Demand for Aussie beef continues to grow in South-East Asia

14 March 2025

Key points:

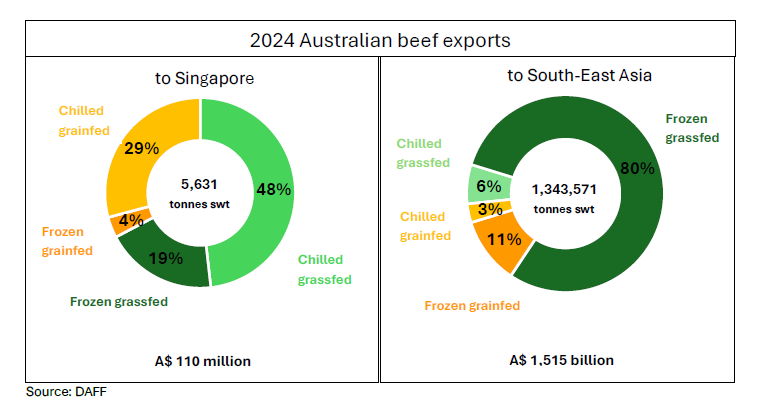

- Beef exports to South-East Asia hit new records in 2024.

- Singapore is a high-value market, with a greater proportion of chilled products.

- Thailand continues to be one of Australia’s fastest-growing beef markets.

Over the past decade, South-East Asia has been among the fastest-growing destinations for Australian beef. Its share in Australia’s global beef exports has grown from 9% in 2014 to 13% in 2024.

The region’s demand for beef was one of the key drivers of Australia's all-time high beef export volumes in 2024, with a record 173,327 tonnes shipped weight (swt) being exported, valued at A$1.5 billion.

Although growth was seen across all categories, a particular focus area was grainfed beef, which has more than tripled over the last 10 years, totalling 24,246 tonnes swt in 2024. Growing purchasing power and an increasing consumer awareness of different types of beef are driving demand for grainfed beef.

Singapore: Australian beef meeting demand for ‘accessible premium’

One third of beef exports sent to Singapore in 2024 were grainfed products (the highest grainfed proportion in South-East Asia). With over 80% of households earning more than USD 50,000 disposable income annually, Singaporeans are the most affluent consumers in the region. This income level allows them to have the region’s highest per capita meat consumption and second-highest beef consumption. Singaporean consumers perceive Australian beef as an “accessible premium” option that is suitable for everyday home cooking (Global Consumer Tracker, Singapore).

In 2024, 77% of total exports to Singapore were chilled. Chilled grainfed beef represented almost a third of these exports. Consequently, the average export price to Singapore was A$19.35 – 96% higher than the global average export value.

Thailand: one of Australia’s fastest-growing beef markets

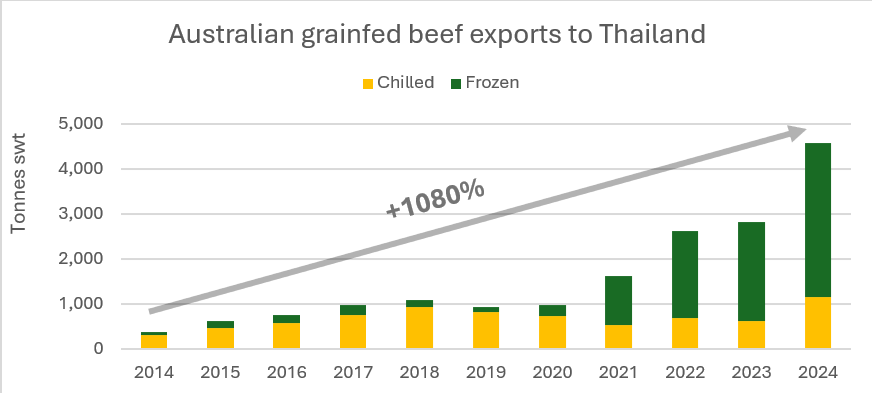

Thailand has emerged as one of the fastest-growing markets for Australian beef. Over the past decade, Australia’s total beef exports have quadrupled, reaching a record high of 22,305 tonnes swt in 2024. The Thailand-Australia Free Trade Agreement (TAFTA) eliminated tariffs and quotas on beef imports from Australia in January 2020, and it has been instrumental in reaching record volumes.

Australian grainfed exports have seen a remarkable increase of 1,080%, reaching 4,578 tonnes swt in 2024. This accounts for 20% of total beef volume (up from 7% in 2014).

Source: DAFF

Boasting a vibrant foodservice sector, Thailand caters to locals as well as the significant tourist population. While local Thai cuisine is known for its beef dishes, a substantial increase in Japanese and Korean restaurants has also grown the popularity of grainfed beef cuisines. In 2024, the number of Japanese-style restaurants reached 5,916 – a 63% rise from 2019 (Source: Japan External Trade Organization). Due to its versatility and competitive prices, many of these establishments use Australian grainfed beef.

Ongoing opportunities for Australia

The demand for Australian grainfed and chilled beef was proven during the COVID-19 pandemic, when demand for premium red meat was sustained by locals in the region despite the dramatic drop in tourist numbers. Growth has continued post-COVID, underpinned by increasing preferences for quality, as the economy develops and consumer purchasing power elevates. With the return of international tourists and robust economic forecast in the region, ongoing opportunities for Australia exist to further enhance its presence in the South-East Asian beef market.

*Note: South-East Asia includes Indonesia, Malaysia, Philippines, Singapore and Thailand.

Attribute to: Emiliano Diaz, MLA Market Insights Analyst