Keys to success in Jordan for Australian beef and lamb

25 September 2017

Red meat has strong growth potential

The Middle East/North Africa (MENA) region has long been a significant destination for Australian sheepmeat exports, attracting the lion’s share of both boxed sheepmeat and live sheep in 2016–17. It has also grown in significance as a beef market for Australia.

Within MENA, Jordan is a market that is potentially overlooked, being a relatively small country in the north of the region, sandwiched between Saudi Arabia and Israel but with ports on the Red Sea.

It has a population of 9.5 million, roughly equivalent to the United Arab Emirates, and is known as a tourist destination for many in the region.

BMI forecasts that the number of wealthy households earning more than US$50,000/year will increase by almost 43% over the next five years.

Meat protein demand has been increasing, driven by a growing population, urbanisation, rising incomes, dietary changes and increasing number of refugees and other expats from neighbouring countries, along with limited domestic resources that limit growth in domestic production.

Jordan was Australia’s twelfth largest sheepmeat market by volume 2016–17.

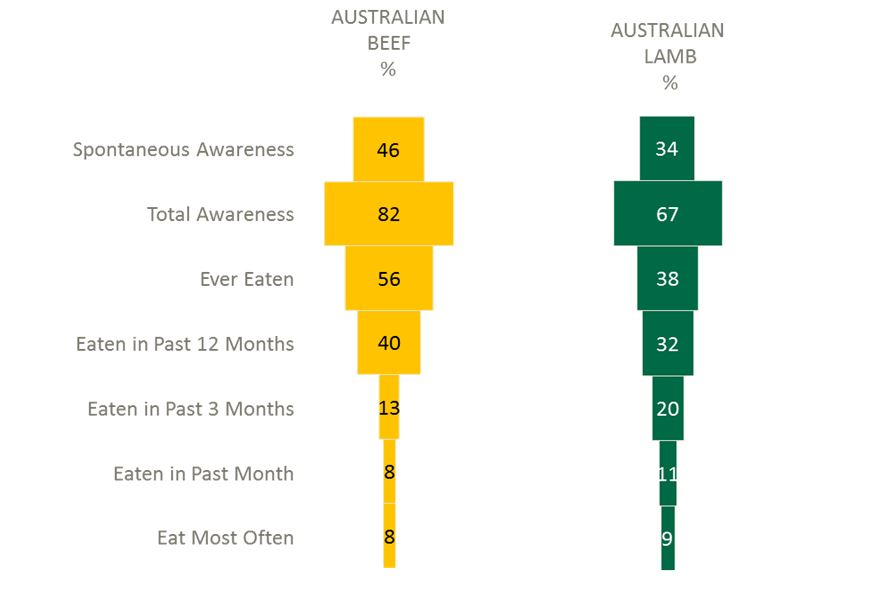

Sheepmeat is an important part of Jordanian diets, but MLA’s Global Consumer Tracker indicates that beef is consumed more often than lamb.

Chicken is the most popular protein, but is not highly regarded as a protein source, with its main strengths being versatility and a low price.

By contrast, lamb is seen as a family favourite and premium meat known for its tenderness, while beef is also considered something of a family favourite. Both beef and lamb are seen as much tastier than chicken.

A strong tradition for local beef and sheepmeat

In Jordan, the importance of tradition and family is reflected in meat shopping and consumption habits. When selecting between meats, being a “family favourite” is the attribute most strongly correlated with purchase, and is also a very important factor to support a price premium.

| In the protein category | |

|---|---|

|

Most strongly associated with volume of purchase |

Most strongly associated with being willing to pay more for |

|

1. Is my/my family’s favourite meat |

1. Tastes delicious |

|

2. Tastes delicious |

2. Is my/my family’s favourite meat |

|

3. Fresh |

3. Is the most superior meat |

Australian beef and lamb face strong competition from domestic product. Consumers prefer meat sourced locally, as they know it will be Halal and perceive it to be fresher and safer. These ‘hygiene’ factors are challenging for Australian imports to deliver on, however opportunities certainly exist. Among importing countries, Australian red meat is well-placed, with the major competition coming from New Zealand (for beef) and Romania (for lamb).

