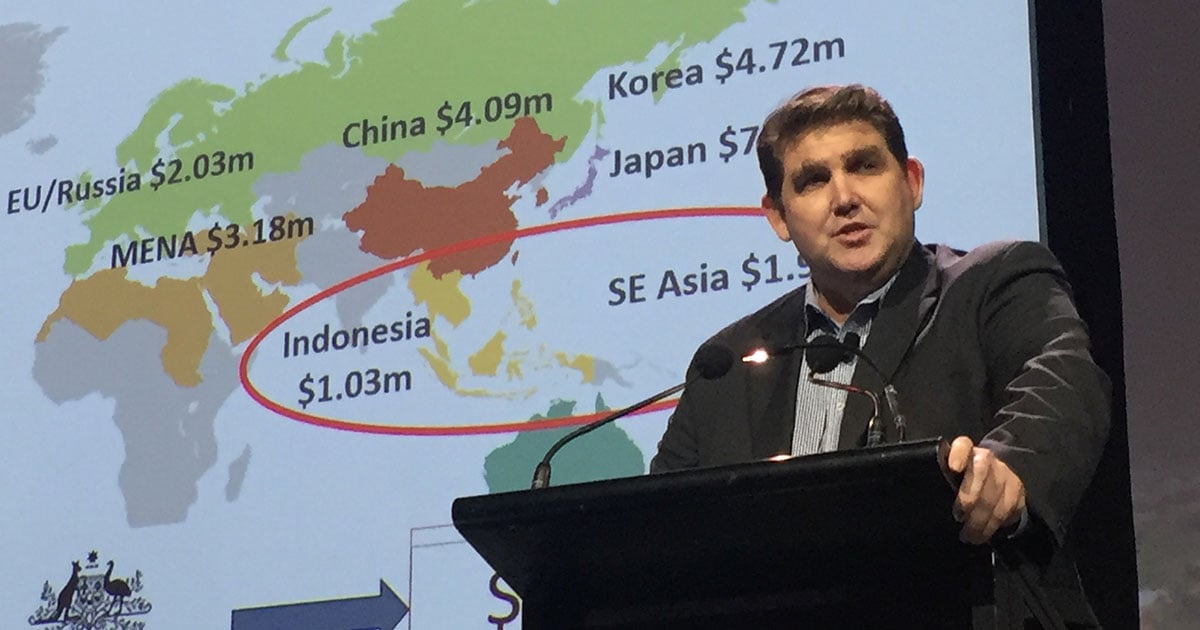

Indonesia update

By Andrew Simpson, MLA International Business Manager, Southern Asia

The Indonesian Government’s almost singular focus on lowering beef prices, coupled with self-sufficiency policies and ongoing challenges in permit allocations and changes, has potential to displace Australia as Indonesia’s dominant imported red meat supplier.

The Indonesian Government’s almost singular focus on lowering beef prices, coupled with self-sufficiency policies and ongoing challenges in permit allocations and changes, has potential to displace Australia as Indonesia’s dominant imported red meat supplier.

This was the message I shared with the audience at the Northern Territory Cattlemen’s Association forum in Darwin in late March.

A strategy for affordable beef…and the reality

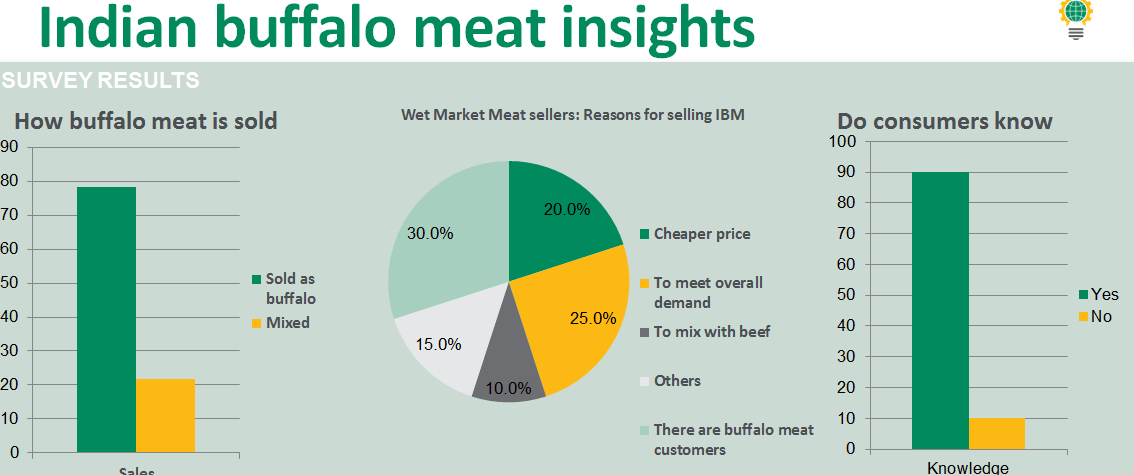

Since July 2016, the Indonesia Government has allowed the entry of Indian buffalo meat in a drive to provide more affordable beef to its consumers at IDR 80,000/kg (equivalent to A$8/kg) or about 25% cheaper than current wet market fresh beef prices. However, in reality, this has not eventuated, with Indian buffalo meat profiteers selling as high at IDR 100,000/kg.

