Euro trio granted beef access to China

Greater China is the world’s largest imported beef market. In 2013, when direct shipments into mainland China exploded, Australia had close to half the imported beef market, but since then China has continued to diversify suppliers.

Shipments from South America have grown considerably since 2015 and Australia has slipped from being the first to third largest supplier (in part affected by significant shifts in Australia’s beef supply). Last year, China granted US beef access, but that trade, still in its infancy, is set to fall victim to a fresh round of Chinese retaliatory tariffs amid growing trade tensions.

More recently, the United Kingdom (UK), France and Ireland have all gained access to the colossal China market but the trade is yet to develop. But then again, what is their ability to supply and which segments may they target?

How much does this Euro trio currently export?

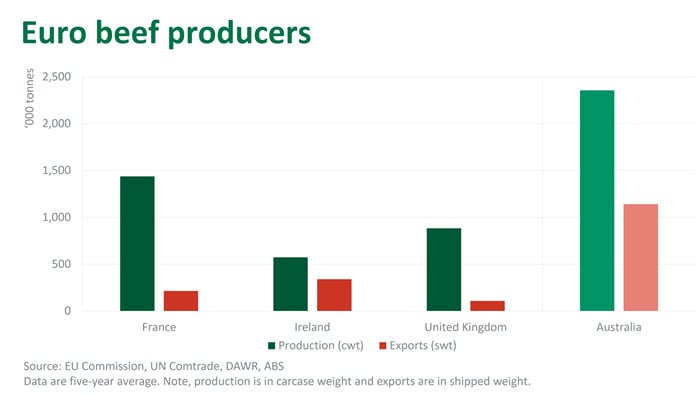

France is a powerhouse of European beef production, accounting for 1.44 million tonnes cwt in 2017 and the largest of the EU-28. The UK and Ireland are smaller but still significant contributors to EU supply, producing 899,000 tonnes cwt and 617,000 tonnes cwt, respectively, in 2017 according to EU Commission. In addition, all three countries have a higher proportion of beef cattle genetics (as opposed to dairy) within the herd compared to the rest of Europe.

In combination, this Euro trio accounts for more beef production than Australia but all three are equally large beef consumers. In fact, Ireland, the biggest beef exporter within the EU, is the only one of the three where production exceeds consumption.

Over the last five years, the top-10 beef export markets for France were all within the EU and accounted for 96% of shipments. Similarly, only one of the top-10 export markets for Ireland and the UK fell outside the single market.

EU beef producers are yet to have much presence in Asia but there are two examples of increasing interest. Ireland shipped no beef to the Philippines in 2013, but this increased from almost 4,900 tonnes swt in 2014 to 10,600 tonnes swt in 2017. Likewise, between 2013 and 2017, UK beef exports to Hong Kong increased from 850 tonnes swt to a little over 7,100 tonnes swt.

EU exports to China may be limited

Despite some shift, the EU has a small footprint in Asia and, even with China opening up, France, Ireland and the UK will not have the exportable surplus to push the amount of beef into the market the trade saw following increased South American access.

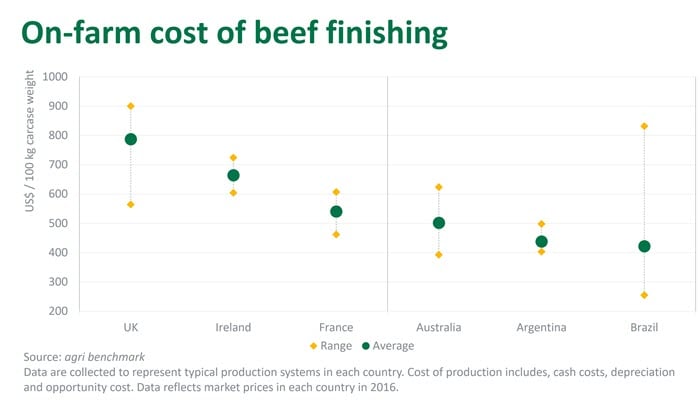

Critically, EU producers operate at a high cost of production but China, and many Asian markets, are very price sensitive. Comparing agri benchmark data highlights the on-farm cost advantage that Australian and South American beef producers have other their European counterparts.

Ultimately, the new EU entrants will not be able to push large volumes of beef into China or compete purely on price, so any new trade may target premium markets and come up against Australian, more so than South American, beef.

Currently, of the three new entrants only France has been granted chilled beef access into China, limiting significant encroachment into Australia’s share of the premium fresh beef cabinet. Furthermore, Australia has been selling imported beef into China for as long as anyone, and has established trading relationships and built awareness and a reputation in a market that is difficult to navigate.

Another limiting factor of export growth will be China approving plants for export within each of the new entrant countries. Only Ireland has plants (currently three) approved to export to China, with the UK and France either still waiting or in the process to being approved.

One wild card will be Brexit. The UK currently accounts for close to half of Irish beef exports. If trade barriers significantly hinder or halt that trade, Ireland may develop any new beef markets, such as China, with greater vigour.