Independent retail is preferred

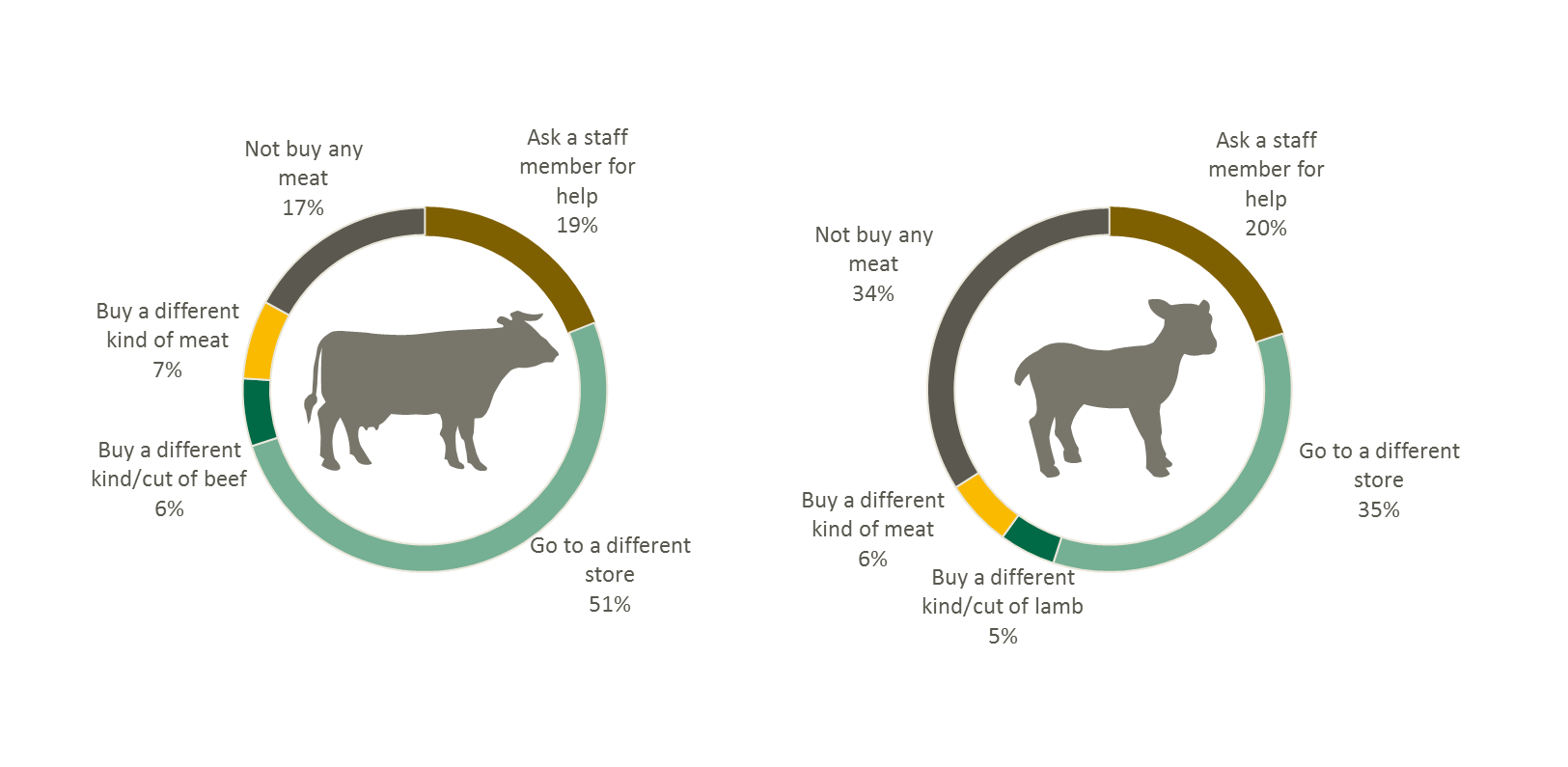

The Jordanian preference for ‘local’ extends to choice of vendor, with 47% of both beef and lamb buyers purchasing from a local butcher at least once a week – more often than from a supermarket, hypermarket or wet market. They are likely to prefer local butchers because they can be guaranteed freshness, safety and Halal, and also because they can judge the quality. The implications for Australian beef and lamb are clear; it’s imperative to find the right distribution model so that Australian product is present at first glance. If what they want is not there, customers will likely go elsewhere – only one in five will ask staff for help.

