Have we reached a lamb lull?

16 August 2024

Key points:

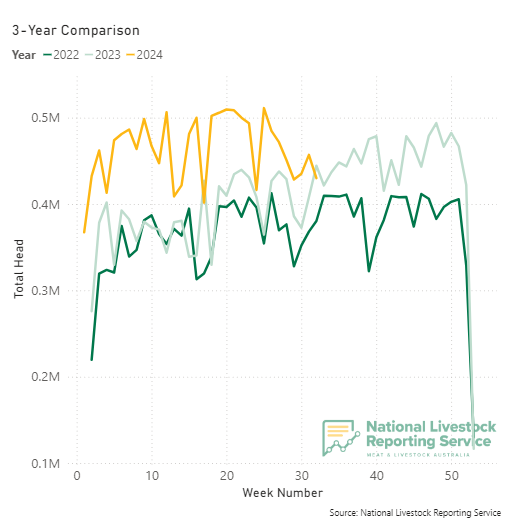

- NLRS lamb slaughter figures fell below 2022 weekly levels for the second time this year.

- Year-to-date lamb slaughter is tracking 23% above the 10-year average.

- New season lambs have started to enter the market, though slower than previous years.

The supply of processor-ready lambs has been elevated for the past 12–18 months due to consecutive years of positive rainfall, a matured rebuild and producers shifting to meat breeds.

In March, weekly NLRS lamb slaughter numbers tipped 500,000 for the first time and has surpassed that figure six more times since then.

Processors have been participating in regular scheduled shutdowns over August, though most plants are now operating as normal.

Processing numbers tend to bounce back quickly after the August closures, however this week analysts have observed the first indicators of a possible constriction in supply.

Last week’s NLRS lamb slaughter figures fell below the 2022 weekly levels for the second time this year to 430,004. The other occurrence this year was during the Easter long weekend.

A strong lamb cohort from 2023 has kept supply up to processors as they operate at capacity over the year, however, dry conditions impacting SA, Victoria, Tasmania and southern NSW have had a significant impact on the 2024 spring drop.

Operating conditions were positive over the 2023–24 summer, although the tap turned off suddenly moving into autumn. Producers have faced high numbers of retained breeding ewes, expecting large lamb drops onto a less-than-ideal feedbase.

Due to this dynamic, there has been more chatter around early weaning, which allows producers to free up stocking rates. Ewe feeding requirements decrease when lambs are weaned, as they are no longer required to lactate. This supports ewe fertility into the following season, though it can impact the speed at which new season lambs are able to make processor-ready weights.

New season lamb numbers are starting to pick up through saleyards starting in Forbes, Wagga and Bendigo, however, this has been at a slower rate than previous years, attributed to the seasonal impact on feed and the decision making around early weaning.

Currently, year-to-date slaughter is tracking 23% above the 10-year average of weekly slaughter. We will continue to track weekly slaughter closely, as the impact of a possible third-quarter slowdown in lambs supply may close this gap in the coming months.