Likely impacts: US beef re-entry to China

Michael Finucan

MLA General Manager – International Markets

China and the US concluded negotiations for US beef access in early July with the first air freighted consignment due to arrive in Beijing in mid-July.

Key facts about the protocol

- Beef and beef products must be derived from cattle that were born and slaughtered in the US. However, cattle can be sourced from Mexico or Canada but must be traced from the first port of entry into the US or be consigned directly to slaughter in the US.

- Cattle must be traceable to the US birth farm using a unique identifier, or if imported to the first place of residence or port of entry.

- Cattle must be raised without the use of hormone growth promotants or beta agonists (for example ractopamine). Product will be tested by Chinese authorities on arrival, though US cattle producers or processors are not required to have a mandatory system in place for ensuring freedom from these chemical residues.

- Beef and beef products must be derived from cattle less than 30 months of age

- Chilled or frozen bone-in and deboned beef products are eligible for shipment.

- Carcasses, beef, and beef products must be uniquely identified and controlled up until the time of shipment.

Short-term impacts

It is still unclear how much US beef will meet these protocol requirements with only limited supply chains capable of meeting the China protocol requirements for hormone-free and full traceability.

It is not expected that there will be a wave of beef entering the China market in the short-term as commercial players weigh up the benefits of meeting the extra protocol requirements.

It has been suggested by reputable US reporting firm, CattleFax, that the protocol will add US$275/head to the cost of raising cattle, which equates to about an extra US$34 cwt/carcase.

The pace of growth will be dependent on a range of factors such as domestic demand and demand from other Asian customers for similar cuts (e.g. short plate).

Longer-term impacts

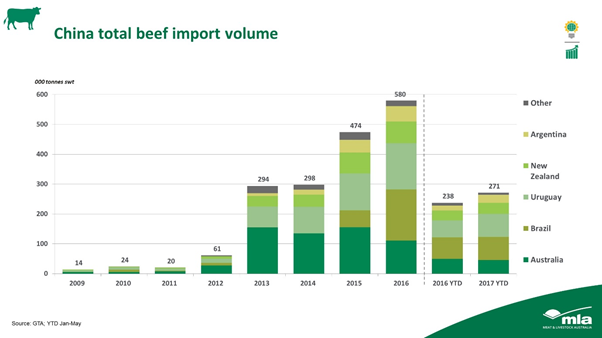

China has a large and growing beef market and there is room for additional suppliers to the market. This has been shown with the opening of access for Brazil and others with the market continuing to expand as new players enter.

Imports currently make up about 9.5% of China’s total beef consumption volume.

China’s total beef consumption volume is forecast to increase 3% from 2016 (7.57 million tonnes) to 2017, when it is forecast to reach 7.8 million tonnes (Source: BMI Research). This growth will come from imports.

Despite the growing opportunities in China, US access will place the Australian industry on notice. Our industry will need to work hard to retain consumer loyalty, particularly at the higher end retail sector and fine dining where Australia has dominated for many years.

While it is expected that US exports will consist of a range of cuts for further manufacturing (as they do from Australia), the US will be looking to target high end consumers with premium product.

Australia has carved out a stable chilled and grainfed business into these premium sectors targeting the wealthy upper-middle class consumers.

This sector will continue to grow as the wealthy consumer segment grows and cold chain infrastructure is improved, however it will be a more challenging and competitive space now with US product available.

Our industry will need to continue to communicate our strengths such as our clean green production system and integrity systems. We also will have an advantage with our chilled shipping times being very short compared to the US. Australia has already build a strong position in the China market and as it grows we will need to continue to segment the market and find those consumers who are looking for a product that has a great story behind it and is underpinned by quality and safety systems that meet the needs of Chinese consumers.

More information

Michael Finucan

mfinucan@mla.com.au