Growing volatility in the cow market

16 April 2025

Key points:

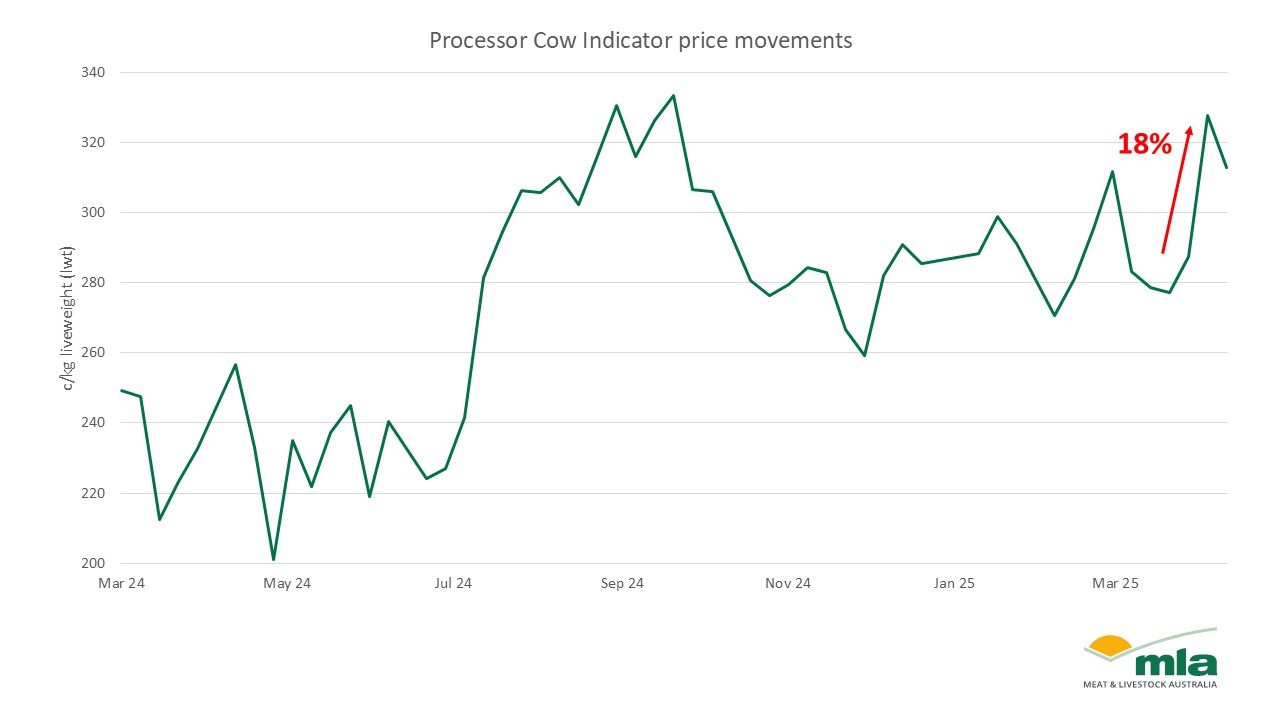

- Increasing volatility in the cow market is likely caused by shifting market fundamentals.

- The Processor Cow Indicator reached the highest price in three years, influenced by weather conditions (including flooding) and a changing geopolitical landscape.

- Record prices have led producers to capitalise on a strong cow market.

The cow market is experiencing increasing volatility, with basic market fundamentals likely causing the shifts rather than the 90CL imported price. The 90CL hit a new record as processors are short on supply due to weather conditions.

For the final week of March, the weekly average price for the Processor Cow Indicator sat at 304¢/kg liveweight (lwt). This was 10% above the previous week’s price and 28% above the 10-year average.

Last week, the price lifted by 33¢ to 319¢/kg lwt, with heavy cows at Wagga being sold for 322–360¢/kg lwt. Producers flocked to the saleyards, resulting in a 40% lift in the throughput of cows to the market. Wagga recorded 2,150 cows on 7 April and 1,995 cows on 14 April.

A similar trend was seen at Dalby on 9 April, with cows and heifers dominating the sale. The saleyard recorded 991 cows while prices eased by 27¢ to 285¢/kg lwt. However, in the previous week, cow yardings sat at 513 while prices lifted by 31¢ to 312¢/kg lwt. An increase in yardings has meant a decline in quality, with a larger proportion of leaner types of cows coming to the market; however, heavy cows still command a premium over leaner cows.

The cow market is currently being dominated by the market fundamentals of supply and demand. When supply increases, prices ease because an increase in the supply of leaner cows has decreased the price, but producers are trying to take advantage of the highest prices in over three years.

Uncertainty in the meat market will drive volatility. The US tariffs, as well as the recent floods in Western Queensland, have created an environment for potential market volatility. The impact of these events on the market is unknown but has led to producers being more cautious.

Attribute content to Emily Tan, MLA Market Information Analyst