Fajitas to fine dining - emerging opportunities for Australian red meat in Mexico

Mexico presents some exciting opportunities for Australian red meat, particularly with the recent temporary reduction in imported beef tariffs and positive demand drivers.

Temporary tariff reductions

In February 2017, the Mexican Government issued a decree indicating it will temporarily reduce tariffs on beef by establishing a tariff-rate quota, including for fresh/chilled and frozen beef, and bone-in and boneless cuts. It was implemented to drive down the price of beef, which has risen significantly in the last five years.

Mexico will allow up to 200,000 tonnes of beef from countries without a free trade agreement, including Australia. The quota is issued on a first-come-first-served basis and, at this stage, will run through to 31 December 2017. So far in 2017, little of the quota has been used. For Mexican authorities to extend the temporary tariff removal, significant demand for access to the tariff-free quota needs to be demonstrated.

Young and affluent Mexican consumers

Younger wealthier Mexicans are driving beef consumption growth. Mexico is the second largest economy in Latin America after Brazil with a population of more than 130 million. Only 10% of Mexicans are aged over 65; the average age is just 28 years1. Middle income earners are on the rise and by 2021 an estimated 150% more households are forecast to be earning at least A$19,500 1. Younger consumers with more money to spend are fuelling demand for high quality food and a more formal dining out experience. According to Global Data, 73% of Mexicans state that high quality ingredients are the most influential factor when purchasing premium food products2.

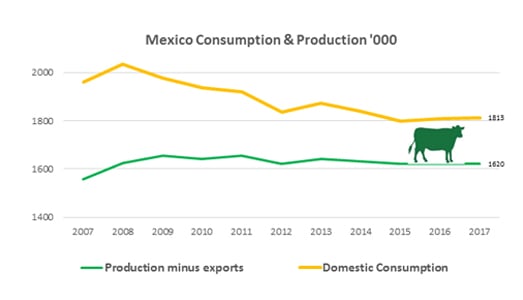

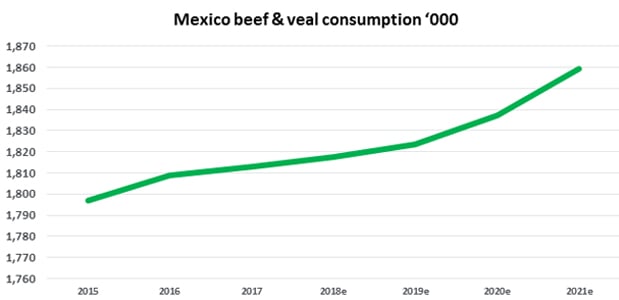

Mexicans are expected to consume approximately 1.8 million tonnes of beef in 2017 and demand is projected to rise1. Mexico is also becoming a significant exporter of beef, which has upset the balance to some extent of domestic supply and demand. As a result, domestic production alone is unable to meet demand so imported beef is rising.

The average Mexican consumer also tends to consider that ‘fresh is best’, preferring chilled meat over frozen product.

Foodservice spending on the rise

Spending at foodservice in Mexico is forecast to reach more than $36.4 billion by 2021, up 60% from an estimated $22.8 billion in 20173. The growing working-age population and urbanisation is lifting demand for more convenience among foodservice customers. UberEats entered the market in late 2016, creating alliances with around 500 restaurants in Mexico City.

According to Mexico’s National Restaurant Chamber CANIRAC, there are more than 515,049 foodservice establishments in Mexico, with a large number concentrated in Mexico City (11%), Federal District (10%) and Jalisco (8%) 4. This number excludes unregistered businesses which dominate the large informal economy known as 'fondas’, informal vendors offering inexpensive meals.

Mexico attracts more tourists

International tourists to Mexico reached 35 million in 2016, 8.9% higher than 20156. Domestic tourism plays a significant role in Mexico’s economy, representing 75.6% of tourist arrivals to hotels in 20166. While Mexicans appreciate value-added cuts, restaurants in high-end hotels are less sensitive to price, where more premium products are offered.

Major beef importers to Mexico

More than 83% of Mexico’s beef imports were from the US in 2016 with the majority fresh/chilled product5. Muscle cuts such as shoulder clods (also known as chuck) and rounds are the most popular US cuts exported to Mexico.

Canada is the second major supplier to Mexico, with 11% volume market share5.

Australia is a relatively small beef supplier to Mexico and has been at a disadvantage due to high import tariffs since the ratification of North American Free Trade Agreement in 1994, enabling US and Canadian beef to enter Mexico duty-free. The main cut imported from Australia is thin flank. This product complements local dishes which require thin, leaner beef cuts which are used in fajitas, for grilling and milanesa-style cooking.

Opportunities for Australian red meat

Australian beef exports to Mexico have historically consisted of small volumes of frozen product used for further processing. In addition, Australian beef has faced tariffs which aren’t payable by larger North American beef importers.

However, the recent relaxation of tariffs and the world-leading shelf-life of Australian chilled beef present opportunities in this market, particularly considering that Mexican consumers have a growing appetite for premium, high quality fresh meat.

More information

Natalie Isaac

MLA Global Manager – Industry Insights and Strategy

E: nisaac@mla.com.au

Sources

1. BMI Research data tool

2. GlobalData Consumer Survey – Q3 Q3 2016, Mexico

3. BMI Research – Foodservice spending (Hotels and restaurants)

4. CANIRAC – Todo Sobre La Mesa – based on 2015 figures

5. Global Trade Atlas

6. Datatur - Results of Tourism Activity 2016