US heats up competition

25 September 2017

US beef production is expected to reach a nine-year high in 2017, following surging supplies in 2016 and the recovery of its cattle herd. US beef exports have also increased, creating stronger competition in some of Australia’s key markets – particularly in Asia.

Increasing US beef availability and tighter Australian beef supplies have allowed the US to increase supply into Japan and Korea, and a notable rise in shipments to Taiwan, Vietnam and Indonesia.

In Korea, the US benefits from a favourable tariff compared to Australia (5.3% advantage). However, in Japan and China, Australia benefits from a lower tariff negotiated under the Japan–Australia Economic Partnership (JAEPA) and China–Australia Free Trade Agreement (ChAFTA).

Tariffs on Australian and US beef in key markets

| Tariffs on Australian beef | Tariffs on US beef | |

|---|---|---|

|

South Korea |

29.3% beef tariff |

24% beef tariff |

|

Japan |

29.9% chilled beef tariff |

US has no FTA with Japan |

|

China |

Under ChAFTA:

China–Australia Free Trade Agreement |

12% tariff for chilled and frozen beef |

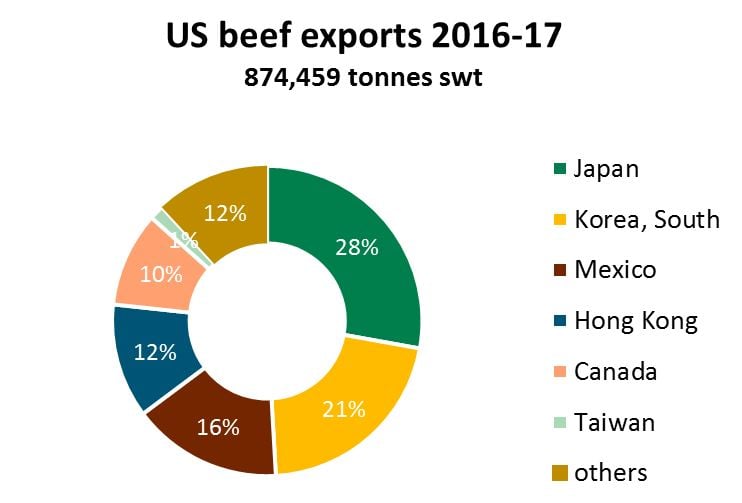

US beef exports

- The primary export markets of US beef are Japan, Korea and Mexico, with demand for chilled beef product growing in these markets.

- US exports to all key markets have increased in 2016–17 with the biggest growth in Japan (up 31%, to 230,360 tonnes swt) and Korea (up 38%, to 175,972 tonnes swt).

- Overall, US beef exports were valued at US$5.6 billion FOB in 2016–17 – the second highest fiscal year on record (GTA).

The USDA long-term projections forecast steady growth for the US cattle herd out to 2026. The US’ share of global beef exports is anticipated to hold relatively steady, averaging just over 12% over the next 10 years, and is projected to remain the largest importer of beef in the world.

For a full report on US supply, consumption, exports and market access, click here.

More information

Carolina Bilharinho

Market Insights Analyst – Competitor

E: cbilharinho@mla.com.au