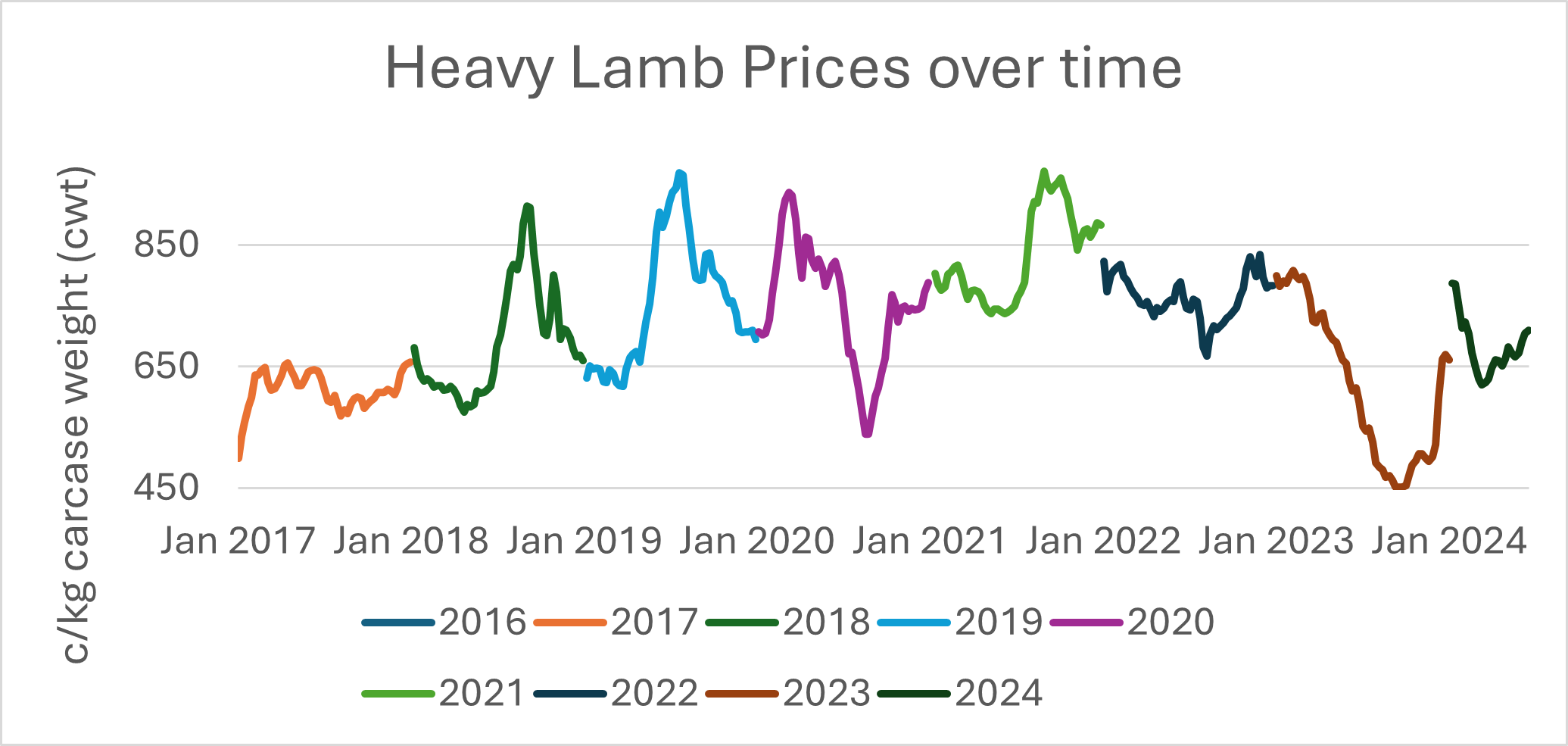

Historically in 2018–2019 and 2021, a clear trend appeared which reflected the seasonality where prices start to increase at the start of lambing season, reaching its peak at the beginning of spring. This trend completely breaks down in the following years due to reasons such as unpredictable world events and foot-and-mouth disease (FMD).

