Are feedlots facing a profit squeeze?

Key points

- Current feed grain prices remain the lowest since December 2021.

- Days on feed are expected to grow as feeder prices lift and grain prices ease.

- Lifts to cattle and feed grain prices will place pressure on lot feeder margins.

Feeder cattle and feed grain prices are inversely related, meaning one increases, the other decreases and vice-versa. There are two main reasons for this:

- Both commodities react differently to weather conditions. During a drought, grain becomes scarce due to poor harvest yields, whereas cattle turn-off increases as producers sell cattle due to the lack of feed.

- Feed and cattle are the two largest costs for feedlots, meaning that changes in the price of one will affect demand of the other, which in turn affects price.

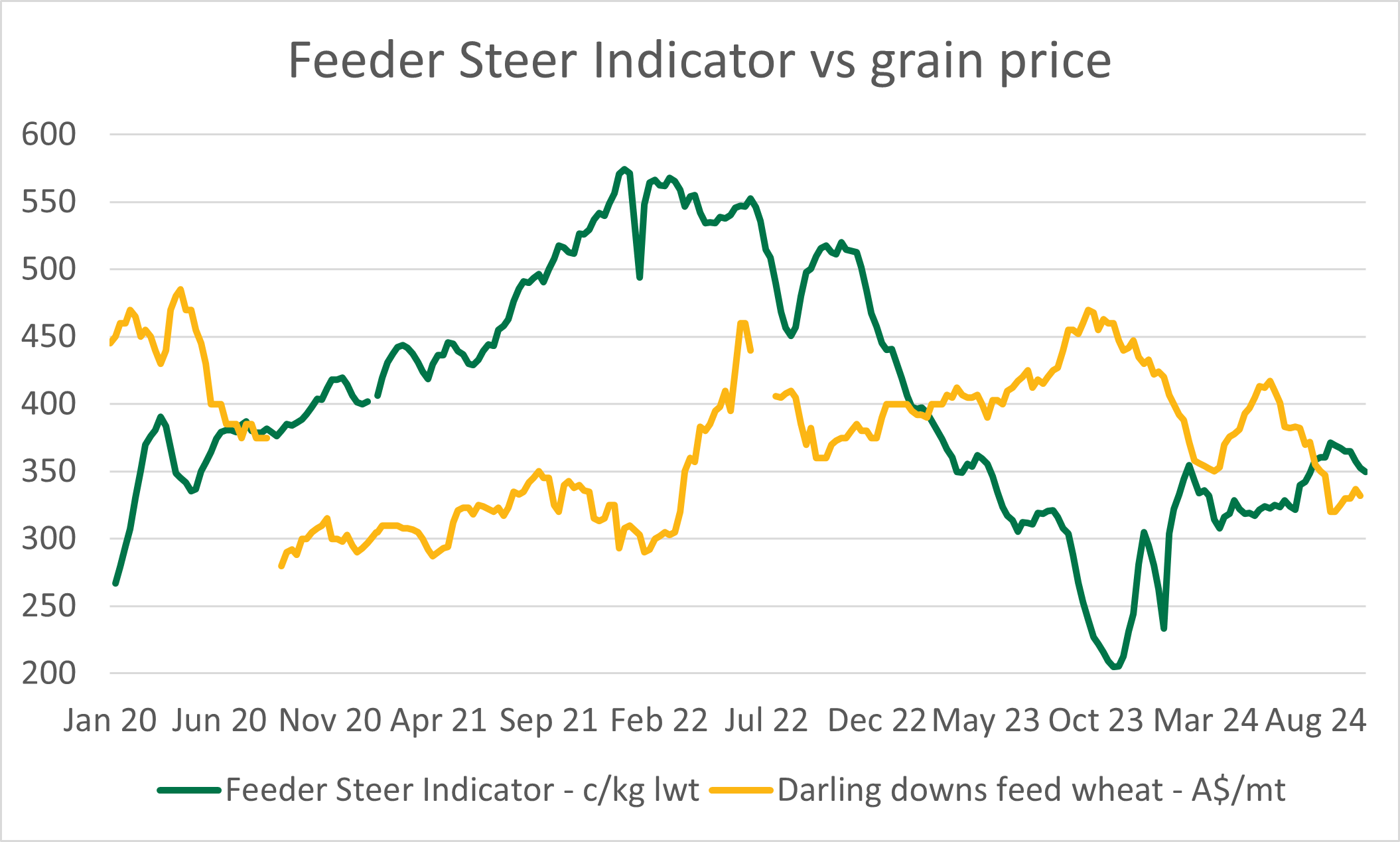

The current feeder steer price sits at 350¢/kg liveweight (lwt) and The Darling Downs feed wheat price is $322/metric tonne (mt) – the lowest since December 2021. This is uncharted territory after record livestock prices in 2020–22 followed by record low cattle prices in 2023. A larger price differential in the price relationship can indicate greater profit margins compared to a smaller price margin.

Grain prices remained strong between $350–420/mt at the start of the year, while livestock prices started to pick up and sit between 300–350c/kg lwt. When cattle prices are subdued, long-feeding programs are usually less attractive and shorter programs are more cost-effective (less time holding cattle in a volatile market). These trends were reflected in MLA and Australian Lot Feeders’ Association’s latest lot feeding brief, with turn-off lifting by 14% to 762,000 head over the March quarter.

Market conditions had begun to flip by June 2024. Cattle prices were tracking upwards and grain prices were easing, with cattle prices 6% higher than grain prices. This typically indicates cattle will be kept on feed for longer to induce weight gain, as it is usually cheaper than buying additional cattle. However, cattle bought earlier at a lower price could be put on feed for longer to capitalise on grain prices.

Turn-off over the June quarter eased by 4% to 734,000 head combined with for the seventh consecutive quarter, the number of cattle in Australian feedlots lifted to record levels (1.4million head on feed).

However, a convergence of cattle and feed grain prices can indicate feedlot profit margins are under pressure as feedlots are limited by the cost of their inputs to achieve profitability.

Attribute content to Emily Tan, MLA Market Information Analyst