If the specific type of beef/lamb you were looking for was not on display, would you…?

While Jordan’s grocery retail sector remains much more fragmented than Gulf Cooperation Council countries’, it is modernising. Wealthier Jordanians are more likely to purchase their red meat from hypermarkets and supermarkets than average.

Fresh is best

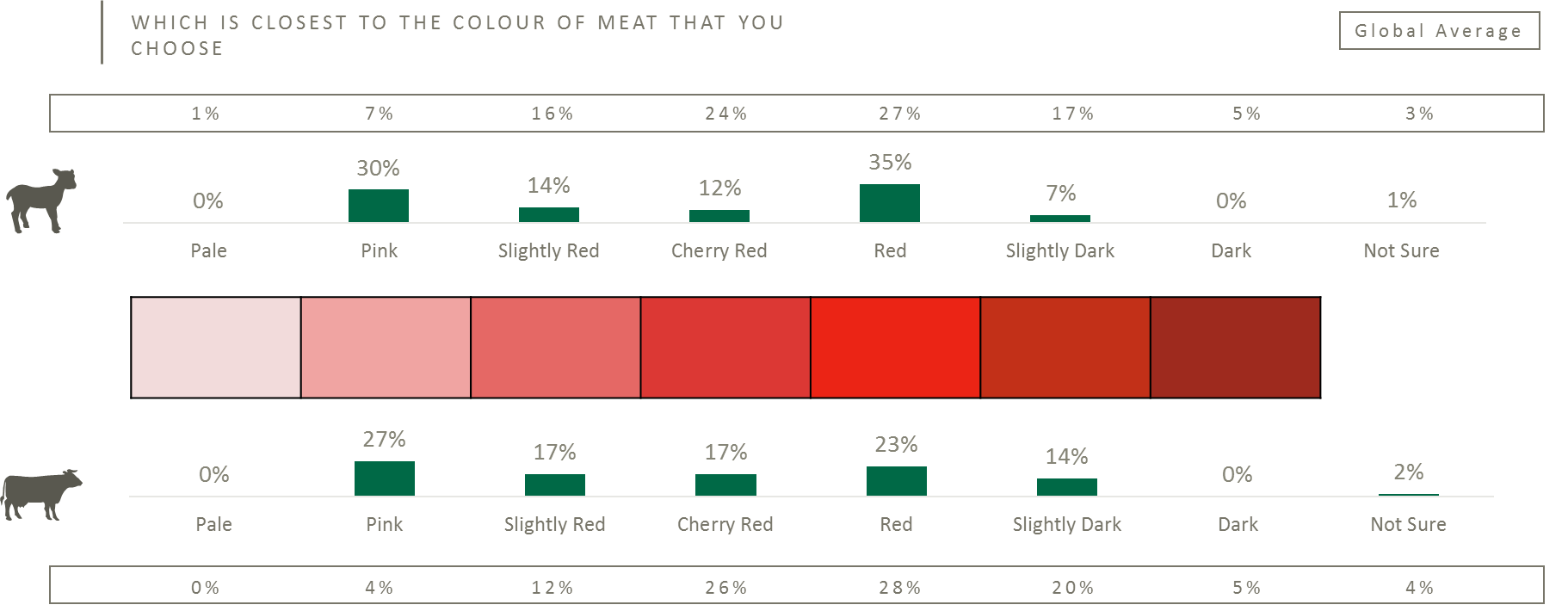

Jordanians have a strong preference for ‘freshly slaughtered’ beef and lamb. They will rarely buy chilled if fresh is available, and will avoid frozen meat. If providing freshly slaughtered meat is not feasible, the date of packing and use-by date, along with Halal certification, needs to be clearly displayed. The presence of blood is undesirable, and Jordanians are also very particular about the colour of meat on display, tending to prefer meat toward the lighter end of the colour spectrum.

Overcome barriers to unlock potential

Consumers’ strong preferences in the meat category provide obstacles for Australian exporters, but if these can be overcome there is potential for strong growth in Jordan.

More information

Natalie Isaac

MLA Global Manager – Industry Insights and Strategy

E: nisaac@mla.com.au