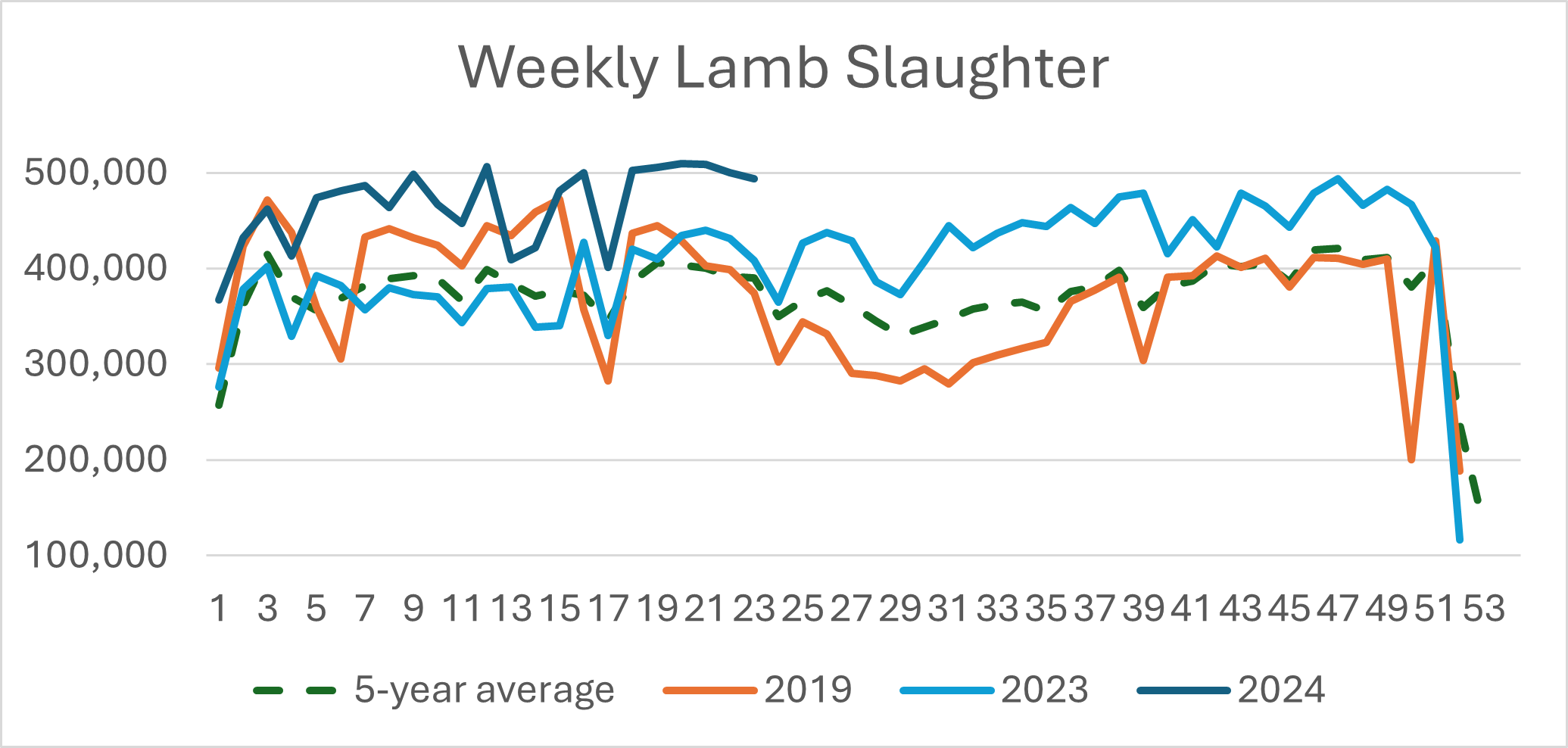

In 2020, prices peaked in March and continued to ease into August where prices were at their lowest. This trend is unusual but can be explained the COVID-19 outbreak.19. During this period, demand eased from processors which were unable to process more animals. This diverges from the standard yearly seasonal trend. Notably, there are a multitude of factors that influence price, but overall supply will have a larger impact on the operating environment. Lamb slaughter typically begins to dip from lambing season up until spring flush. In 2020, slaughter hovered around 300,000 to 350,000 head. This is well below the figures of 2018–19 where drought led to increased destocking. During 2020, the dynamic flipped into a rebuild where slaughter eased and there was increased attention on restocking.

During 2022 there continued to be a buck in the trend. Prices reached their peak in November at 833¢/kg carcase weight (cwt), with a dip in prices in July to 667¢/kg cwt. July is when prices would typically rise in line with the beginning of lambing season. Although the prices bucked the seasonal trend, the combination of a FMD scare, a strong season and decent processor capacity meant there was minimal price volatility. Slaughter figures were consistently strong throughout 2022 without seasonal dips. This points to increased supply in the market after a strong rebuild in 2021.

There was a strong start to 2023, however there was a consistent, continual ease in prices until the end of the year where prices reached 450¢/kg cwt before prices recovered. This market crash was motivated by the El Niño announcement in March. The announcement induced producers to turn-off lambs earlier to help prevent unwanted stock into the new year. Increased turn-off is not unexpected given the industry had the largest flock in a decade at 78.5 million head and the second largest lamb slaughter at 25 million head. Slaughter gradually increased from 350,000 head, to end the year just below half a million head processed.

Analysis of these pricing and slaughter trends shows that there is a possibility of increased volatility and uncertainty in the market. It is most likely the market will not follow the expected seasonal trends seen in 2018 and 2019. Market participants will become more reactive to slight movements in market conditions as seen in 2023 with the looming weather announcement. With no year the same, the markets continue to be complex, keeping everyone on their toes.