How does your business compare to others across the country?

Key points

- MLA and AWI lamb focused survey is calling for responses over the next month.

- The survey provides insights for all businesses along the supply chain.

- More than 10% of sheep producers are covered in the survey.

Twice a year, Meat & Livestock Australia (MLA) and Australian Wool Innovation (AWI) conduct the Sheep Producer Intentions Survey (SPIS). The survey is currently calling for responses throughout October.

By providing a time series of unique data points, the survey helps MLA, AWI, and the broader industry understand the flock profile, expectations for lamb sales, breeding ewe retention, producer intentions, and, importantly, producer sentiment and decision-making factors. The current survey covers 12% of sheep producers across the country.

The first wave focuses on the lamb cohort, offering an estimate of the total flock size, a profile of the lamb population, and insights into producer intentions for lambs and breeding ewes. The second wave shifts to the breeding ewe population.

The October survey, which opened this week, is an essential tool for the supply chain. It specifically focuses on producers' lamb flocks and their intentions for the remainder of the spring flush. The survey gathers information on lamb sales to date, projected lamb sales through to the end of the year, and forecasted sales for the first half of the following year. This data provides the industry with a gauge of supply volumes and timing.

In February, we follow up with respondents for the Producer Update on Lamb Sales Estimates (PULSE) survey. This checks the planned sales against actual sales for the October–December period and offers a revised forecast, highlighting any significant factors that altered planned sales.

The survey is a valuable source of information with wide-ranging benefits for the supply chain.

Industry benefits of the survey:

- Supports the development and refinement of MLA industry projections, ensuring insights are accurate and targeted.

- Helps processors and market analysts plan ahead with projected sales volumes, offering a broad timeline on supply.

- Aggregated survey data is published in public reports, accessible to everyone.

- Participants can opt-in to receive a report card comparing their responses to aggregated regional data.

Key insights from previous surveys

Sentiment

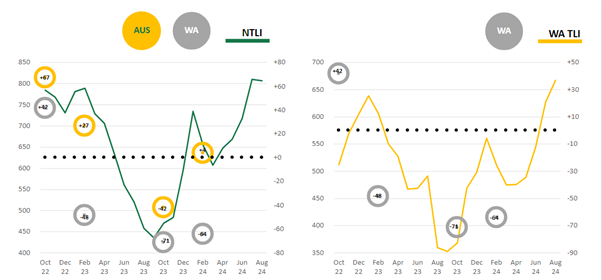

Lamb price are the largest driver of sheepmeat producer sentiment, however, but not the only one. The National Trade Lamb Indicator (below left) aligns closely with national sentiment. However, when comparing the WA Trade Lamb price with WA sentiment (below right), there is less correlation, suggesting other factors are influencing WA producers.

Decision making drivers

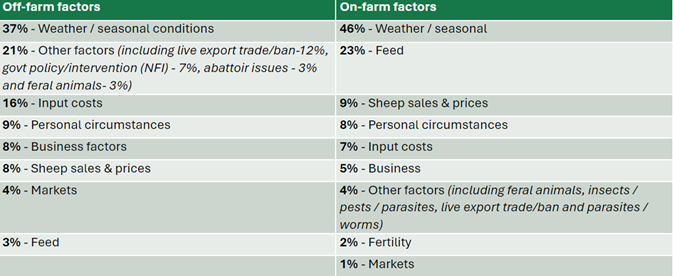

The survey also identifies external decision making drivers. Insights from the most recent wave in May indicated that weather, input costs, and personal circumstances are significant drivers, both on and off-farm.

While the survey covers more than 10% of sheep producers and provided accurate results, producer participation is essential to the depth of this data. MLA encourages producers to participate, not only to support industry analysis but also to see how their businesses and plans compare to others in their region and across the country.

You can complete the survey here.

Attribute to: Erin Lukey, MLA Senior Market Information Analyst