Australian Bureau of Statistics release 150 years of historic agricultural data

Key points

- Wool production per head has maintained efficiency since 1990.

- Downward trend in the sheep and lamb flock since the start of the 1990s.

- Long-term upward trend in the national cattle herd.

This week the Australian Bureau of Statistics (ABS) has released 150 years of historic agricultural data, covering crops and livestock from 1860 to 2022. This information includes national and state data breakdowns dating back to 1860, and covers grains, livestock and wool production/land use.

Meat & Livestock Australia (MLA) will use this data to provide detailed analysis of long-term industry trends. Here, we touch on some initial insights, looking into headline trend movements over the last 100 years.

Sheep and wool

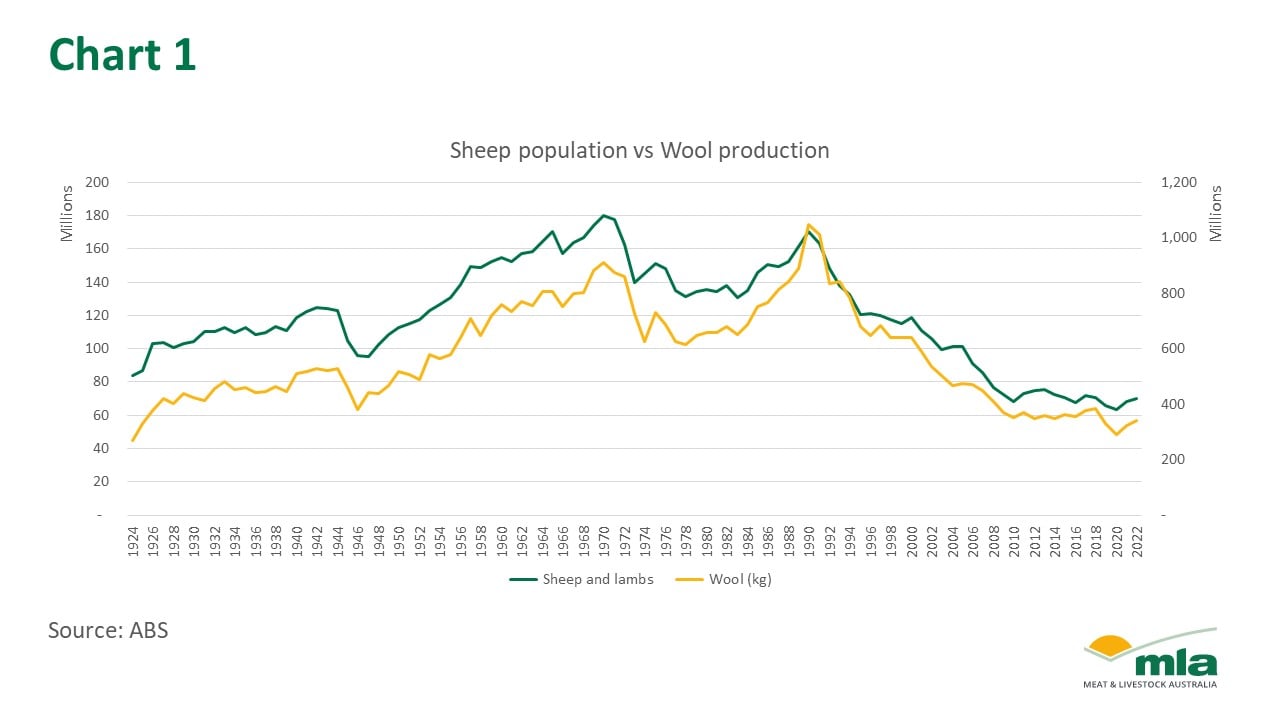

There have been significant movements in the sheep industry from 1924. Australia started as a major player in the wool production space, with data sources showing wool production growing steadily to 1970, dipping during the cattle boom in the ‘70s, and returning to a peak of over 1 million tonnes produced in 1990. Wool and Merino prices crashed in the early ‘90s leading to producers exiting the industry or moving to mixed operations. Since this point, both wool production and the sheep flock has been trending downwards.

