Australian exports stay firm as global landscape shifts

10 May 2024

Key points:

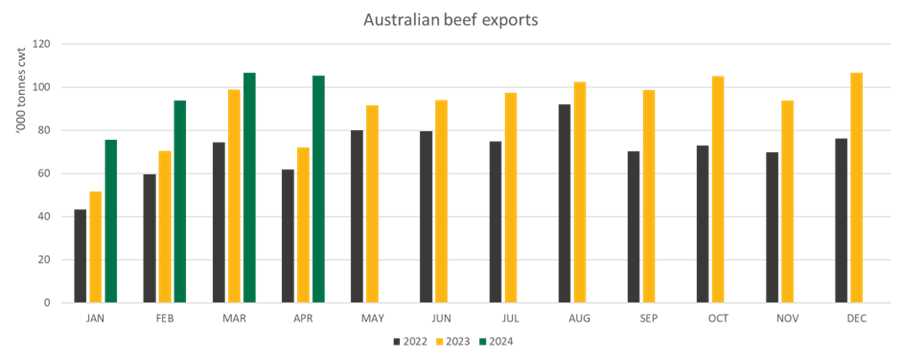

- Beef exports rose 46% from 2023 in April to 113,431 tonnes.

- Mutton exports rose 20% to 18,913 tonnes, with strong export flows to North America and the Middle East.

- Brazil has declared itself foot-and-mouth disease free without vaccination but still needs to gain international accreditation.

Beef

Beef exports lifted 46% from April 2023 to 113,431 tonnes. This is the largest beef export volume for April since 2015, and the second highest on record.

Exports lifted in most major exports markets, with the United States remaining the largest beef market with exports rising 127% from last year to 27,257 tonnes.

Large increases were also seen in several smaller markets across South-East Asia and the Middle East and North Africa (MENA) region. Exports to Thailand more than doubled to 2,141 tonnes, while exports to Saudi Arabia lifted 235% to 1,602 tonnes.

The only major market where exports dipped was for China, where volumes eased 11% compared to last year to 14,888 tonnes. Between considerable increases in exports to smaller markets and a slight fall in exports to China, Australia’s beef exports are now the most diversified they’ve been since 2016; exports outside of Australia’s top four markets have made up 25% of the total in 2024 so far, compared to 17% for the first four months of 2023 and 15% in 2022.

Source: DAFF, MLA

Source: DAFF, MLA

Sheepmeat

Lamb exports rose 41% from April last year to 31,318 tonnes, while mutton exports rose 20% to 18,913 tonnes. This is the largest April export figure for lamb, mutton, and overall sheepmeat exports on record, following very strong export totals in February and March.

The United States remained the largest market for Australian lamb exports, while mutton exports to MENA lifted 144% from last year to 5,853 tonnes, displacing China as our biggest mutton market for the month.

Growth in mutton export volumes was observed across the entire MENA region, but especially in the Gulf States; exports to Saudi Arabia rose 153% to 1,956 tonnes, exports to the United Arab Emirates lifted 28% to 804 tonnes and exports to Qatar lifted a massive 501% to 765 tonnes.

Market access update

On Friday last week, Brazil declared itself free of foot-and-mouth disease ‘without vaccination’. This is a designation that would grant Brazil market access to several key beef markets, if the disease-free status is accepted by the World Organisation for Animal Health (WOAH) and importing countries.

Over the past decade Brazil has become the world’s largest beef exporter by volume, accounting for around 25% of global trade in 2023. Its exports are heavily geared towards China, where it has market access, and its disease status prevents exports into Japan and South Korea.

Fortunately for Australian exporters, Australia’s suite of free trade agreements (FTA) gives our beef a comparative advantage in global markets regardless of technical market access. In 2026, Australia’s FTA with South Korea will give us a 35% tariff advantage on most favoured nation (MFN) (baseline) trading terms, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), of which both Australia and Japan are signatories, will give Australia an 18% tariff advantage over MFN trading terms.