Steady volumes entering the market

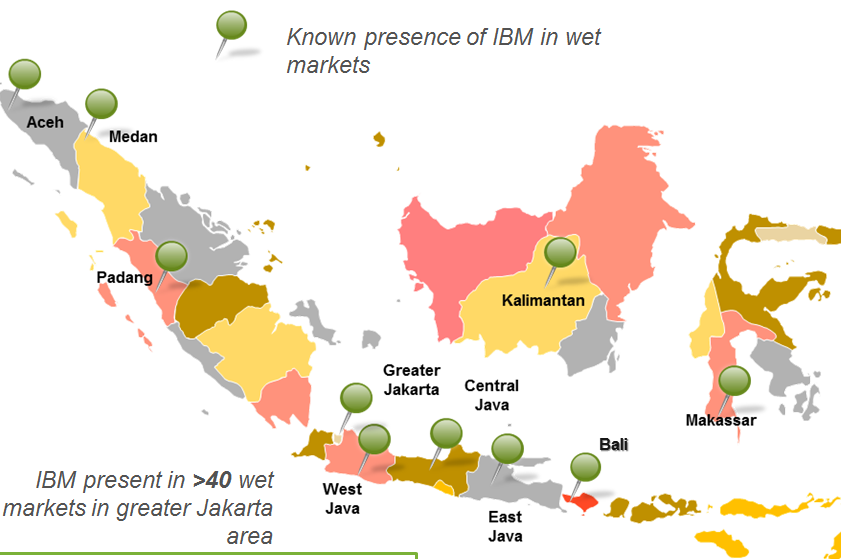

Around 70,000 tonnes of Indian buffalo meat have entered Indonesia between July 2016 and April 2017. As of April, the Indonesian meat industry estimates that there is about 30,000 tonnes of Indian buffalo meat still in warehouses. Of the 40,000 tonnes used to date, meat distributor associations estimate that Indian buffalo sales have been steady at around 7-8,000 tonnes per month since December 2016. MLA survey data has revealed Indian buffalo meat selling in multiple regional locations.

Where it’s having the biggest impact

The influx of Indian buffalo meat in the last several months has been greater than expected. While market and consumer reactions have been mixed, a number of boxed beef and live cattle importers have expressed heightened concern about the presence of buffalo meat in wet markets and in the manufacturing sector.

MLA survey data suggests that displacement in wet markets is around 10% (or 1,000 tonnes/month) and 50% (3-4,000 tonnes/month) among small to medium enterprises that manufacture Bakso meat balls and sell from street vending outlets.

Consumers not sure what they’re getting

Survey results across the greater Jakarta region indicate that consumers are aware of buffalo product. However, visually it is very difficult for consumers to tell the difference between beef and buffalo at wet market vendors. Further data suggests that only where marked or priced accordingly can consumers feel comfortable knowing it is an alternate product to beef. This is due to profiteering and a lack of transparency or audit authority in markets, making it easy for sellers to adulterate buffalo into mixed packs or seek premiums for unmarked product.

Strategic objectives in the interests of both sides

Given the significant impact of Indian buffalo meat from both economic and biosecurity perspectives, the Australian red meat industry needs to continually update its approach to Indonesia with a coordinated strategy in meeting short and medium term cyclical demand.

The strategy would complement broader initiatives that are already conducted by MLA/LiveCorp/industry with regular interaction with Indonesian counterparts. These measures would include:

1. Reiterate that Australia is a valued supplier and partner at government and commercial levels

- Proactively communicate Australia as a reliable partner in food security and work to define a consistent policy that supports commercial investment.

- Proactively communicate the biosecurity threat of food and mouth disease and that beef production contributes to improved livelihoods and welfare of farmers in Indonesia and Australia is proud to have been an integral part of this development. Both countries benefit from the depth of our long term partnership.

2. Positively promote and position Australia’s live cattle and boxed beef to Indonesian consumers

- Work to secure market segments where consumers are seeking a point of difference that fresh beef provides opposed to buffalo.

- Beef is an essential part of a healthy diet and Australia is a safe, reliable partner and supplier with good systems and integrity programs in place.

3. Work constructively to reduce technical barriers that supress trade and distort prices

- Mitigate the impact of a 5:1 breeder policy on commercial interests (which requires importers to commit to importing one breeding animal for every five feeder or slaughter cattle they import) whilst adopting a transparent review of breeding programs through research investment such as the Red Meat Partnership.

- Australia is committed to continue working with Indonesia in support of Indonesia’s food security objectives – as demonstrated by our ongoing collaboration and investment in all parts of the supply chain: working together to improve efficiency, productivity and performance of Indonesia’s cattle sector.

More information

Andrew Simpson

MLA International Business Manager, Southern Asia

asimpson@mla.com.au