Chart 1

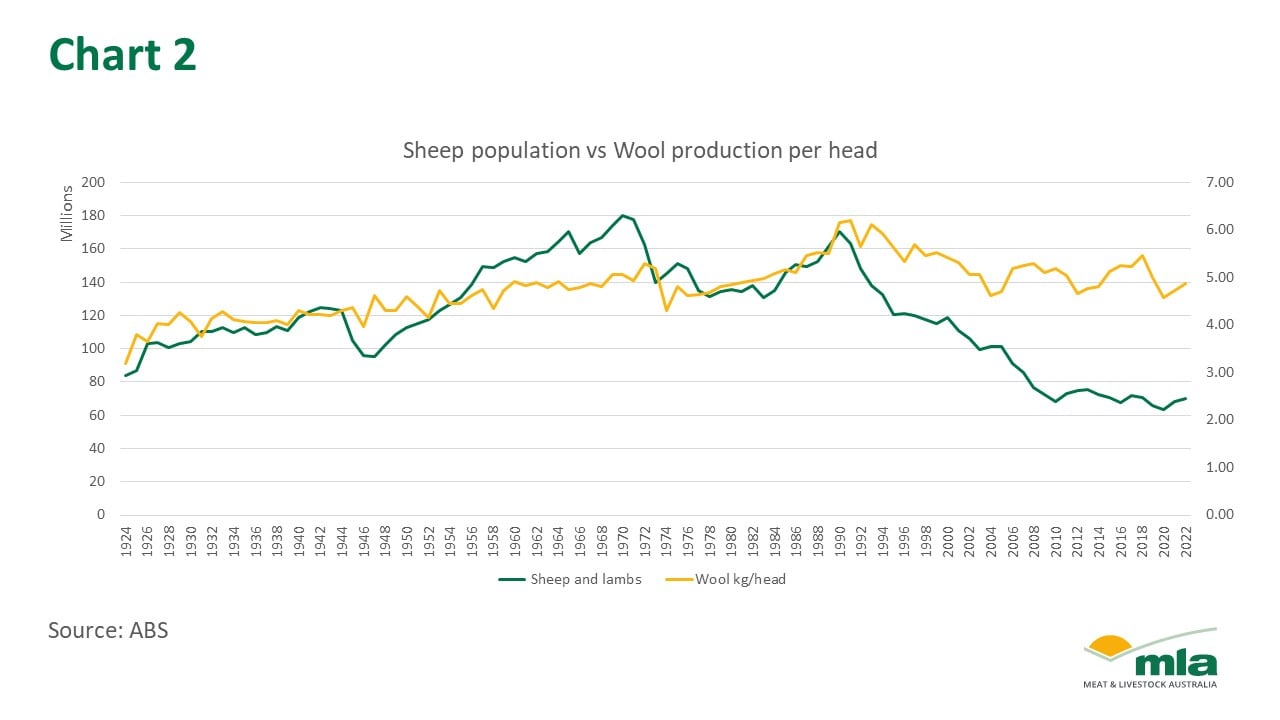

Despite this downward trend, and a lift in sheepmeat production, wool production in the country has maintained its efficiency to 2022. Wool production per head peaked in 1990, after the livestock shift in the ‘70s to 6.20 kg/head. Since then, wool production has remained above 4.5 kg/head indicating improved efficiencies in wool producing breeds.

Chart 2

Sheep and cropping

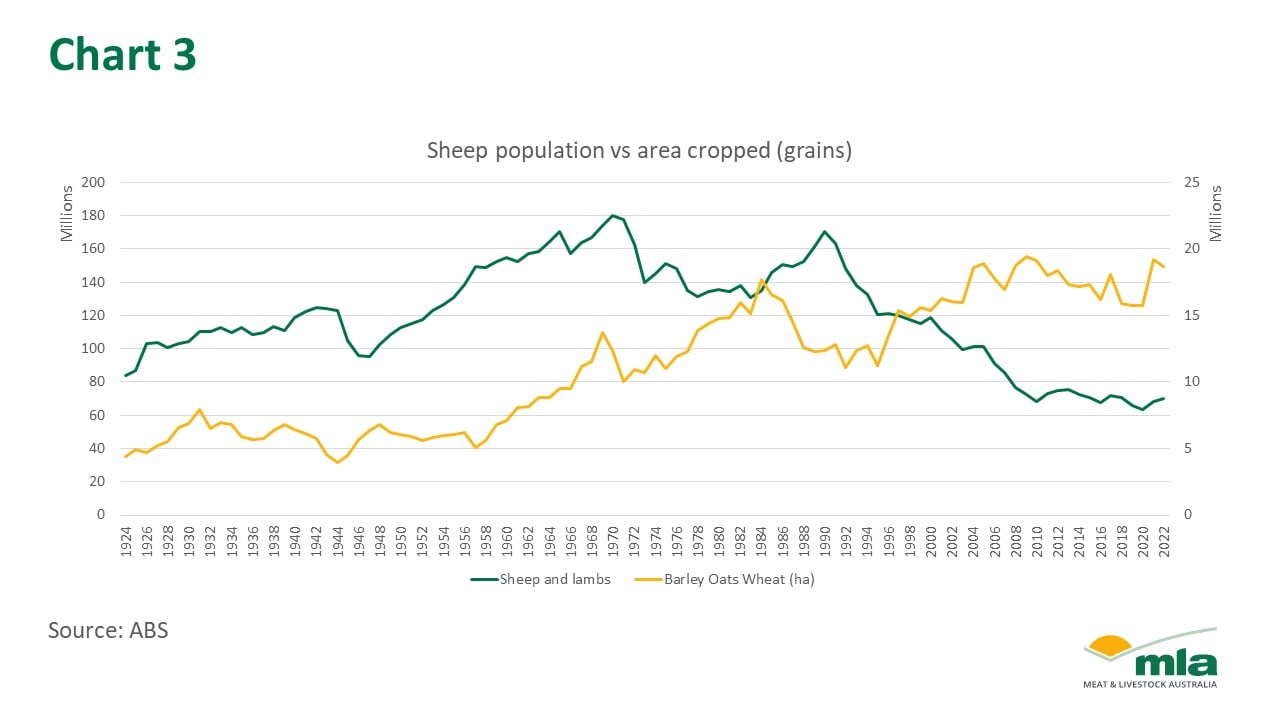

On a national scale, there has been downward trend in the sheep and lamb flock since the start of the 1990s. This was around the same time that area farmed for grain (wheat, barley and oats) started to lift. Since this time, sheep stocking and area cropped have been moving in differing directions. A drive of this may been the upwards trend of farm cash income from cropping properties, and the increase in mixed farming practices.

Chart 3

Cattle

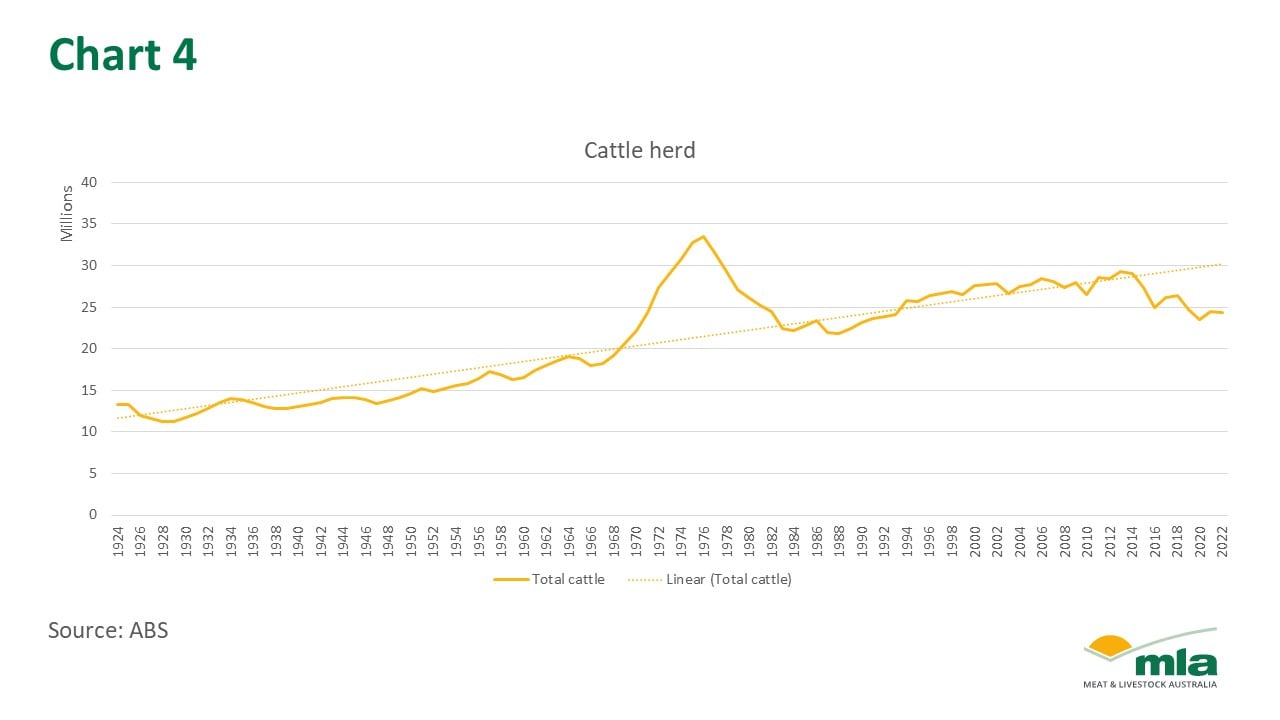

ABS data from 1924 to 2022 has shown an increasing trend in the national herd size. This longitudinal data provides beneficial context to the peaks and troughs of the cattle industry. The significance of the industry boom during the 1970s is evident in the chart, as ABS herd figures reached upwards of 33 million head, which was followed by a return to regular trend lines.

The last 10 years has seen a shift in herd size, which has been the result of several intense drought periods, and possibly a shift to lower density stocking, however MLA projections, which go beyond 2022, estimate a return in herd size to around 2015 levels.

Chart 4